- Dogecoin price very silently breaks above a key trendline.

- DOGE price sees bears scrambling to get the price back in check.

- Expect to see this as the cue for bulls and investors to dive into the price action and squeeze out bears.

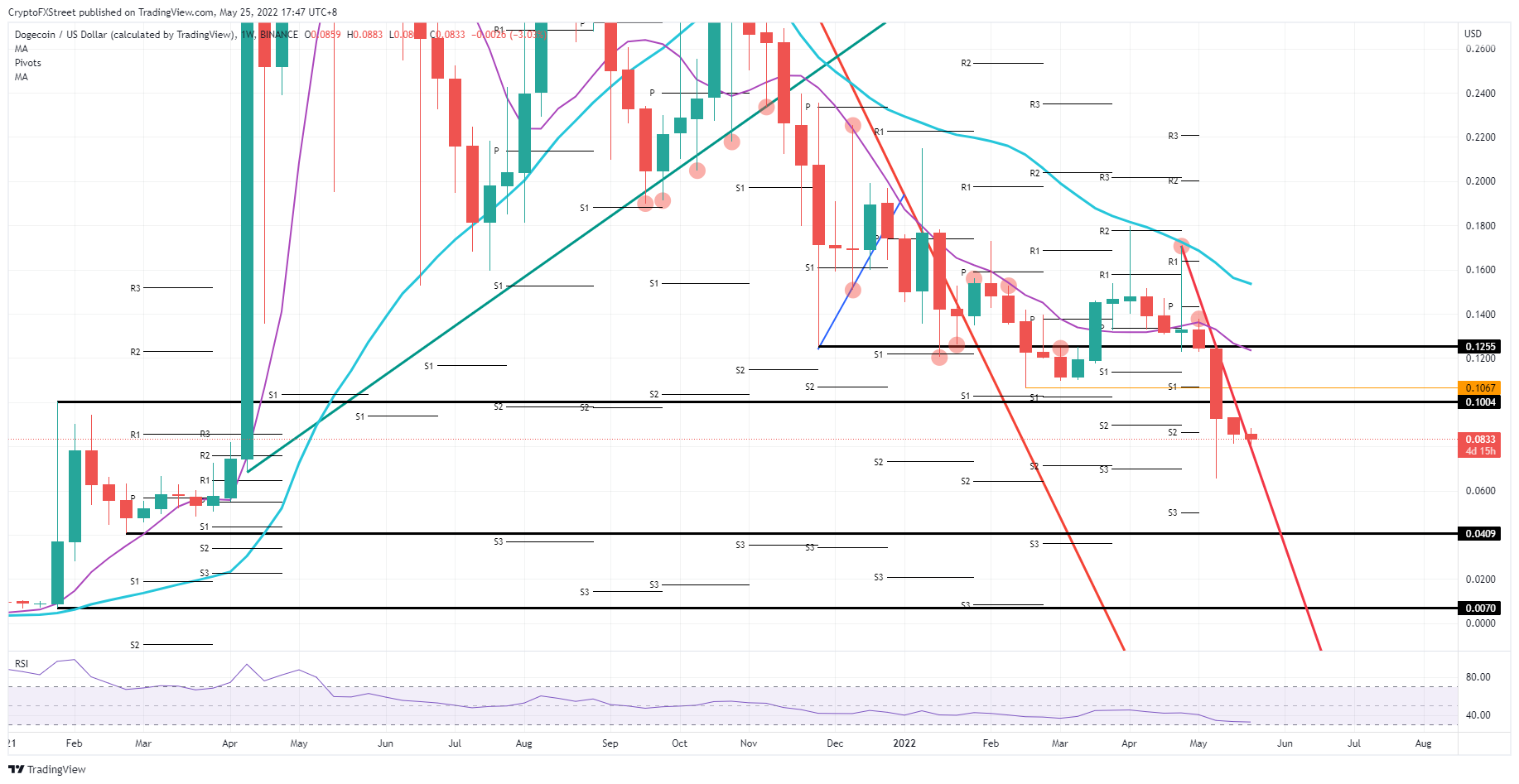

Dogecoin (DOGE) price has silently thrown off the yoke of a red descending trend line that has been putting pressure on DOGE price since the end of April. Although price action still looks muted, it is the cue that bulls were waiting for, as bears are trying to push price action back into a downtrend. Now expect to see bulls take the upper hand as a shift on the geopolitical stage could provide tailwinds that help them gain control, with $0.1255 on the front foot as a nearby price target.

DOGE price set to dip lower

Dogecoin price had lost a lot of its feathers from back when it was Elon Musk's next adopted child in his stable of investments. Since the billionaire's interest faded, however, DOGE price had to make it on its own accord, with the headwind of increasing dollar strength in its way. Since price action slipped below $0.1000, several warning lights have come on, but sentiment looks to be changing now that DOGE price has broken out of the red descending trend line.

DOGE price will now try to use the trendline as support to bounce off, allowing bulls to get in long on price action, and squeezing out bears in the process. The first and most significant level to the upside to face is $1.00 as it holds psychological importance and is a historic pivotal level since the high at the end of January. Once bulls can capture the area, expect another phase in the rally towards $0.1255, where a double cap will trigger some profit-taking and stage a short fade, with backtracking price action searching for support somewhere around $0.1200 or $0.1067.

DOGE/USD weekly chart

A false breakout at hand could spell the perfect bull trap if price action falls back below the red descending trend line. In such a case, expect an accelerated move to the downside in a squeeze dragging bulls down to $0.0600. At that level a double bottom could form, with 23% incurred losses before dropping towards $0.0409, and adding another 37% to that 23% of already booked devaluation.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Dogecoin lead double-digit gains across meme coins, with Shiba Inu, PEPE and BONK skyrocketing to new monthly highs

Top meme coins Dogecoin (DOGE), Shiba Inu (SHIB), PEPE and BONK lead the meme coin sector with double-digit gains on Wednesday following the crypto market recovery.

Cantor is set to launch a $3 billion venture backed by Softbank and Tether

Brandon Lutnick is spearheading a $3 billion Bitcoin investment through Cantor Fitzgerald, partnering with SoftBank, Tether, and Bitfinex to form 21 Capital. The firm aims to emulate MicroStrategy’s strategy of holding Bitcoin as a treasury asset for long-term appreciation.

Top 3 gainers Fartcoin, Zerebro, DeepBook: Solana and Sui meme coins soar on bold risk-on wave

Meme coins led by Fartcoin, Zerebro and DeepBook (DEEP) are extending gains during the Asian session on Wednesday amid soaring investor risk appetite. Bitcoin (BTC) briefly crossed $93,000 the previous day alongside widespread rallies among altcoins.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bulls target $95,000 BTC, $1,900 ETH, and $3 XRP

Bitcoin (BTC) price hovers around $92,800 on Wednesday after rallying 9.75% over the past two days. Ethereum (ETH) and Ripple (XRP) followed BTC’s footsteps and continued their recovery rally. The technical outlook suggests an upward trend, targeting $95,000 BTC, $1,900 ETH, and $3 XRP.

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.