- Bitcoin price rally takes a breather as analysts recommend locking in profits ahead of a trend reversal.

- Analysts expect another leg up for the Solana rally, expect market capitalization to surge three times the current level of $34 billion.

- Traders rotate capital between layer zero and layer one solutions like Solana, Luna, Avalanche and Fantom, looking for the next Bitcoin or Ethereum.

Analysts suspect that the current price trend in Bitcoin is not as reliable and expect a second pullback to $44,300. Bitcoin's fear and greed index is at the edge of "greed" and "extreme greed." It is unclear where the cryptocurrency will head next.

Traders show a preference for Cardano, Solana and Terra as Bitcoin rally cools off

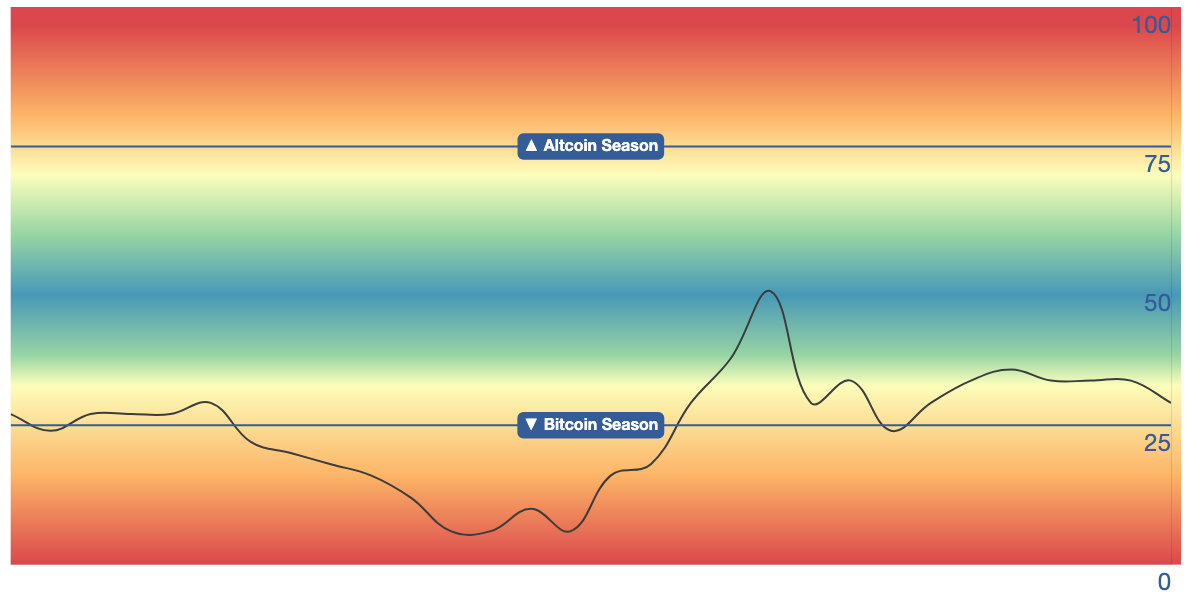

The "Altcoin Season Index" by blockchaincenter.net is an indicator that signals if altcoins are performing better than Bitcoin in a given year. If 75% of the top 50 altcoins by market capitalization perform better than Bitcoin over a year, it is an "Altcoin Year."

Currently, the index shows a skew toward altcoins over the past 30 days. Altcoins still have further room to catch up to Bitcoin on the yearly chart.

30-day chart of Altcoin Season Index.

August is an "Altcoin Month," and the current altcoin price action backs this result.

Cardano, Solana and Terra are leading the alt season with double-digit gains over the last two weeks. Analysts expect Cardano's price to make a strong comeback and hit a new all-time high ahead of the Alonzo Hard Fork that is scheduled to occur on the mainnet on September 12, 2021.

Setting higher targets for Cardano, the cryptocurrency analyst and partner at The Spartan Group behind the Twitter handle @SpartanBlack_1 predicted a threefold increase in the Solana market capitalization from the current level.

If $90B is the right valuation for $ADA, then $SOL is easily a 3X from here.

— SpartanBlack (@SpartanBlack_1) August 31, 2021

Solana's price rally is prolonged, and the altcoin has surged 21% over the past 24 hours. As the "Ethereum killer" continues its upward climb, traders have started booking profits in tranches, labeling it a "no regret move."

Pseudonymous analyst on Twitter behind the handle @dkcrypto13 tweeted:

Euphoric day for all $SOL holders. We are seeing short capitulation. Just be aware that, while it can go on for longer than you think possible, it often resets violently. I am selling 25% of my #solana here, which is a no regret move. Best chain out there, but gotta manage risk.

— DK (@dkcrypto13) August 30, 2021

The latest updates on the Solana network have made the project more lucrative to the crypto trading community. The altcoin's "wormhole" is a bi-directional bridge that supports the exchange of assets between the Ethereum and Solana blockchain. Traders are awaiting another exciting update to the "wormhole" that would allow for a three-way transfer of assets and support the Terra blockchain.

Over the past month, LUNA (Terra's reserve currency) garnered attention from several investors as its market capitalization crossed $13.7 billion. The adoption of LUNA and the Terra network is rising with the burn of $185 million worth of LUNA tokens and anticipation of a significant network upgrade called Columbus-5.

The upgrade is expected to drive the launch of more projects on the Terra network and increase the demand for LUNA in the long term.

On the institutional front, investors are following a similar pattern as retail traders. Bitcoin investment products have recorded their eighth consecutive week of outflows, a total of $3.8 million, while altcoin funds continue to report fresh inflows.

$24 million in capital was injected in crypto funds in the week that ended on August 27, according to CoinShares, a digital asset investment management firm. Of all altcoins, Cardano funds accounted for over $10 million in inflows, leading to a bullish outlook among traders and analysts.

Cryptocurrency analyst @AltcoinSherpa terms the current market as "Layer 1 season." He notes the rotation of capital in Layer 1 solutions on the blockchain, pointing out how traders are looking for early entry and an upside in the short term.

Layer 1 season it seems. As others have said, we're seeing a lot of rotation of capital from L1 to L1. Why does this happen? ie. $SOL-> $LUNA-> $AVAX-> $FTM

— Altcoin Sherpa (@AltcoinSherpa) August 30, 2021

-Better opportunities on new DeFi protocols (better APY)

-$ incentives (300mm for FTM)

-being 'earlier' =better upside pic.twitter.com/X27v6UMMJI

Adrian K. Zduńczyk, certified technical analyst and founder and CEO of “The Birb Nest,” warned traders to remain cautious of Bitcoin price corrections. The analyst suggests that traders lock in profits ahead of a trend reversal in Bitcoin.

In his recent "Bitcoin and Altcoin market update," Zduńczyk is quoted:

Knowing there's been massive rally for bulls in last 5-6 weeks, I'll take this weekly doji as yet another reason to lock in some profits while we're in the high 40s – JUST IN CASE.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Dogecoin and Bitcoin Cash Price Prediction: Funding rates decrease indicate weakness in DOGE and BCH

Dogecoin and Bitcoin Cash registered 3% and 8% losses on Tuesday following increased selling pressure from the futures market. The decline comes amid large-cap cryptos like Bitcoin, Ether and XRP, holding still with slight gains.

XRP could sustain rally amid growing ETF and SEC vote prospects

Ripple flaunted a bullish outlook, trading at $2.1505 on Tuesday. Investor risk appetite has continued to grow since the middle of last week, propping XRP for a sustainable upward move triggered by the swift decision by US President Donald Trump to suspend reciprocal tariffs for 90 days.

VeChain Price Forecast: VET bulls aim for a double-digit rally

VeChain price hovers around $0.023 on Tuesday after breaking above a falling wedge pattern the previous day; a breakout of this pattern favors the bulls. Bybit announced on Monday that VET would be listed on its exchange. Moreover, the technical outlook suggests rallying ahead, targeting double-digit gains.

Dogecoin, Shiba Inu and Fartcoin price prediction if Bitcoin crosses $100K this week

The meme coin market fell sharply on Monday, shedding 4.8% in market capitalization to settle at $49.25 billion, according to data compiled from CoinGecko. The sell-off coincided with increased volatility across broader crypto markets while investors rotated funds into Bitcoin briefly tested $85,000.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.