Altcoin Technical Analysis Ethereum Classic, Bitcoin Cash and ChainLink: LINK/USD and BCH/USD bulls regain control

- BCH/USD, ETC/USD and LINK/USD faced bearish Sundays.

- ETC/USD bears retained control this Monday.

BCH/USD daily chart

BCH/USD bulls took over the market, following a heavily bearish Sunday. The price has gone up from $283.80 to $293.75 as bulls look to re-enter the $300-zone. The Elliott Oscillator has had two straight red sessions.

There are two strong resistance levels at $301.20 and $319.72. On the downside, healthy support exists at $282.25, $273.75 (SMA 200), $257.55 (SMA 20), $248.30 and $241.73 (SMA 50).

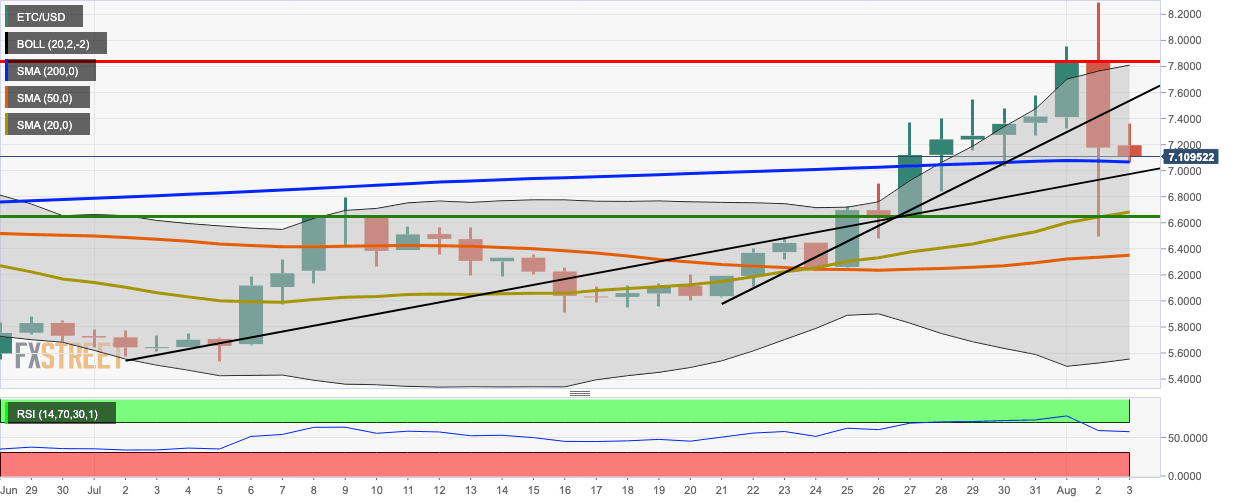

ETC/USD daily chart

ETC/USD bears remained in control of the market for two straight days as the price looks to drop below the $7-level. This Monday, the price has fallen from $7.20 to $7.12. The RSI is trending horizontally around 58.11. To continue downward momentum, the bears must overcome healthy support levels at $7.07 (SMA 200), $6.65 (SMA 20) and $6.356.

LINK/USD daily chart

LINK/USD bulls regained control of the market following a slightly bearish Sunday. This Monday, the price has gone up from $8.28 to $8.71. The price reached intraday highs of $8.90 before it retreated a bit from the 20-day Bollinger Band's upper curve.

The price has found support on the upward trending line. The MACD shows that market momentum has changed from bearish to bullish. Good support lies at $8.11, $7.82 (SMA 20) and $7.60.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

-637320937137521886.png&w=1536&q=95)

-637320937778780477.png&w=1536&q=95)