Analysts say Bitcoin price pullback and profit-taking at $50K ‘was expected’

Traders say a correction to lower support levels and standard profit-taking was expected after Bitcoin’s swift ascension to $50,000.

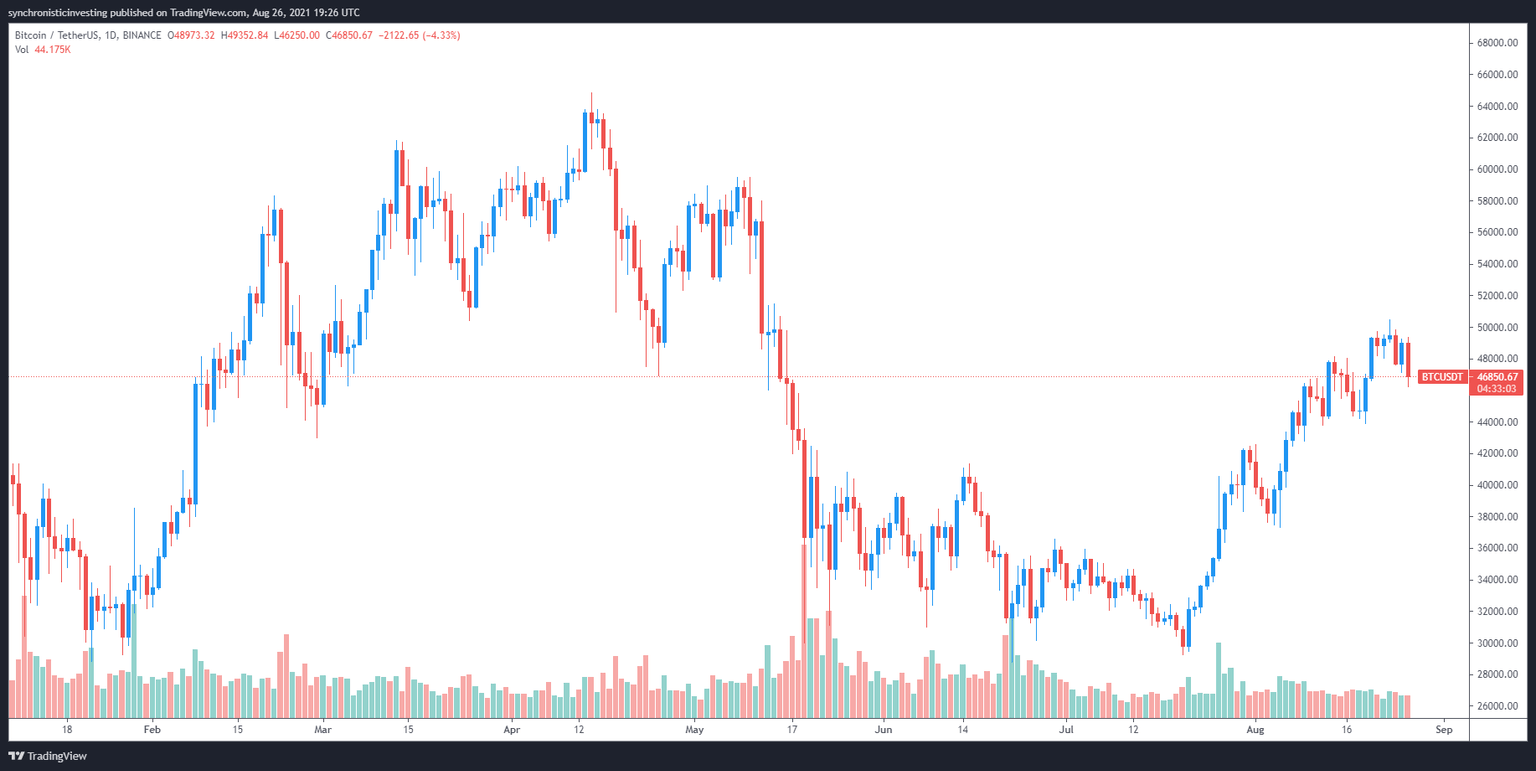

The euphoria seen across the cryptocurrency ecosystem over the past couple of weeks was tampered down on Aug. 26 as an early morning attempt by bulls to push the price of Bitcoin to $50,000 was soundly rejected.

Data from Cointelegraph Markets Pro and TradingView shows that following its rejection, the price of Bitcoin slid to a low of $46,457 before bulls managed to regroup and put a halt to the downturn.

BTC/USDT 1-day chart. Source: TradingView

Here’s what analysts are saying about Thursday’s price action for Bitcoin and a few things they are watching for as the digital asset is caught between a tug-o-war between bulls and bears.

BTC price could trend south for a while

The $50,000 price level was identified as a critical area for Bitcoin by market analyst and Cointelegraph contributor Michaël van de Poppe, who posted the following tweet outlining the significant support and resistance areas.

Couldn't break the critical area for #Bitcoin.

— Michaël van de Poppe (@CryptoMichNL) August 26, 2021

Might be making a slight bounce here, but overall trend is south for a little.

Massive support around $44K.

Invalidation if breakout above $49K happens (and mostly, $51K). pic.twitter.com/d7gTuHKCvA

According to van de Poppe, Bitcoin is likely to spend some time in a downward trend following this latest pullback, but there is a significant amount of support at the $44,000 level that could protect it from further decline.

The $51,000 price level was noted by van de Poppe as an important price to overcome to invalidate the current bearish trend.

The analyst said:

It's obviously not a bear market, but the overall consensus is that emotions can take over. Especially if Bitcoin corrects some more towards $44,000 or potentially $42,000, the topic of 'long bear cycle' will start to take over.

Traders expect the $46,200 support to hold

According to Whalemap, a crypto-focused data tracking service, the calls for a lengthy bear cycle are premature at best according to on-chain data.

Bitcoin volume profile. Source: Whalemap

As seen in the chart provided, the $46,200 support level is important as the next support level is found at $39,600. On-chain data also shows that there is a limited amount of selling volume between $46,200 and $57,400.

Whalemap analysts said:

No reasons to get bearish just yet. Risk reward looks pretty positive if you look at on-chain data. A lot of UTXOs held unspent at $46,200 and not much selling pressure up until $57,400.

Profit-taking at $50,000 was expected

Crypto analyst Will Clemente issued some reassuring words on Aug. 24 when warned of a possible short-term bearish pullback based on exchange inflows and whale wallet activity.

I am short term bearish.

— Will Clemente (@WClementeIII) August 25, 2021

Drop in Illiquid Supply Ratio and coins moving onto exchanges. Also seeing some selling from whales. pic.twitter.com/nRhdB2GuSp

Thursday’s pullback in the market showed that Clemente’s concerns were warranted and the analyst followed up the previous tweet with, “I think the large portion of this short-term move is probably over.”

In a separate tweet, Clemente said:

“It's not unexpected to see some profit-taking after the move up to $50,000, but watching the rate at which this is happening and more importantly, are sellers willing to start selling at a loss? Some clues can be offered by Realised P/L, SOPR, SOAB, ASOL, and Realised Gradient.”

The overall cryptocurrency market cap now stands at $1.999 trillion and Bitcoin’s dominance rate is 44.2%.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.