- ApeCoin proposals are up for Decentralized Autonomous Organization vote that concludes on October 12.

- Large wallet investor sold $114 million in ApeCoin and resumed buying over the past week.

- Analysts predict an ApeCoin price rally to $6.60 as the NFT token begins recovery.

ApeCoin (APE), the native currency of the Bored Ape Yacht Club (BAYC) metaverse, has recouped its recent losses. Analysts have predicted a 25% rally in the NFT token as large wallet investors resume buying.

Also read: Solana price: Crypto analysts predict God candle while researchers allege deceptive design

ApeCoin DAO proposals and why they matter

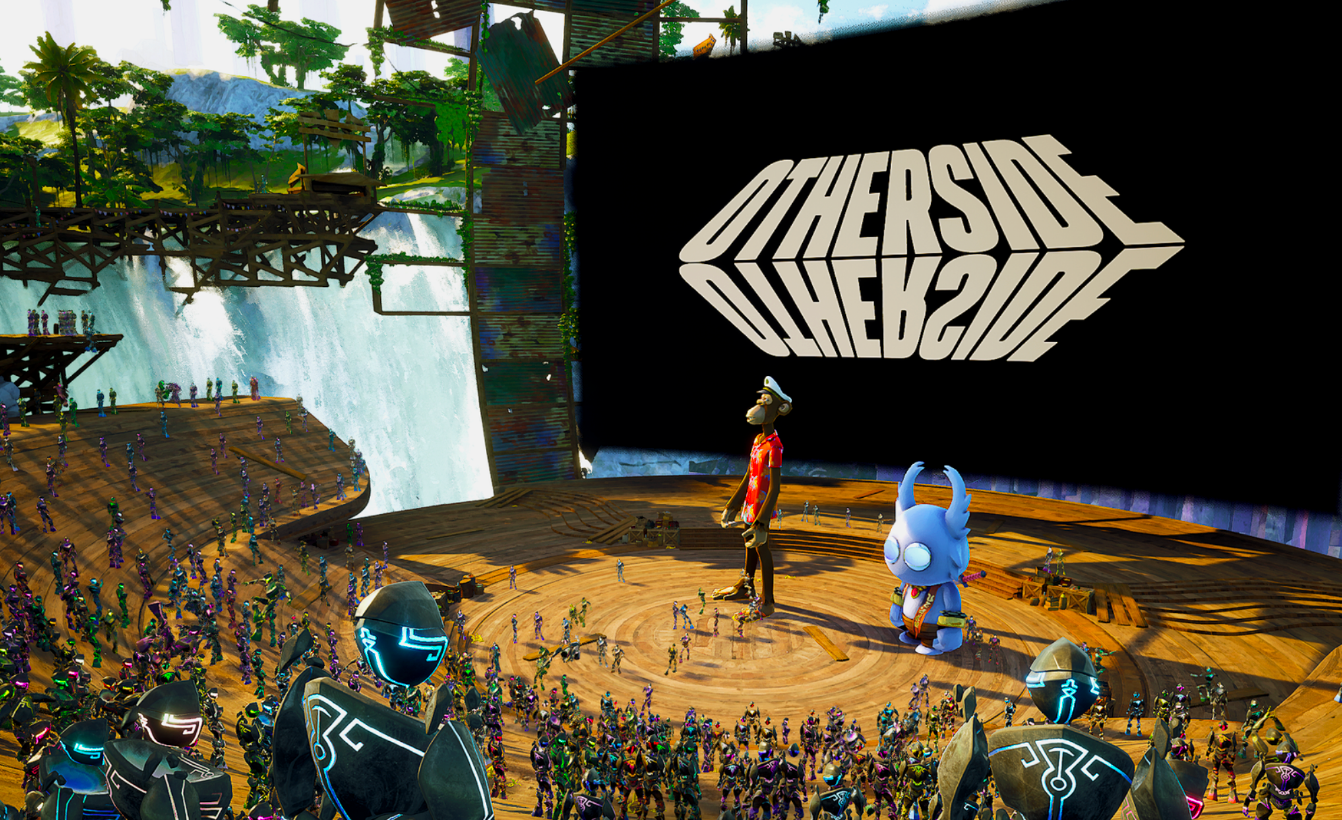

Two proposals, AIP-94 and AIP-106 are up for vote in the ApeCoin DAO. AIP-94 proposes an Otherside animated anthology. Otherside is a gamified, interoperable metaverse currently under development. It blends several multiplayer role-playing games online.

AIP-94 proposes an anthology where each episode occurs on digital plots of land in the Otherside metaverse. Bored Ape Yacht Club characters from the ApeCoin ecosystem would feature in the series, a mass consumption media product.

The goal is to push the value of the Bored Ape Yacht Club NFTs higher and connected assets like APE are likely to benefit from the launch. This would push awareness about the ApeCoin ecosystem higher and result in mass consumption of APE.

The Otherside Metaverse

AIP-106 proposes a contest for Proof-of-Attendance Protocol (POAP) NFT creators. Each POAP is meant as a bookmark of the users or the role-playing characters' life and a record of the memory shared between collectors and issuers. The proposal expects new POAP NFTs to be issued for each live proposal. Both AIPs propose a boost in the utility and adoption of ApeCoin.

Whale wallet sheds $114 million in APE, resumes buying

A large wallet investor identified by analysts at Ourboros Capital recently shed $114 million worth of APE tokens. The whale resumed buying at the end of the APE selling spree and added the NFT token to their portfolio over the past week. Typically, accumulation by whales is considered bullish behavior.

Whale profiler for ApeCoin

Will ApeCoin price climb 25%?

TheEuroSniper, a crypto analyst and trader evaluated the ApeCoin price chart and presented a setup with a target of $6.60. This level is 25% away from ApeCoin’s current price, $5.24. The outlook on ApeCoin is bullish and the NFT token has recouped its losses, yielding nearly 5% gains over the past week.

APE-USDT price chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Grayscale files S-3 form for Digital Large Cap ETF comprising Bitcoin, Ethereum, XRP, Solana, and Cardano

Grayscale, a leading digital asset manager operating the GBTC ETF, has filed the S-3 form with the United States (US) Securities and Exchange Commission (SEC) in favor of a Digital Large Cap ETF.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH, and XRP brace for volatility amid Trump’s ‘Liberation Day’

Bitcoin price faces a slight rejection around its $85,000 resistance level on Wednesday after recovering 3.16% the previous day. Ripple follows BTC as it falls below its critical level, indicating weakness and a correction on the horizon.

Top crypto news: VanEck hints at BNB ETF, Circle files S-1 application for IPO

Asset manager VanEck registered a BNB Trust in Delaware on Tuesday, marking its intention to register for an ETF product with the Securities & Exchange Commission (SEC).

Solana Price Forecast for April 2025: SOL traders risk $120 reversal as FTX begins $800M repayments on May 30

Solana price consolidated below $130 on Tuesday, facing mounting headwinds in April as investors grow wary of looming FTX sell-offs.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.