ApeCoin, EOS and Flow emerge as big disappointments as the DeFi market loses $4 billion

- The crypto market suffered heavy losses over the last few days, with the DeFi tokens absorbing the majority of the blows.

- ApeCoin, Flow and EOS each registered a decline worth between 26% to 30% in the span of a week.

- Binance Smart Chain noted the most drawdown in terms of the total value locked on-chain, which fell by nearly 30% in the last two weeks.

The bearishness observed this week took the market by surprise, in part due to the growth observed in the TradFi markets, which is now negatively correlated to the crypto market. However, amidst all the cryptocurrencies, it was the DeFi tokens that suffered the most.

DeFi tokens take the hit

While the entire crypto market is experiencing a bearish run, with the exception of a few cryptocurrencies, some depreciated more than others. These some belonged to the Decentralized Finance (DeFi) market, which in itself observed a drawdown.

The total value locked in the DeFi markets fell by 5.7% from $69 billion to $65 billion over the past week. Of the topmost DeFi chains, Binance Smart Chain ended up observing the biggest decline, with its TVL plunging by nearly 30% in the span of 10 days. The credit for this decline goes back to the Securities and Exchange Commission, which filed a lawsuit against the exchange last week.

DeFi market TVL

Consequently, over the past two weeks, BSC’s TVL has come down by nearly 30% leaving about $3.96 billion locked on the chain. The regulatory crackdown was the trigger for the broader market crash, which continued this week owing to the announcement by the Fed of pausing interest rate hikes. Surprisingly, the drawdown in the crypto market was against the usual trend but owed the decline to the promise of rate hikes in the future.

However, amidst these events, the altcoins continued bearing the brunt of the bears, with ApeCoin, EOS and Flow emerging as the biggest losers. The DeFi tokens took significant damage losing their value from 27% to 30% in the past seven days.

DeFi tokens at new lows

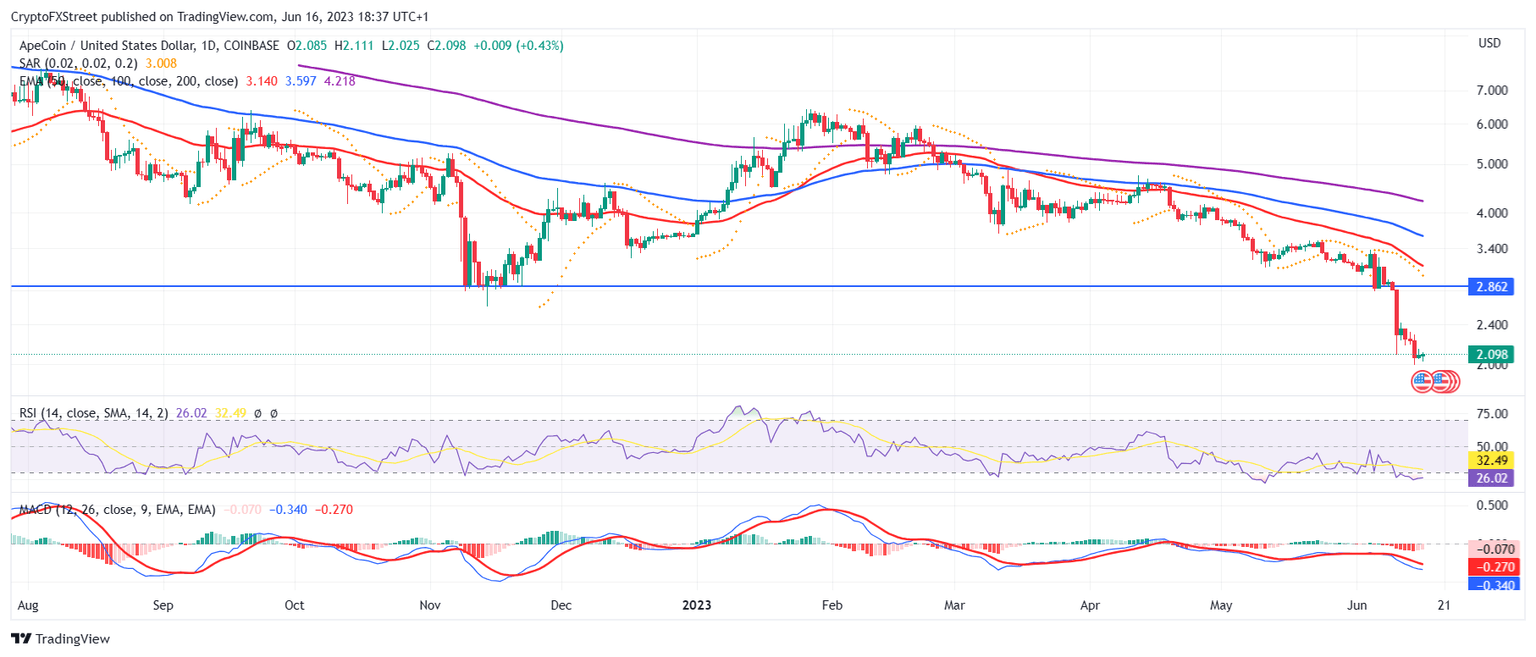

At the time of writing, ApeCoin price is recovering after marking an all-time low of $2.066 this week. The last line of defense for the altcoin was $2.862, which it lost a week into June, resulting in a week-long decline of 26%.

APE/USD 1-day chart

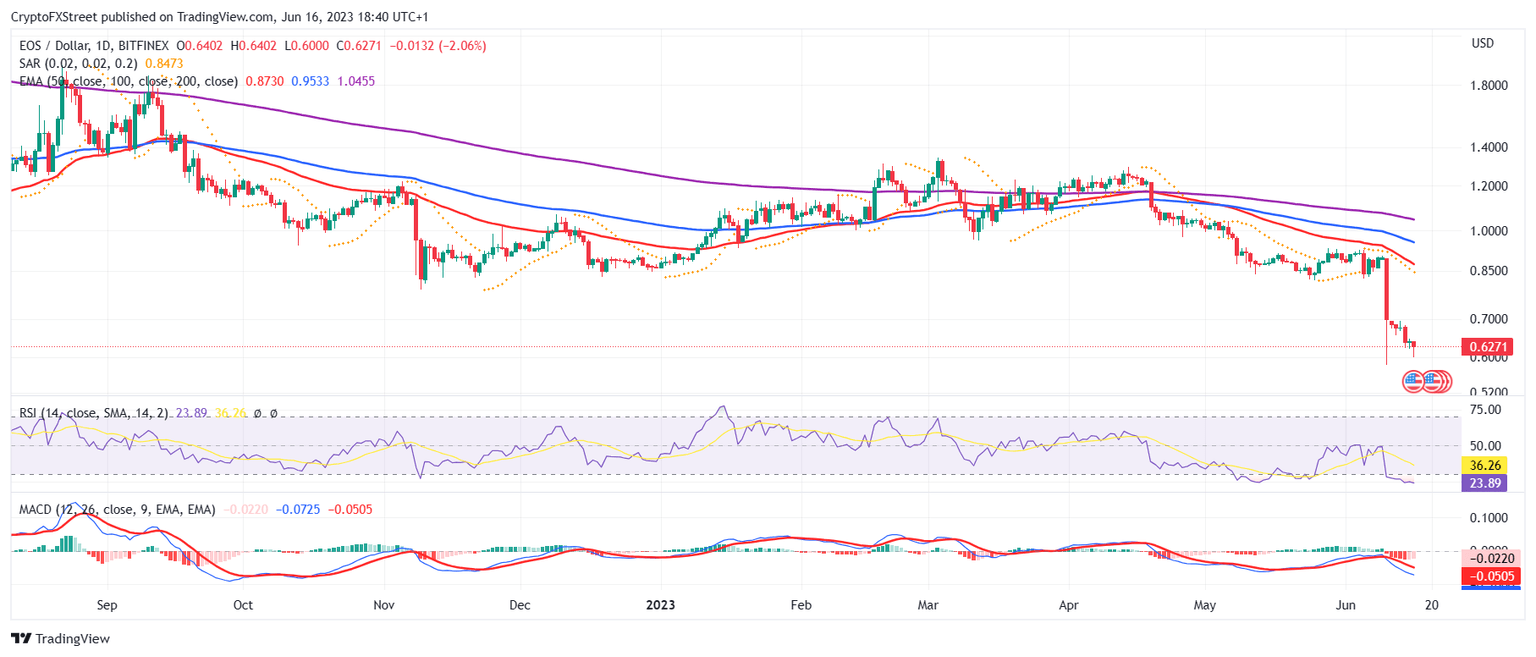

EOS, too, marked a nearly five-and-a-half-year low after falling by more than 30% in the last seven days. The altcoin is still painting red on the charts, trading at $0.6271. The bearishness is only further growing in the case of the DeFi token and could lead to further decline.

EOS/USD 1-day chart

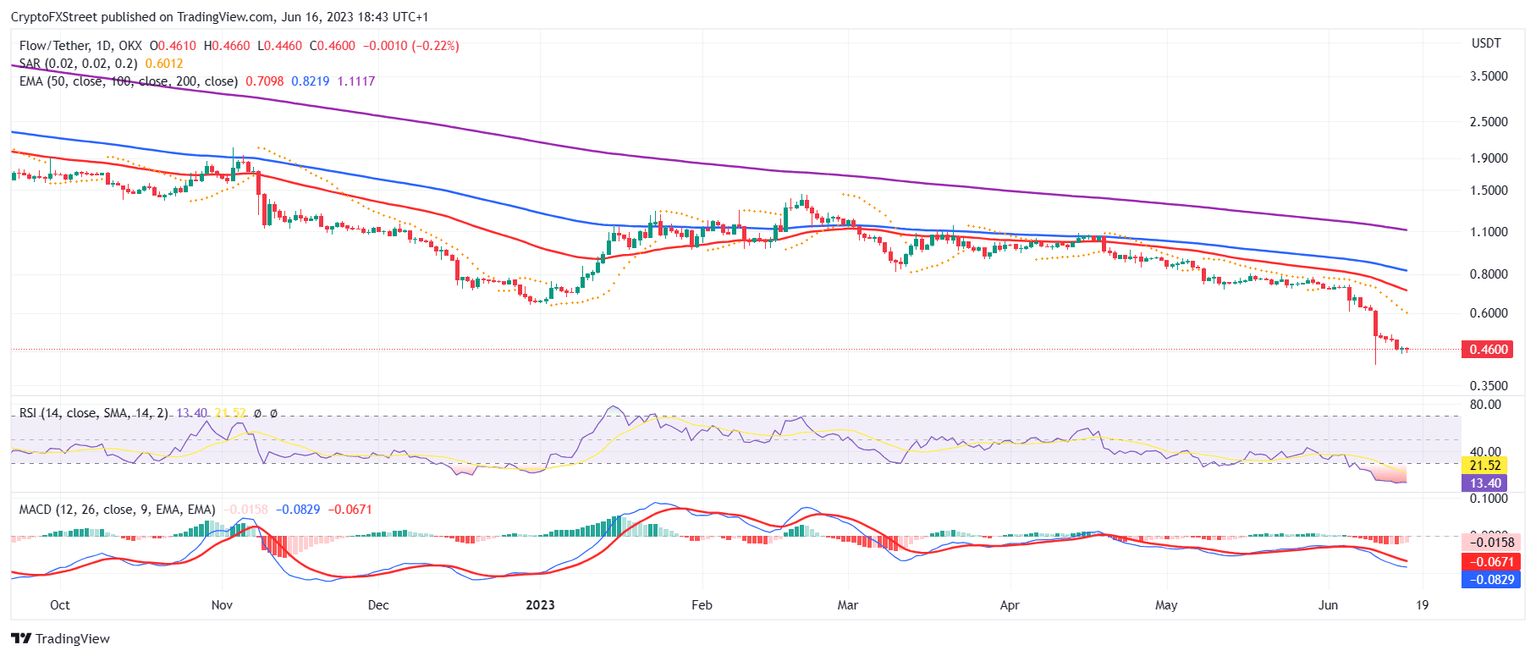

In line with ApeCoin is Flow which is also observing a historical all-time low of $0.4600 after plunging on the charts by nearly 27% in the past week. The altcoin has already been in a decline since mid-April after losing the Exponential Moving Averages (EMAs).

FLOW/USD 1-day chart

All the cryptocurrencies are still observing bearishness in the market, and if the broader market conditions deteriorate going forward, further declines can be expected. The ongoing tiff between SEC and Coinbase, as well as Binance, could impact the price action negatively in the near future if developments do not go in favor of the exchanges.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.