- ApeCoin price continues to face difficulties moving above a critical resistance level at $13.

- Two trade ideas identified yesterday have been resolved.

- A new long opportunity exists – but downside risks remain a major concern.

ApeCoin price action has traded mostly sideways throughout the Saturday session, sticking to a range between $13.80 and $12.40. The bulls attempted to break out Friday but were denied and pushed back down. However, bears were unable or unwilling to capitalize on that weakness. So indecision is now the name of the game.

ApeCoin price develops a strong bullish reversal pattern on its Point and Figure chart

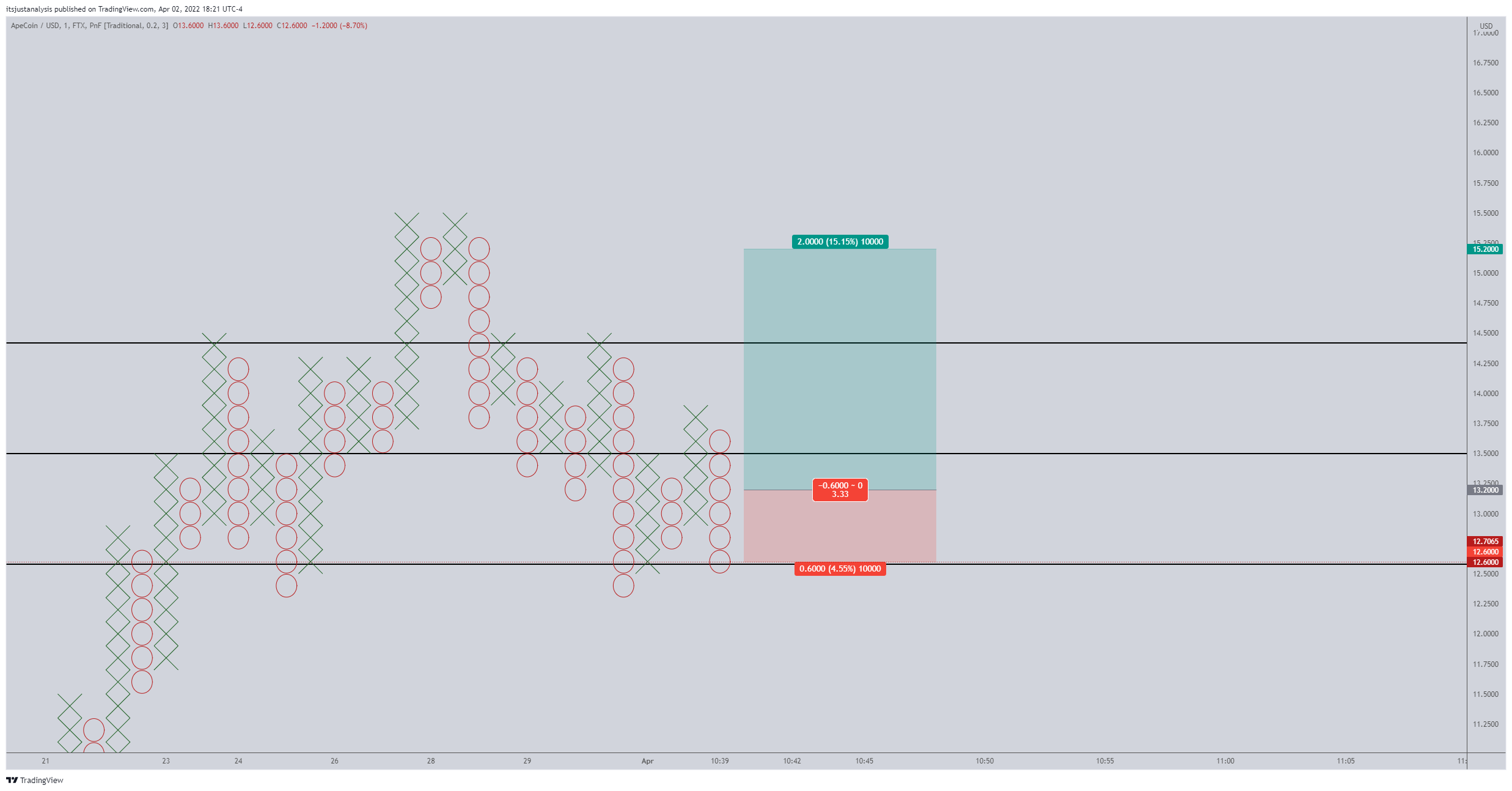

ApeCoin price had two intraday setups on the $0.20/3-box reversal Point and Figure chart on Friday, one long and one short. The long entry triggered and moved up two boxes before returning lower and hitting the trailing stop at break even. The short entry was invalidated because the long side triggered first. Now, a new long opportunity presents itself for ApeCoin bulls.

The hypothetical long entry for ApeCoin price is a buy stop order at $13.20, a stop-loss order at $12.60, and a profit target at $15.20. The trade represents a 3.33:1 reward for the risk. The setup is based on the entry from a Point and Figure pattern known as a Bearish Fakeout.

APE/USDT $0.20/3-box Reversal Point and Figure Chart

The trade is invalidated if the current O-column moves down to $12.20 before the long entry is triggered. A two to three-box trailing stop for ApeCoin price would help protect any profit made post entry.

From an Ichimoku perspective, the whipsaws and indecision make perfect sense. ApeCoin price is inside the 4-hour Ichimoku Cloud. The Cloud represents indecision, volatility, congestion, fakeouts, and a myriad of other negative trading behaviors.

APE/USDT 4-hour Ichimoku Kinko Hyo Chart

In a nutshell, the Ichimoku Cloud is where trading accounts die until there is a clear breakout above the Ichimoku Cloud at $14 or below the Ichimoku Cloud at $12.60, painful trading conditions are likely to continue.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Whale grabs 16,000 ETH as Ethereum Foundation vows support for L1, RWA and stablecoins

Ethereum Foundation's Co-Executive Director Tomasz K. Stańczak highlights simplified roadmap scaling blobs and improving L1 performance. Ethereum whale scoops 16,000 ETH, emphasizing growing interest in the token as the price recovers.

Bitcoin retests key resistance at $85K, breakout to $90K or rejection to $78K?

Bitcoin (BTC) price edges higher and approaches its key resistance at $85,000 on Monday, with a breakout indicating a bullish trend ahead. Metaplanet announced Monday that it purchased an additional 319 BTC, bringing its total holdings to 4,525 BTC.

XRP price teases breakout, bulls defend $2 support

Ripple (XRP) price grinds higher and trades at $2.15 during the early European session on Monday. The token sustained a bullish outlook throughout the weekend supported by bullish sentiment from the 90-day tariff suspension in the United States.

Senator Elizabeth Warren launches fresh offensive on crypto

Senators Elizabeth Warren, Mazie K. Hirono, and Dick Durbin want the DoJ’s decision to terminate crypto investigations reversed. The Senators raise concerns over the DoJ’s shift in priorities, terming it a “grave mistake.”

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.