ApeCoin price hints at diminishing returns for several weeks

- APE price has failed to retest the triangle apex.

- ApeCoin price displays complete bearish control on larger time frames.

- Invalidation of the bearish thesis is a close above $12.

ApeCoin price could go range bound and produce further drops throught spring and summer. There may be better performing digital assets in the coming weeks to keep an eye on.

ApeCoin price signals the end of the bull run

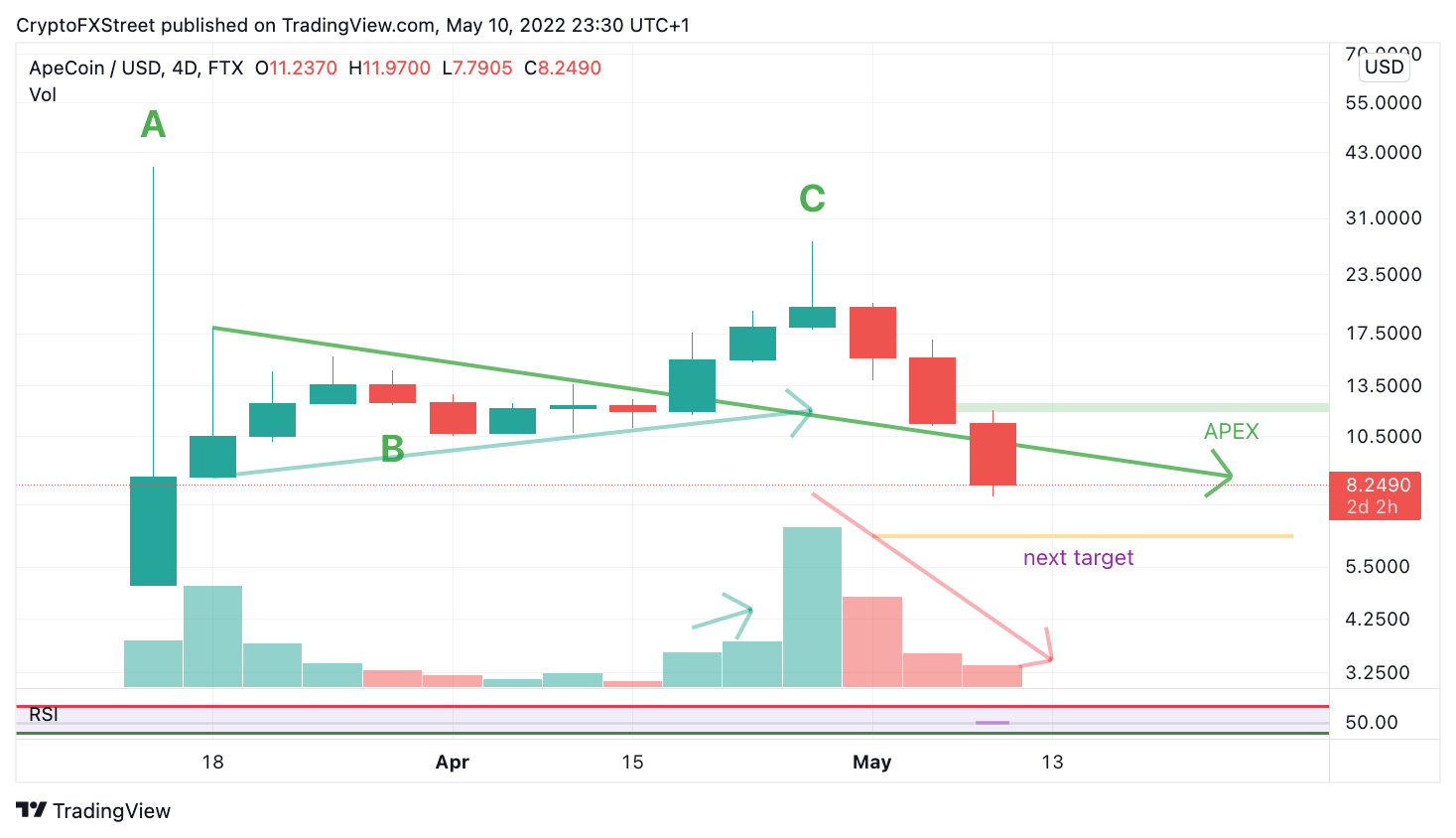

ApeCoin price is signaling a disappointing statement as the bears have managed to establish a settling price below the triangle apex at $12. This is a classic technical analysis signal that all traders should be aware of. Historically, a settling price below a previous triangle apex has resulted in severe bear market conditions in several markets.

ApeCoin price could become a “Crypto underperformer,” yielding diminishing returns from here on out. Because the entire macrostructure was deemed corrective as an ABC pattern (with the triangle as wave B), it may take an equal time before another bullish structure reveals itself. ApeCoin price could begin forming a range within the current $8.00 to possibly $6.00 price level to substantiate the range-bound hypothesis. It is worth noting that the volume indicator shows bearish dominance since the initial sell-off occurred on April 27.

APE/USD 4-Day Chart

Invalidation of the bearish scenario is a breach and close above the triangle apex at $12. If this were to occur, ApeCoin price could truly surprise investors and make a new spring-time high towards $31, resulting in a 275% increase from the current APE price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.