ApeCoin price needs to hold this level for new highs

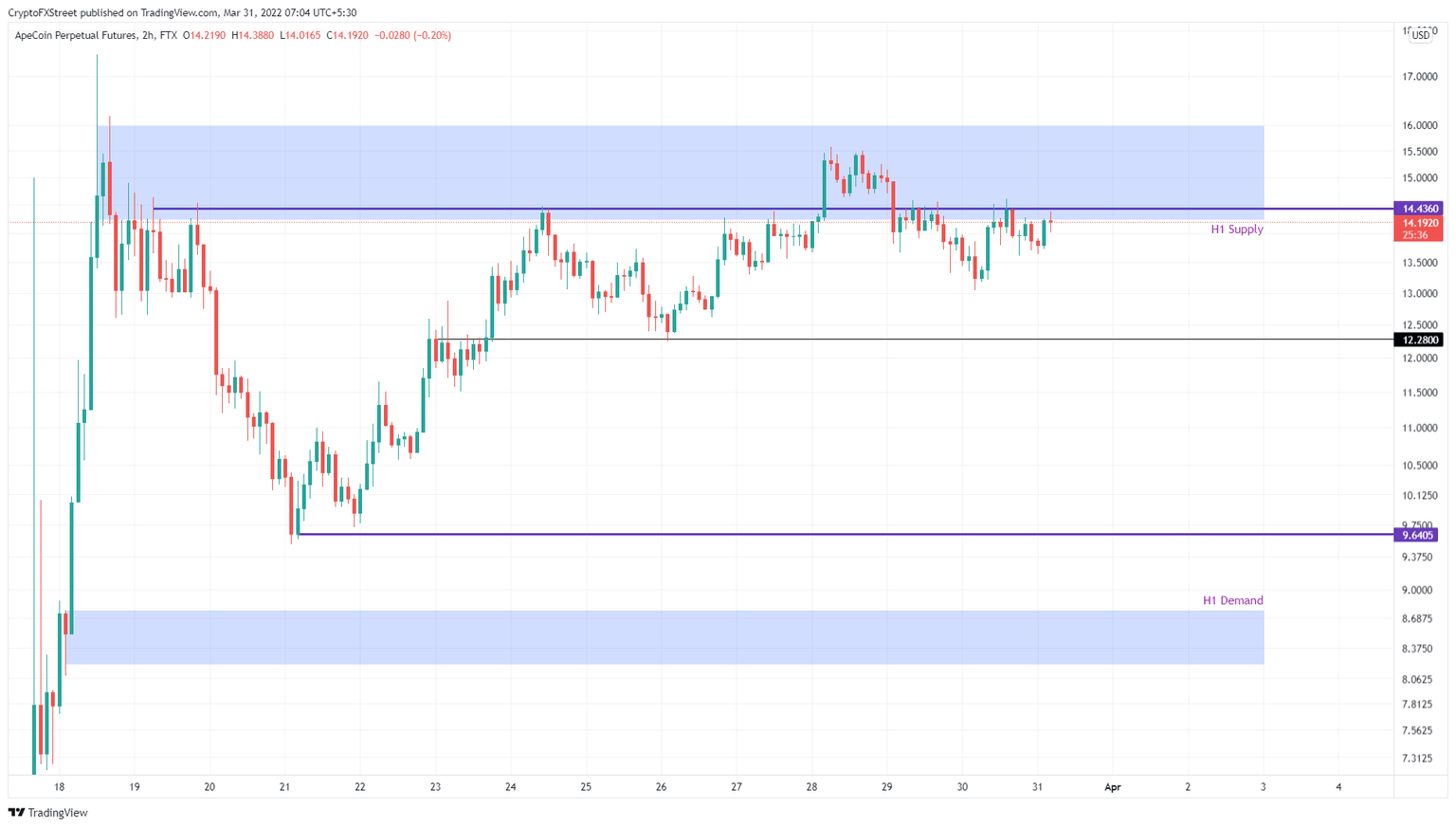

- ApeCoin price is currently grappling with the $14.23 to $15.98 supply zone.

- A rejection could push APE to the $12.28 support level, but clearing this hurdle could welcome new highs.

- A daily candlestick close below $12.28 could trigger a massive downswing to $9.64.

ApeCoin price has seen a considerable thrust to the upside over the past ten days. However, the recent move into a supply zone is proving challenging for the bulls. Investors need to exercise caution as a failure to move higher could lead to a steep fall.

ApeCoin price at make or break point

ApeCoin price is at an inflection point in its journey. After rallying roughly 63% in less than ten days, APE is currently grappling with the $14.43 resistance barrier and the $14.23 to $15.98 supply zone confluence.

So far, bulls do not seem to have the momentum to push through this cluster, indicating a lack of buying pressure. However, producing a four-hour candlestick close above $15.98 will open the path for ApeCoin price to retest the current all-time high at $17.46.

However, the above outlook seems less likely considering the current state of the bulls. To retain the bullish outlook ApeCoin price needs to stay above the $12.28 support level. As long as buyers manage to defend this level, there is a good chance that the next leg-up will trigger a rally that will retest the current highs and perhaps move higher into a price discovery phase.

APE/USDT 2-hour chart

Further supporting a lack of enthusiasm for ApeCoin price is the decline in daily active addresses and on-chain volume. The former saw a sharp dropoff since March 28 from 17,048 to 6,445, while the latter has been declining since March 24 from 2.6 billion to 0.98 billion.

This reduction in daily active addresses and on-chain volume indicates that investors are losing interest in the coin at the current levels.

APE on-chain volume, daily active addresses

Regardless of the bullishness among most altcoins, ApeCoin price seems to be struggling to move higher. A minor retracement to $12.28 seems likely, but an increased sell-side pressure could lead to a breakdown of the said support.

If ApeCoin price produces a decisive move below $12.28, it will invalidate the bullish thesis by creating a lower low and trigger a further descent to $9.64.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%20%5B06.41.29%2C%2031%20Mar%2C%202022%5D-637842994532098162.png&w=1536&q=95)