ApeCoin Price Prediction: An 8% fall seems likely for APE with multiple bearish signals at play

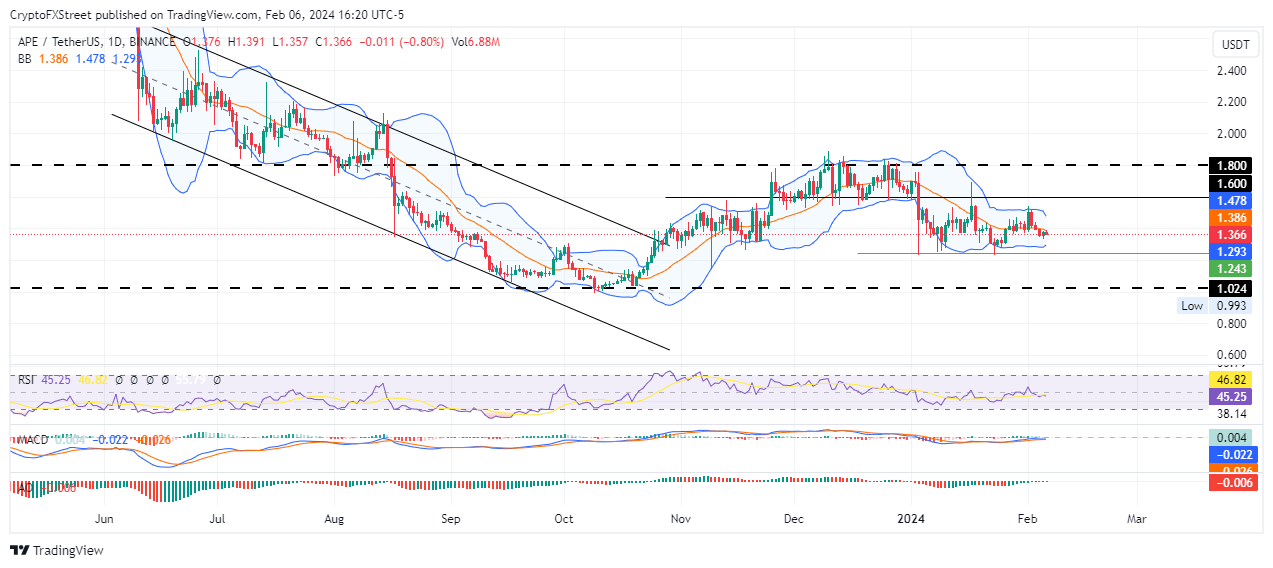

- ApeCoin price remains below the foothold of the centerline of the Bollinger indicator, with several other technical indicators flashing bearish.

- APE could fall 8% to the $1.24 support level, last tested on January 23.

- Invalidation of the bearish thesis will occur upon a candlestick close above $1.60.

ApeCoin (APE) price is trading with a bearish bias, trapped within the confines of the Bollinger indicator. With the upper and lower bands of this technical tool coming together, the volatility contraction could see APE record a bold move soon.

Also Read: ApeCoin price climbs 5% as gaming narrative revitalizes social metrics for APE

ApeCoin price coils up for a bold move

ApeCoin (APE) price is below the centerline of the Bollinger indicator at $1.38, with an analyst saying such a position could precede a move lower once the volatility contraction is over and volatility expansion takes place.

The position of the Relative Strength Index (RSI) below 50 accentuates the bearish outlook. This momentum indicator is not only southbound, pointing to falling momentum, but has also executed a sell signal after crossing below the signal line (yellow band).

Furthermore, both the Awesome Oscillator (AO) and the Moving Average Convergence Divergence (MACD) indicators are in negative territory, below their respective mean lines.

Increased selling pressure could see ApeCoin price drop to breach the lower band of the Bollinger indicator at $1.29.

An extended fall could see the altcoin’s market value roll over to the $1.24 support, levels last tested on January 23. Such a move would constitute an 8% drop below current levels.

In the dire case, the altcoin’s market value could dwindle all the way to the bottom of the market range at $1.02.

On the other hand, if sidelined investors and late buyers buy the dip, the ensuing buyer momentum could see ApeCoin price push north. Overcoming the centerline would bring the upper band of the Bollinger indicator into focus at $1.47. A decisive breach of this supplier congestion level, confirmed by a stable close above the $1.60 threshold would invalidate the bearish thesis.

In a highly bullish case, ApeCoin price could extend a neck higher, tagging the $1.80 psychological level, 30% above current levels.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.