- Altcoins have observed a surge in their prices in the past four months, several key tokens are facing a risk of a correction.

- On-chain metric MVRV reveals a higher risk than average in buying Cardano, Chiliz, Ethereum, Fetch.AI, Lido, among other assets.

- AI and data coins could correct in the coming weeks as the hype surrounding the narrative declines.

Altcoin prices have climbed in the past four months, offering massive gains to holders beginning October 2023. Except for a few lagging altcoins, a vast majority of assets generated profits for average wallet holders in the mid to long term timescale.

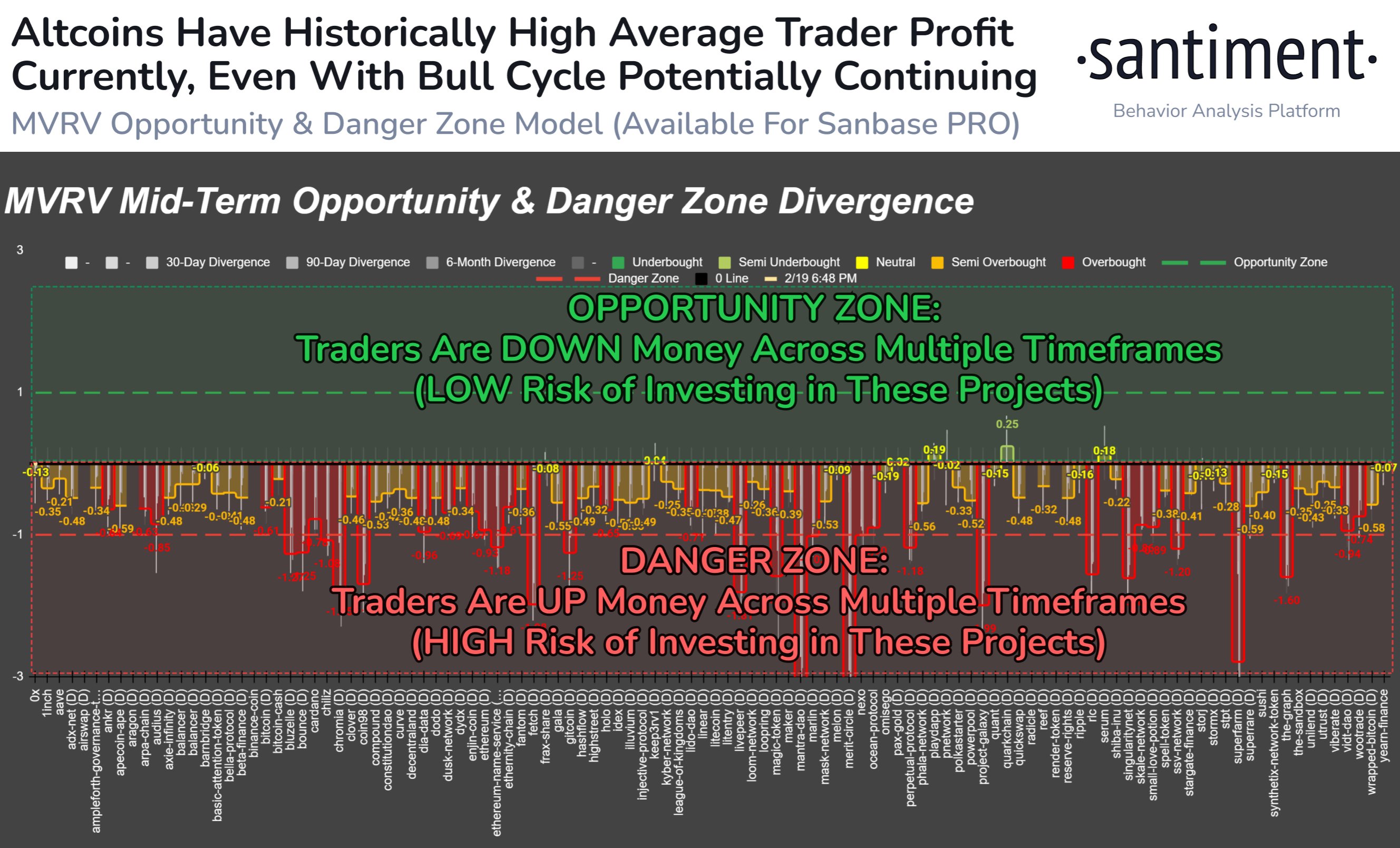

Crypto intelligence tracker Santiment’s predictive model uses Market Value to Realized Value (MVRV) metric to determine whether an altcoin is in an opportunity or danger zone. The model identified several assets in the danger zone, most notable ones including Cardano, Ethereum, Lido and Fetch.AI, among others.

Also read: AIT, GRT, OCEAN: Crypto data coins see massive rally alongside Bitcoin and AI tokens

Altcoins in the danger zone: ADA, CHZ, ETH, ENS, FET, HNT, LDO

Santiment’s MVRV model places several altcoins in the danger zone. Santiment’s analysts believe that these assets are at a high risk of “correcting.” After four months of rallying higher, several assets have reached at a point where they typically correct, increasing the risk associated with opening a trade or a long position in these cryptocurrencies.

The notable cryptocurrencies that are currently in the MVRV danger zone include, Cardano (ADA), Chiliz (CHZ), Ethereum (ETH), Ethereum Name Service (ENS), Fetch.AI (FET), Holo (HNT), Lido (LDO), Nexo (NEXO), Ocean Protocol (OCEAN), Singularity NET (AGIX) and The Graph (GRT).

MVRV model by Santiment. Source: Santiment

The altcoins identified using the MVRV model are fairly “overbought,” while this does not mean that they are set to witness a massive correction, it means that there is a higher than average risk of purchasing these assets after a four-month rally in their prices.

AI hype could die down soon

The hype generated in Artificial Intelligence (AI) tokens with the launch of text to video generator tool Sora fueled gains in several assets like AGIX, FET, GRT. The hype could die down soon, if the narrative fails to gain traction, these cryptocurrencies could witness a correction. The launch of further tools from OpenAI or Sam Altman’s projects could see the “sell the news” effect at play as market participants anticipate a spike in AI token prices.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

US SEC may declare XRP a 'commodity' as Ripple settlement talks begins

The US Securities and Exchange Commission (SEC) is considering classifying XRP as a commodity in its ongoing settlement talks with Ripple Labs. The SEC is considering classifying XRP as a commodity in its ongoing settlement talks with Ripple Labs.

Ethereum developers delay Pectra mainnet launch with new testnet Hoodi

Ethereum developers announced on Thursday that they will launch a new testnet, "Hoodi," to enable validators and infrastructure providers to adequately test the upcoming Pectra upgrade before mainnet deployment, according to Tim Beiko, who runs Ethereum's core protocol meetings.

Cardano Price Prediction: ADA could hit $0.50 despite high probability of US Fed rate pause

Cardano price stabilized above $0.70 after posting another 5% decline in its 3rd consecutive losing day. Multiple ADA derivatives trading signals are leaning bullish, but the US trade war impact outweighs the positive shift in inflation indices.

Stablecoin regulatory bill receives green light during Banking Committee hearing

The US Senate Banking Committee voted on Thursday to advance the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which aims to establish proper regulations for stablecoin payments in the country.

Bitcoin: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin price extends its decline on Friday, falling over 5% so far this week. BTC uncertainty and volatility spikes liquidated $1.67 billion as the first-ever White House Crypto Summit takes place on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.