Traders identify key support and resistance levels that Ethereum must hold as ETH price trades at levels not seen since July 2021.

The crypto market experienced another day of pain on May 12 as the fallout from the Terra's LUNA and UST failure continues to ripple across the ecosystem.

While the coverage for UST and its impact on Bitcoin (BTC) have been extensively covered over the past few days, the pullback has also had a significant impact on the price of Ether (ETH) as traders hastily exited the market.

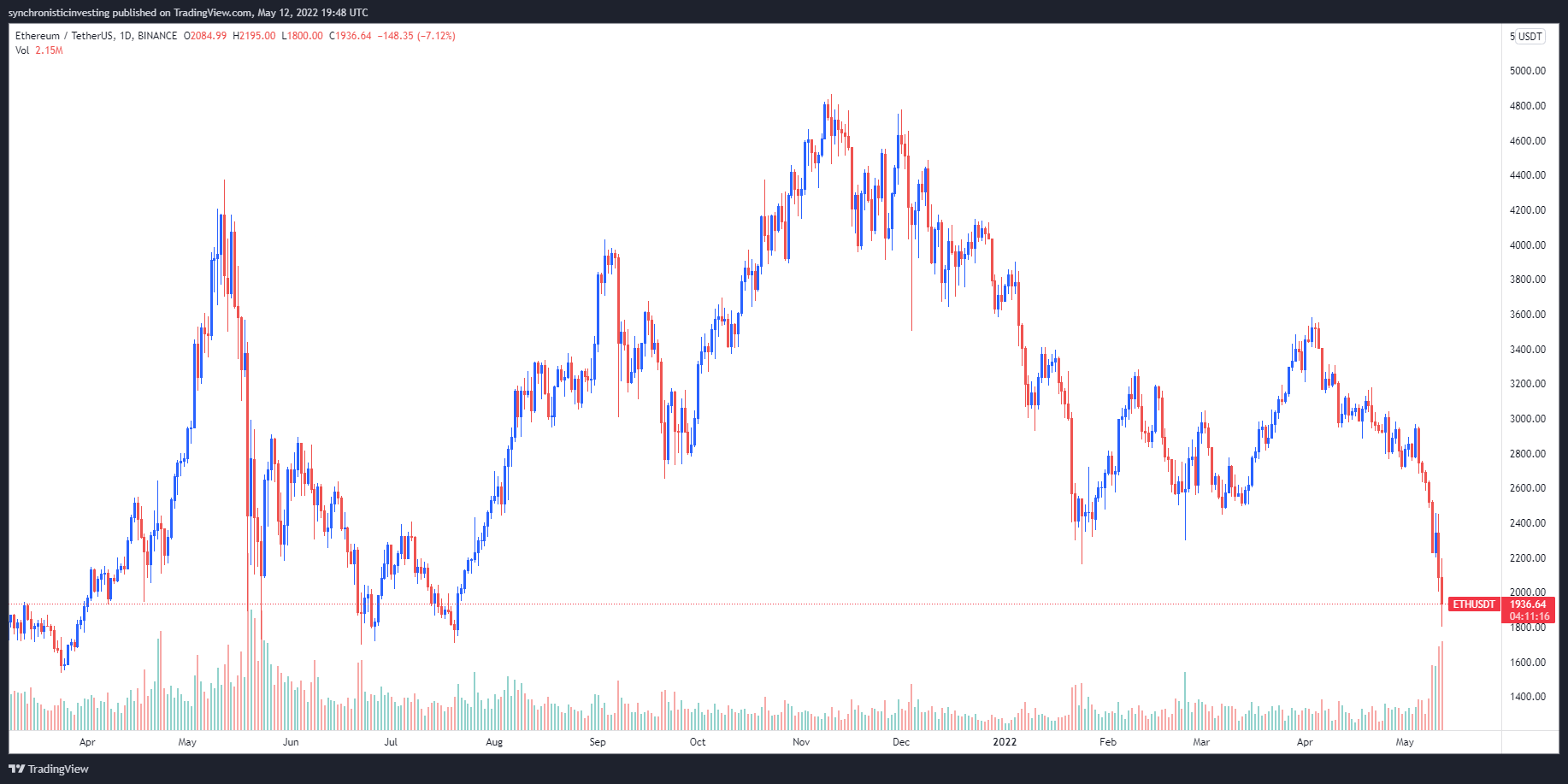

Data from Cointelegraph Markets Pro and TradingView shows that the past seven days of selling dropped Ether to $1,701, a price not seen since July 2021.

ETH/USDT 1-day chart. Source: TradingView

Here’s a look at what several analysts are saying about the outlook for Ethereum and what support and resistance levels to keep an eye on.

Ether needs to reclaim $2,250

The overnight plunge to the low $1,700 range was documented by crypto analyst and pseudonymous Twitter user ‘Rekt Capital’, who posted the following chart outlining the major support and resistance zones for Ether.

ETH/USD 1-month chart. Source: TradingView

Rekt Capital said:

If Ether isn't able to rebound strongly from here so as to Monthly Close above the black ~$2,250 level above, the ~$1,720 will reveal weakness and may not hold price.

Should a further breakdown in price occur, Rekt Capital indicated that the blue zone on the chart is the “ next major support sub ~$1720,” which is located near $1,350.

Bouncing off the 2021 summer lows

Insight into what Ether's price action may look like should it head lower was provided in the following tweet by ‘Crypto Feras’, who mused that just a few weeks ago it sounded crazy to talk about Ether falling to these levels.

ETH/USDT 1-day chart. Source: TradingView

Crypto Feras said:

Technically Ether is bouncing off its 2021 summer lows (outperforming Bitcoin so far). The bounce areas are either this $1,700 - $1,800 [range] or we [are] gonna have to test [the] $1,400 zone.

Possible short-term retest of $1,550

A longer-term view of the Ether's price action was discussed by market analyst Caleb Franzen, who suggested that a “bearish” breakdown below a major trendline.

ETH/USDT 1-week chart. Source: Twitter

Franzen said:

Very possible that we retest the January 2018 highs, around $1,550, in the next 24 hours. If/when we break below that former resistance level, that's another bearish signal.

The overall cryptocurrency market cap now stands at $1.219 trillion and Ether’s dominance rate is 19.2%.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

SEC sues Cumberland DRW for acting as an unregistered securities broker, Solana ETFs at risk

The Securities & Exchange Commission filed a lawsuit on Thursday against Chicago-based trading firm Cumberland DRW for operating as an unregistered securities dealer. The regulator mentioned several cryptocurrencies in the suit including Solana.

Bitcoin risks worst October in six years following high US inflation data and S&P 500 correlation

Bitcoin and the crypto market trended downward on Thursday as the US Consumer Price Index data for September showed that inflation is rising again, reducing the already slim chances of the Federal Reserve cutting its interest rate by another 50 basis points in November.

Uniswap unveils Layer-2 solution Unichain as part of Optimism Superchain

Uniswap saw double-digit gains on Thursday after unveiling the launch of its DeFi Layer-2 solution, Unichain. Unichain is built to provide seamless cross-chain transactions while scaling the Ethereum blockchain.

Ethereum Price Forecast: ETH could decline to $2,200 amid rising US inflation and exchange reserves

Ethereum and the crypto market saw a second consecutive day of losses after the September US Consumer Price Index data came in stronger than expected. September's inflation fell to 2.4% — but above expectations of 2.3%.

Bitcoin: Is BTC sell-off over?

Bitcoin price declined over 6% this week until Friday as the escalation of the conflict between Iran and Israel added fuel to this sell-off. The decline was also supported by falling institutional demand for ETFs. BTC bulls seem to be holding strong at a critical support level.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.