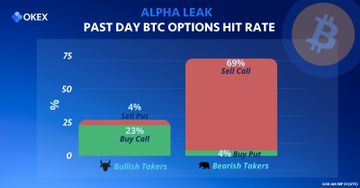

- Over the past 24 hours, 69% of BTC taker flow came from bearish traders reducing their call positions on OKEx.

- Bitcoin analyst on Twitter admits to taking a break from BTC and trading in altcoins for their volatility in the current cycle.

- Bitcoin fear and greed index signals extreme fear, bearish sentiment takes over traders across exchanges.

Cryptocurrency market strategist Dave The Wave has projected a Bitcoin pullback to $20,000 in the ongoing correction. On-chain analysts argue that accumulation is on, though BTC price has plunged to $43,000.

Extreme fear grips Bitcoin traders, the asset continues downward trend

The fear and greed index is considered an indicator of trader sentiment across the cryptocurrency market towards Bitcoin. The indicator is signaling “Extreme Fear” among market participants.

Historically, excessive fear has resulted in Bitcoin trading well below its intrinsic value, and analysts consider this indicator as a gauge, and predict further correction in the asset’s price.

Charles Edwards, the founder of Capriole Investments, believes that Bitcoin’s correlation with S&P is strong. As the index has noted a drop, traders’ outlook on Bitcoin has turned bearish, represented by extreme fear in the indicator.

In the short-term, Bitcoin is a slave to the S&P.

— Charles Edwards (@caprioleio) September 20, 2021

Extremes in Fear & Greed result in ultra-high correlation.

Today we are in Extreme Fear.

Good news is a number of metrics suggesting S&P is near bottom. pic.twitter.com/D2evJGntg3

Seychelles-based cryptocurrency exchange OKEx recently shared statistics of its Bitcoin options on Twitter. The exchange noted a 69% taker flow from Bitcoin bears, aggressively reducing their positions ahead of an anticipated drop in price.

OKEx Bitcoin options statistics for September 20

As bearish sentiment penetrates the market, analysts on crypto Twitter admit to reducing their Bitcoin trading activity and increasing the size of their altcoin positions, owing to the relatively high volatility.

Dave The Wave, a cryptocurrency analyst and crypto influencer behind the Twitter handle @davthewave, has informed his followers in a recent tweet that he will change his bearish outlook on Bitcoin to bullish within two to three months.

Until then, the analyst is trading in altcoins.

Disinterested TA. Parabolas correct. Give it a couple of months and I'll be uber bullish once again.

— dave the wave (@davthewave) September 21, 2021

Why trade BTC when you can trade the extra volatility of alts.

Analysts are anticipating a further drop in the asset’s price. Daniel Joe, a cryptocurrency analyst and trader, states that $40,100 is the bottom for Bitcoin. Joe expects BTC price to recover after another $2 billion in market capitalization is wiped out of the asset.

Is 40.1k the bottom for #BTC?

— Daniel Joe (@DanielJoe916) September 21, 2021

I think it could be the bottom. Onchain trend remains #bullish, Wave 2 corrective following ABC wave structure, top of 30k to 40k trading range tested with a wick back up after a $2B liquidation wipe out. It’s early, so we need to watch closely.

FXStreet analysts predict a jump in Bitcoin price, set a price target of $51,000 level for the asset.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Litecoin Price Prediction: LTC tries to retake $100 resistance as miners halt sell-off

Litecoin price grazed 105 mark on Monday, rebounding 22% from the one-month low of $87 recorded during last week’s market crash. On-chain data shows sell pressure among LTC miners has subsided. Is the bottom in?

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin price struggles around $95,000 after erasing gains from Friday’s relief rally over the weekend. Bitcoin’s weekly price chart posts the first major decline since President-elect Donald Trump’s win in November.

SEC Commissioner Hester Pierce sheds light on Ethereum ETF staking under new administration

In a Friday interview with Coinage, SEC Commissioner Hester Peirce discussed her optimism about upcoming regulatory changes as the agency transitions to new leadership under President Trump’s pick for new Chair, Paul Atkins.

Bitcoin dives 3% from its recent all-time high, is this the cycle top?

Bitcoin investors panicked after the Fed's hawkish rate cut decision, hitting the market with high selling pressure. Bitcoin's four-year market cycle pattern indicates that the recent correction could be temporary.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.