ApeCoin Price Prediction: What’s next for APE after a 33% rally?

- ApeCoin price shows weakness after a 33% rally as it produces long top wicks with short bodies.

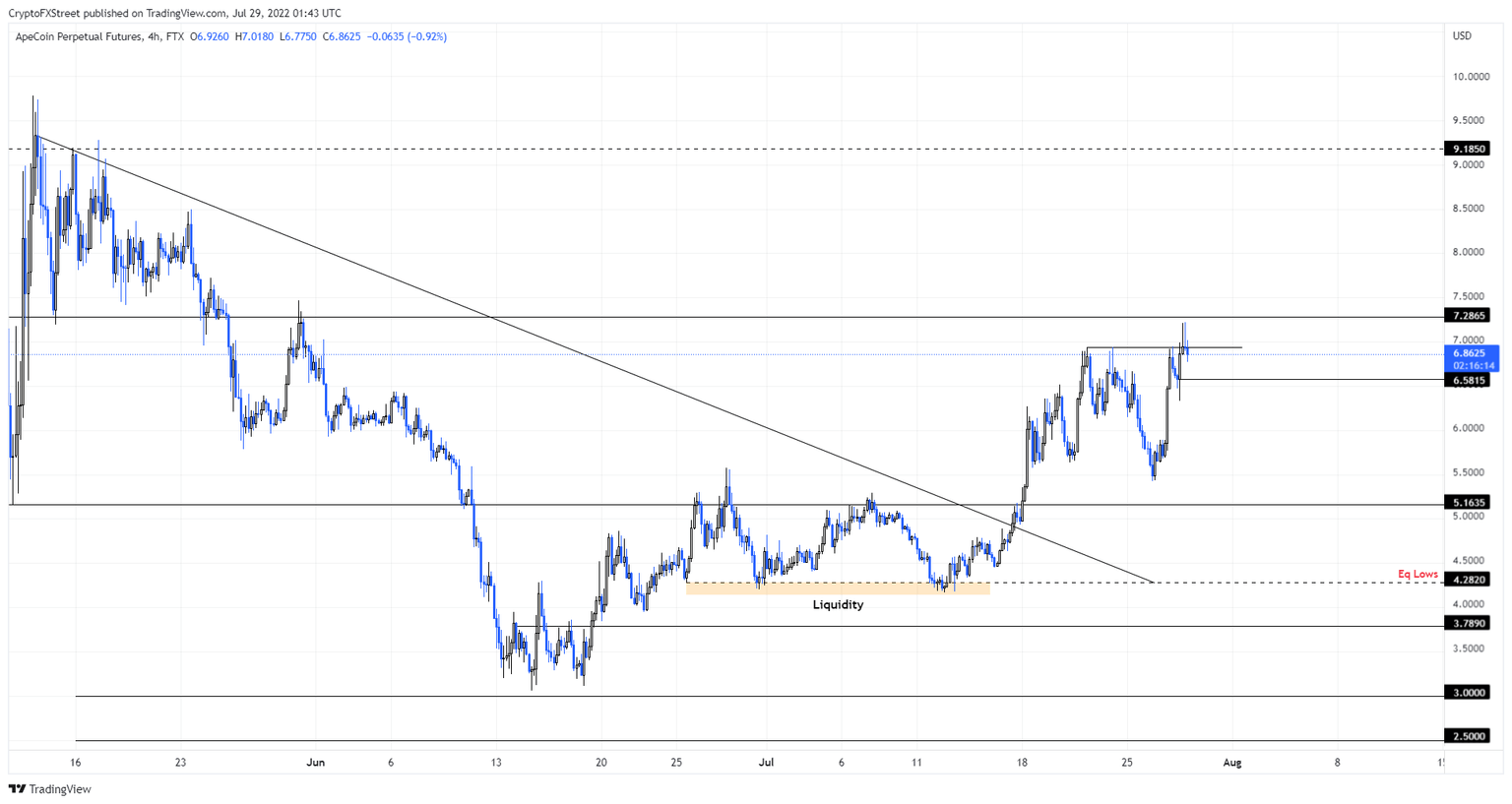

- A breakdown of the $6.58 level will trigger a 24% crash to the $5.16 support barrier.

- On the other hand, if the $7.28 support level is overcome, the bearish thesis will face invalidation.

ApeCoin price shows that its strong rally is coming to an end. This development will be confirmed once APE produces a four-hour candlestick close below an immediate support level.

ApeCoin price readies for a U-turn

ApeCoin price swept below the July 19 and July 21 swing lows formed at $5.60 on July 26 but recovered quickly, indicating the presence of bullish sentiment. As a result, APE rallied 32% and swept above the July 22 swing low and collected liquidity.

After this event, the three candlesticks on the four-hour timeframe had long upper wicks and small bodies, denoting an increase in selling pressure. A confirmation that a reversal is in place would arrive after APE flips the $6.58 support into a resistance barrier.

This move will confirm that the bearish momentum is higher than the buying pressure and trigger a move that could revisit the $5.16 support level. Beyond this barrier, a further downward move is unlikely due to the consolidation that took place between June 25 and July 12.

In a highly bearish case, where sellers tear through this consolidation area, they will be rewarded with liquidity in the form of sell-stops below the $4.28 support level.

APE/USDT 4-hour chart

On the other hand, if buyers make a comeback, pushing APE above the $7.28 support level, it will indicate a resurgence of bullish momentum. If ApeCoin price produces a daily candlestick close above this level, it will invalidate the bearish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.