Analyst suggests AVAX could explode by 220% if Bitcoin price crosses this level

- According to Michael van de Poppe, altcoins, including Ethereum and Chainlink, are bound to experience significant increases.

- The analyst also suggested Litecoin could rally up to almost $210 and predicted ATOM could shoot up to $25.

- For the altcoins to reach these levels, Bitcoin price would need to be at a nine-month high, which could be difficult given it is currently trading at $23,169.

Traders and investors have hopes from the crypto market of going back to its glory of the May 2022 peak. Around that time, Bitcoin price, as well as the altcoins, managed to mark their all-time highs. For BTC and other altcoins to climb back to their respective highs, the crypto market would need a lot of support from the bulls and buyers.

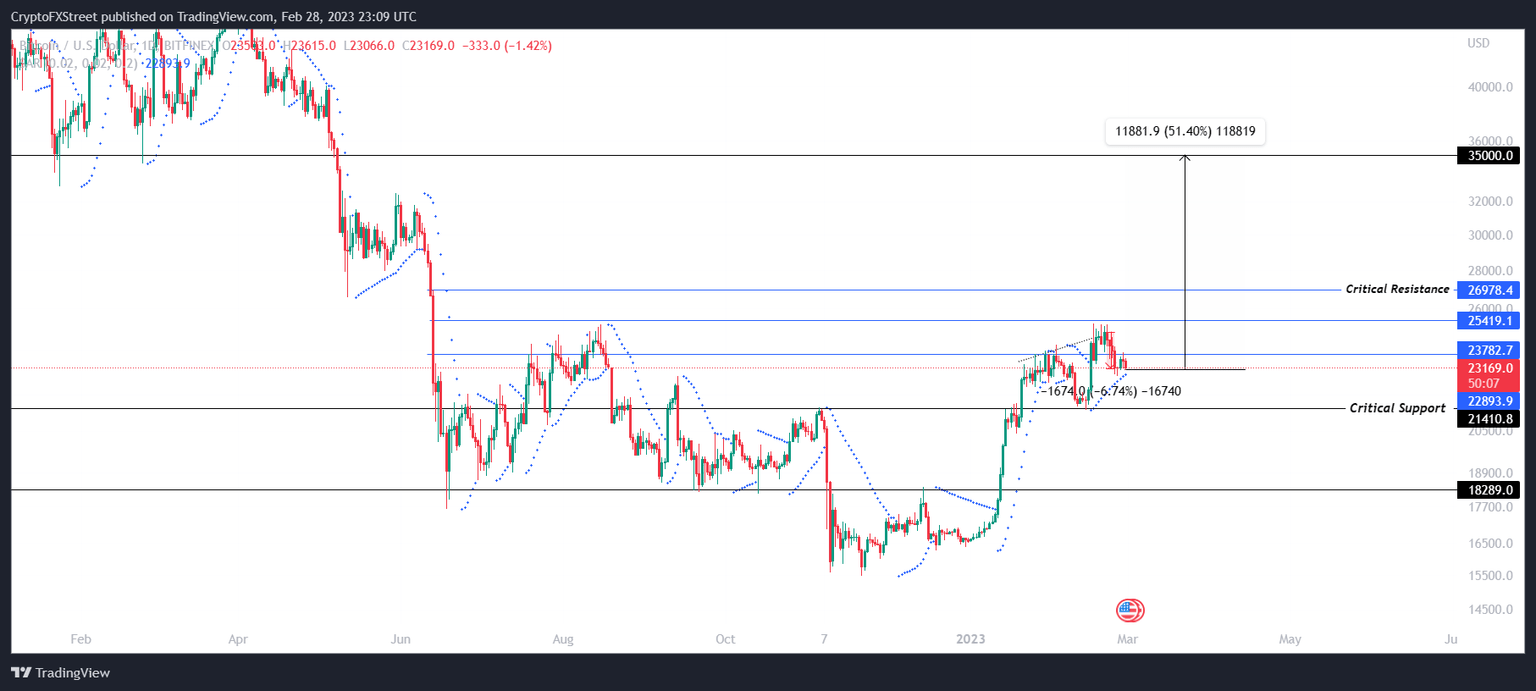

Bitcoin price needs to be at this level

As per analyst Michael van de Poppe, the crypto market and a bunch of in-demand altcoins would be able to note some significant growth if only Bitcoin price rises to $35,000. This price level was last touched by the biggest cryptocurrency in the world back in May 2022, right after it crashed from its all-time high of $67,000.

BTC/USD 1-day chart

At the time of writing, Bitcoin price could be seen trading at $23,100, which means that for BTC to rise up to $35,000, it would need to register a 51.42% rally. However, the practical target for the cryptocurrency would be above the critical resistance above $25,000, a peak that was last witnessed eight months ago in July 2022.

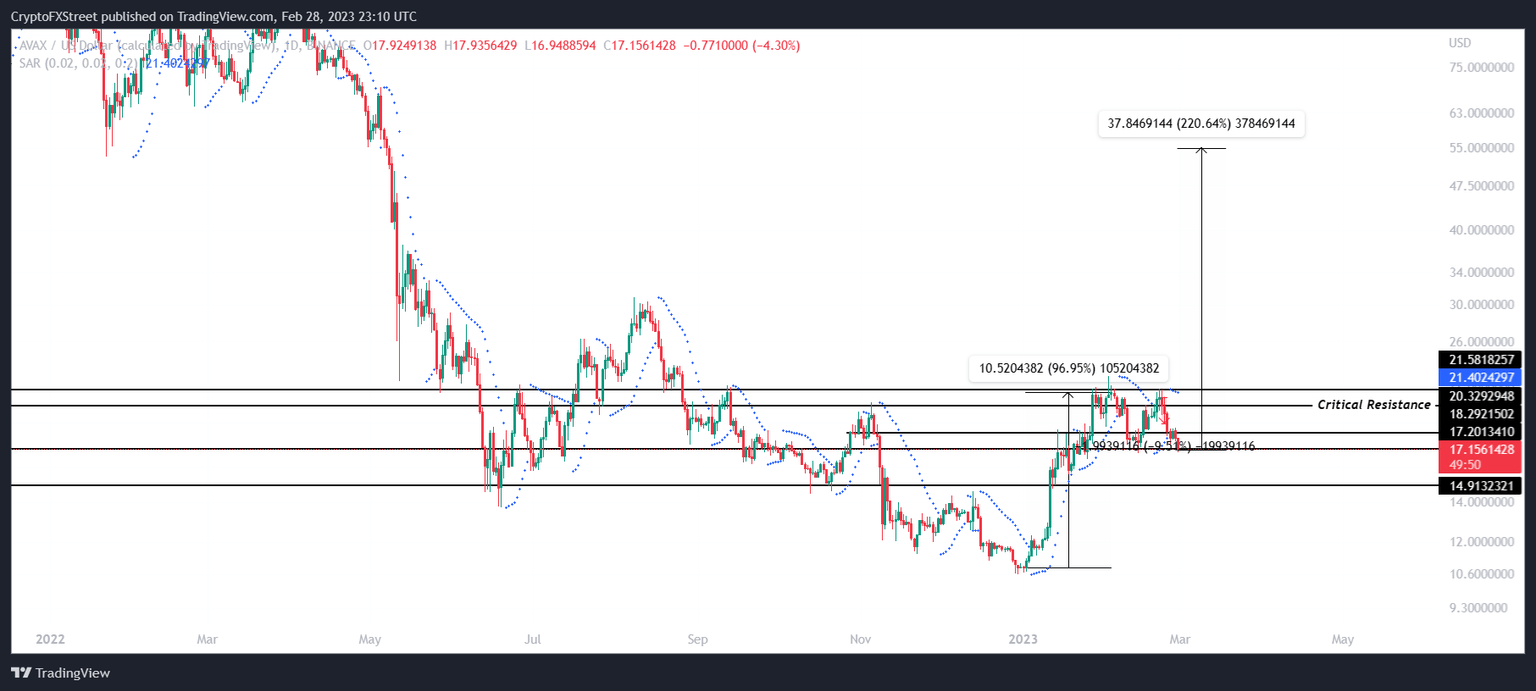

Altcoins could soar significantly

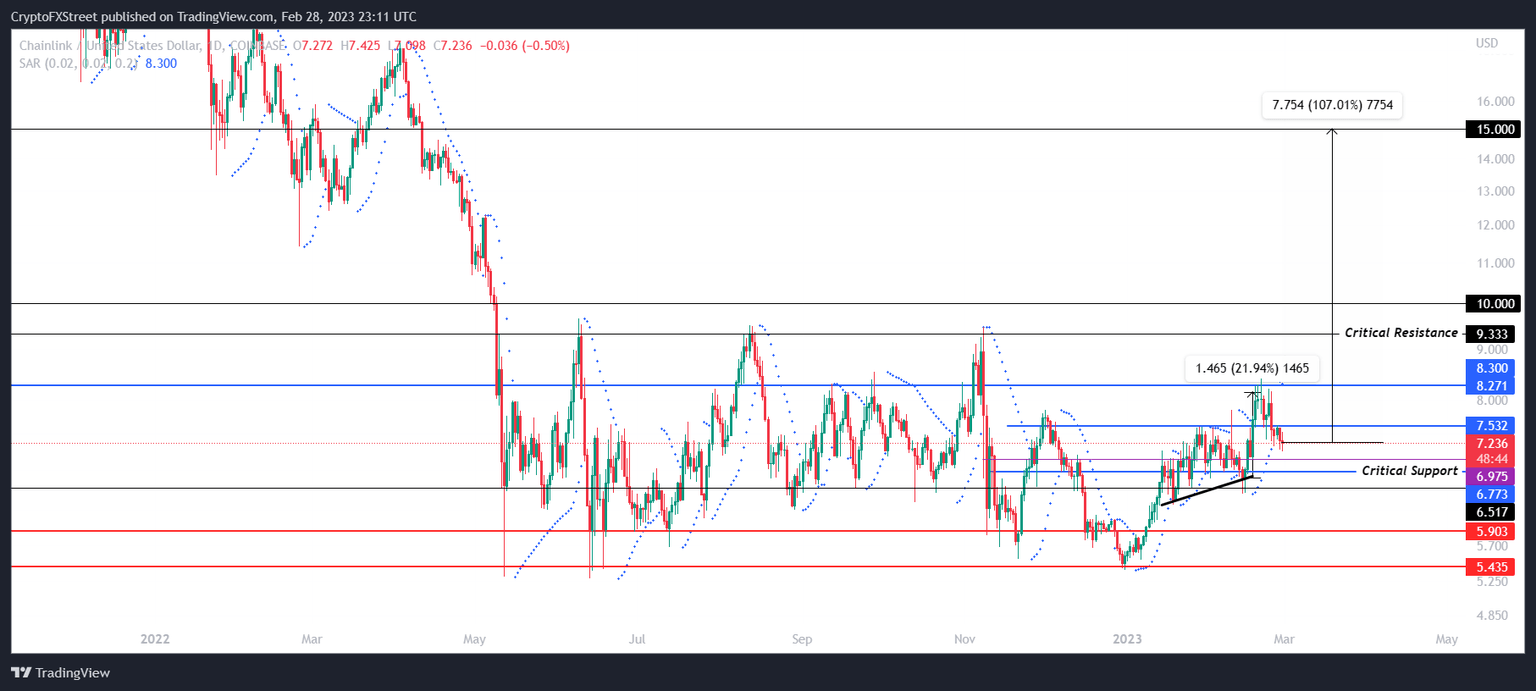

Van de Poppe suggested in his tweet that some of the in-demand altcoins could benefit from BTC’s aforementioned rally and post considerable gains. These altcoins included Chainlink (LINK), Avalanche (AVAX), Cosmos (ATOM), Fantom (FTM), Skale (SKL), Litecoin (LTC) and Ethereum (ETH).

If #Bitcoin runs to $35K,

— Michaël van de Poppe (@CryptoMichNL) February 28, 2023

I'll assume we'll see some significant runs on the markets.$LINK - $12-15$AVAX - $55-60$ATOM - $22-25 $FTM - $1.10-1.30$SKL - $0.20-0.25$LTC - $185-210 $ETH - $2,500-2,800

If these cryptocurrencies were to rally up to the suggested price levels, investors would be able to recover losses going back at least nine months. Among these cryptocurrencies, apart from ETH, LINK and AVAX make the list of the coins expected to make the most gains.

Avalanche price is currently trading at $17.08 and would need to observe a 220.64% rally in order to climb to the forecasted price of $55. Just like BTC, AVAX would also be at a nine-month high if this happens, but for the same, the critical resistance of $20.32 needs to be breached first. Once that happens, the altcoin would have some room to rise further, breaking through a five-month-old barrier.

AVAX/USD 1-day chart

Chainlink price needs to chart a 107.01% growth to reach the $15 mark. Unlike other cryptocurrencies mentioned above, LINK would mark a ten-month high provided it can first flip the critical resistance of $9.33 into a support floor. Breaching this multi-month barrier would put the altcoin at a nine-month high at prices last noted in mid-May 2022.

LINK/USD 1-day chart

However, given the current market conditions, these targets are far-fetched. But should the winds change, and bulls take absolute control for a few weeks, the aforementioned rallies do not seem impossible.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.