- ApeCoin price is down 7% on January 30.

- APE rallied by 40% in the last two weeks, but the uptrend's strength could be waning.

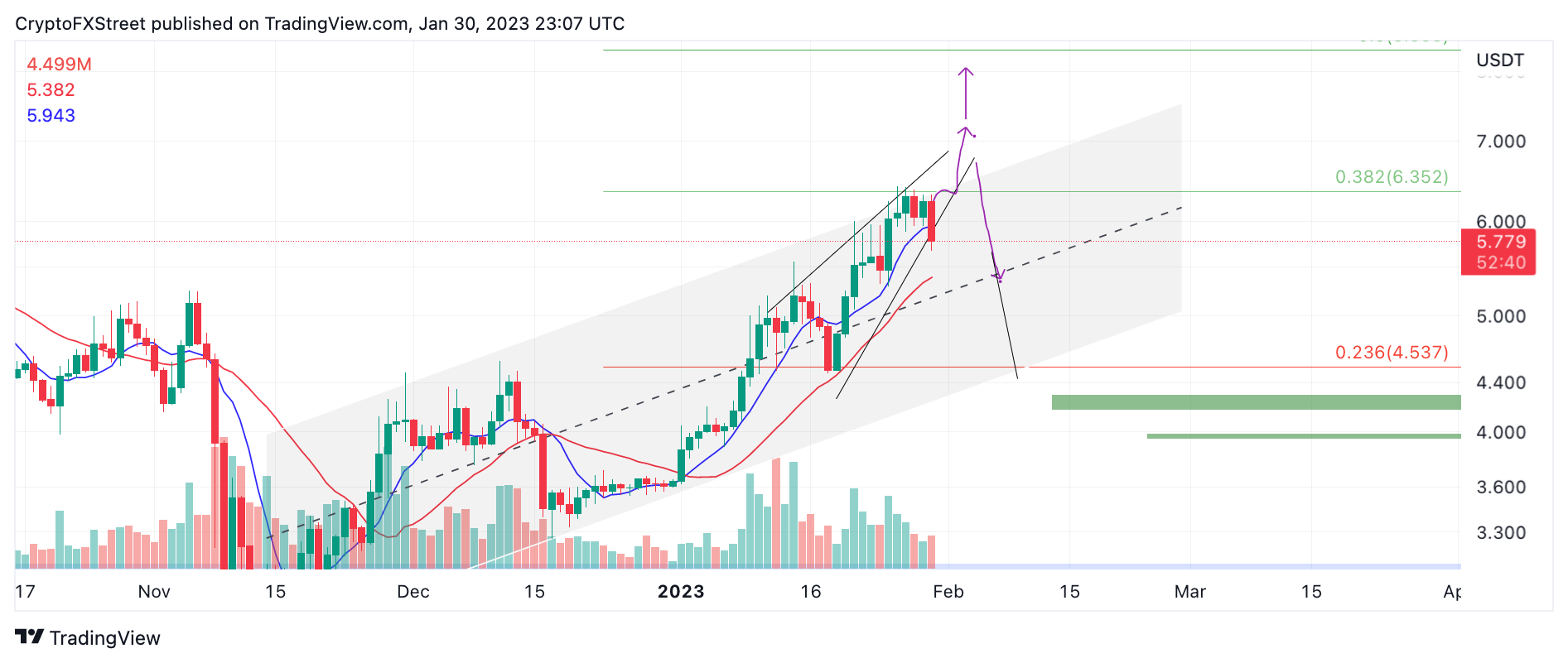

- A breach above $6.41 would invalidate the bearish potential.

ApeCoin price should remain on traders' watch list as a volatile move could be imminent. Key levels have been assessed to forecast possible outcomes for the Ethereum-based NFT token.

ApeCoin price is one to watch

ApeCoin price confirmed last week's "exhaustive uptrend thesis" as the digital currency has fallen by 7%. The APE price now has a choice to make as mixed signals arise on higher time frames. Although the next move will be hard to predict, it will likely be a volatile move worth participating in.

ApeCoin price currently auctions at $5.76. The bears have successfully breached the 8-day exponential moving average (EMA) for the second time in January. The last time the 8-day EMA lost support, the 21-day simple moving average provided cushion for the fall and enabled a 40% rally shortly after. Traders are likely hoping for a repeat in price action; however, a risk to the downside seems more substantial.

For instance, the Relative Strength Index and the indicator used to assess a trend's kinetic potential show the recent 40% uptrend move as a weekend rally when compared to the prior. This is noted by various divergences produced between January 17 and 27. While prices rose, the RSI remained submerged under the previous upswings reading. The bearish divergence is a common pattern found near the top of the trend before sharp reversals.

The divergence justifies bears aiming to wipe out bulls who entered the market after January 16. Thus, the origin point of the 40% rally at $4.53 is in jeopardy of liquidation. The bearish scenario creates a potential 20% decline from the Ethereum-based NFT token’s current market value.

APE/USDT 1-day chart

Traders entering the market can place an invalidation point above January's high at $6.41. A second attempt to tag the swing high could induce a buyer's frenzy with bullish targets in the $7 zone. The ApeCoin price would rally by 28% if the bulls were to succeed.

This video details how Bitcoin price moves could affect ApeCoin price

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Tether mints another $1,000,000,000 USDT on Justin Sun’s Tron blockchain: TRX traders could profit

Tether, the world’s largest stablecoin issuer, has minted another $1 billion worth of USDT on the Tron blockchain according to Whale Alert data published Friday.

XRP Price Prediction: XRP back above $2 liquidating $18M in short positions, will the rally continue?

Ripple (XRP) seeks support above $2.0020 on Thursday after gaining 14% in the past 24 hours. The token trades at $2.0007 at the time of writing, reflecting growing bullish sentiment across global markets.

Avalanche Octane update goes live on mainnet, slashes transaction fees significantly

Avalanche (AVAX) Octane update, live on mainnet on Thursday, introduces a dynamic fee mechanism to the C-Chain. This mechanism reduces transaction costs during high network activity by adjusting real-time fees, as per ACP-176.

Dogecoin soars as 21Shares files S-1 for DOGE ETF

Dogecoin (DOGE) rallied nearly 12% on Wednesday after asset manager 21Shares filed an S-1 application with the Securities & Exchange Commission (SEC) to launch the 21Shares Dogecoin exchange-traded fund (ETF).

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.