Aptos price goes awry as technical analysis points to 15% implosion

- Aptos price is set to decline sharply as selling pressure continues.

- APT nears a crucial level, which could make this week quite ugly for performance.

- If $8.06 breaks, expect to see a very quick move lower that bears a 15% loss.

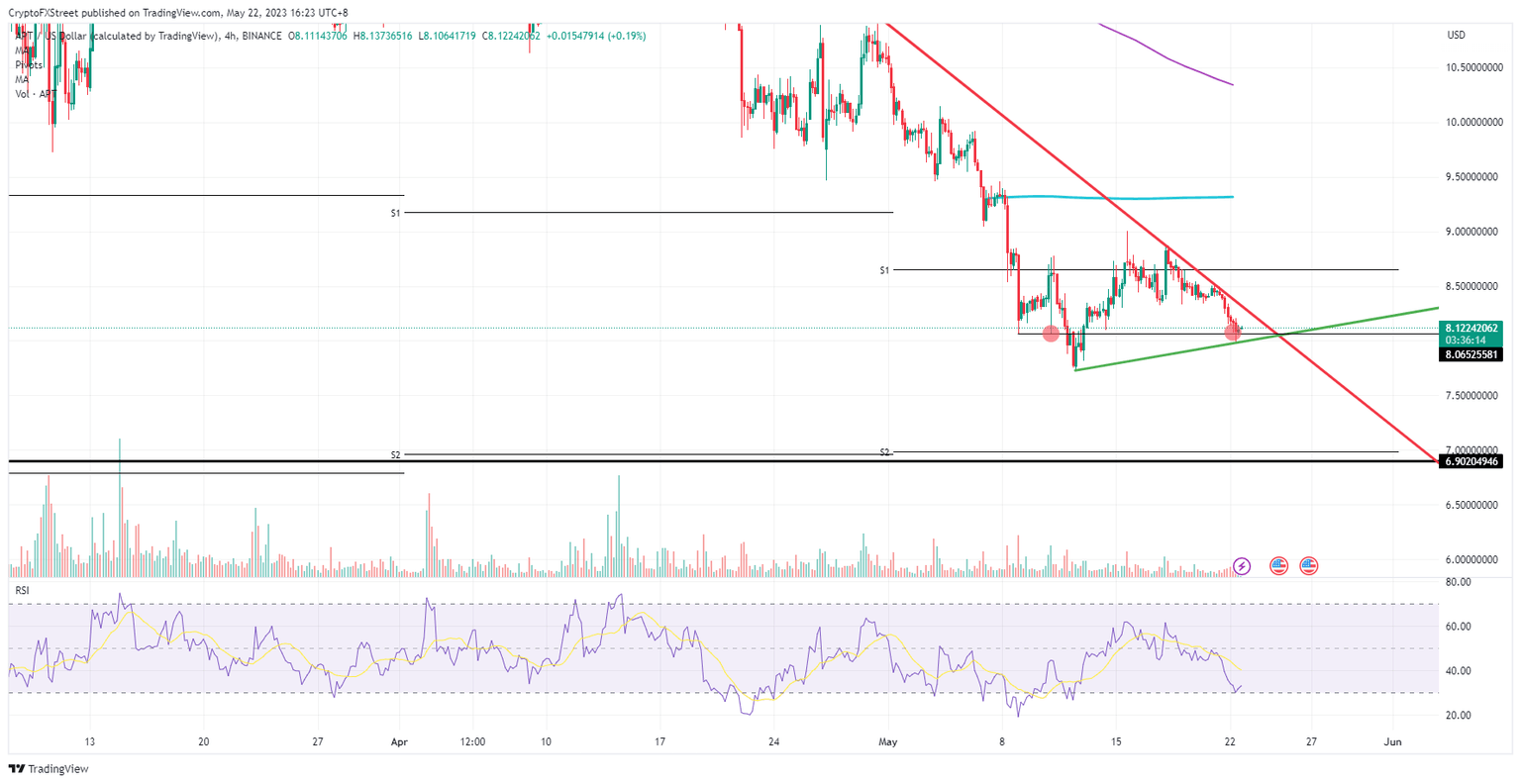

Aptos (APT) price is trading in a very mathematical way as both descending and ascending trendlines cross one another at $8.06. At that same price tag, a pivotal horizontal level can be detected, and it could mean big trouble ahead once broken. With bulls having defended both levels, a breakdown would leave them all exposed and result in a decline big enough that APT will start trading sub-$7.

Aptos price at a crucial inflection point

Aptos price is set to enter an ugly phase on the chart as selling pressure is not easing at the moment. Bulls are at risk of becoming exposed, should bears push price action below $8.06. A brutal leg lower could amount to another 15% loss. Although the Relative Strength Index (RSI) points to a small rebound, it could well be just a drop on a hot plate.

APT saw bulls defending and buying heavily alongside the green ascending trendline and that pivotal line at $8.06. With both almost falling in line with one another, bears could easily squeeze bulls out of their positions by simply testing $8 to the downside. Bulls will start to panic, shooting themselves in the foot by offloading their position and triggering a meltdown that could head to $6.90 before encountering some support.

APT/USD 4H-chart

Upside movement would come only when some follow-through is noticed on the charts. That would mean that the RSI continues to head higher and away from the oversold barrier. The red descending trendline would break to the upside, trigger a massive buying wave and head toward $9 in an initial reaction.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.