Altcoin season may not return until Bitcoin, Ethereum break above key levels

- Bitcoin and Ethereum prices need to break through key resistance levels for altcoin season to return, crypto analyst Arthur Hayes says.

- Cryptocurrencies could break out of their sideways price trend starting September, according to Arthur Hayes.

- Bitcoin trades sideways below $60,000 and Ether struggles under resistance at $2,750 on Tuesday.

A week post the crypto market crash, Bitcoin (BTC) and Ether (ETH) are recovering from the correction. BTC hovers around resistance at $60,000 on Tuesday, while Ethereum struggles to break past sticky resistance at $2,750.

Altcoins ranked in the top 30 assets by market capitalization are also reversing some of the recent losses. Traders are waiting for an altcoin season, an informal term for a period of time when the top 50 alternative assets outperform Bitcoin.

Arthur Hayes, former CEO of cryptocurrency exchange BitMEX and crypto analyst commented in a blog post published Monday about the possibility of an altcoin season, explaining when he thinks it will come and what conditions need to be met.

Altcoin season and what’s next for Bitcoin, Ethereum

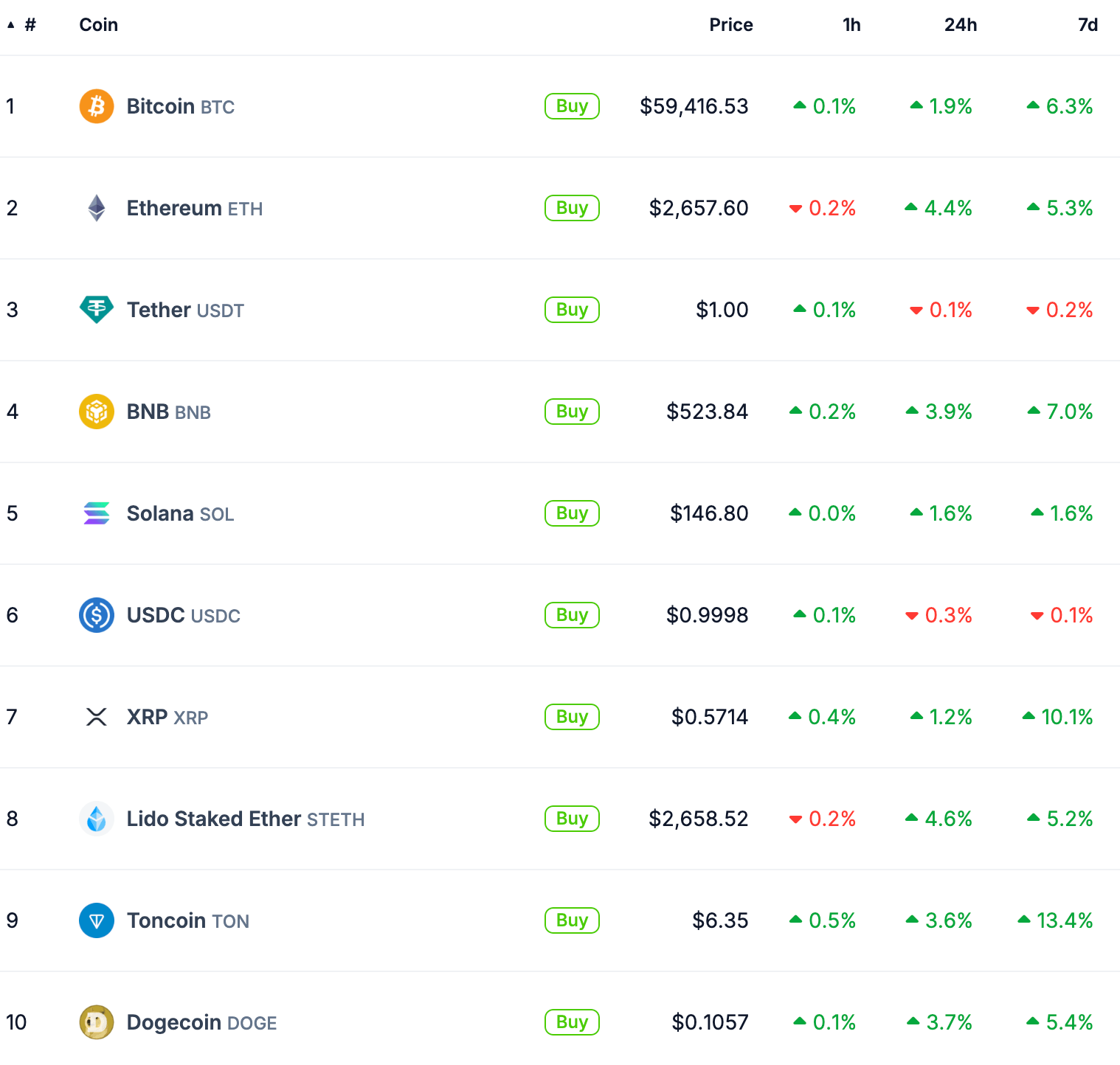

Crypto market is reeling from the correction that pushed Bitcoin under $50,000, erasing billions of dollars in market capitalization . As Bitcoin and Ethereum recover, altcoins are also gaining ground, per CoinGecko data.

Nearly all assets ranked in the top 10 cryptocurrencies by market capitalization have extended gains in the last seven days, some of them outperforming Bitcoin’s price rise. This is a sign of recovery in altcoins.

Altcoin price performance

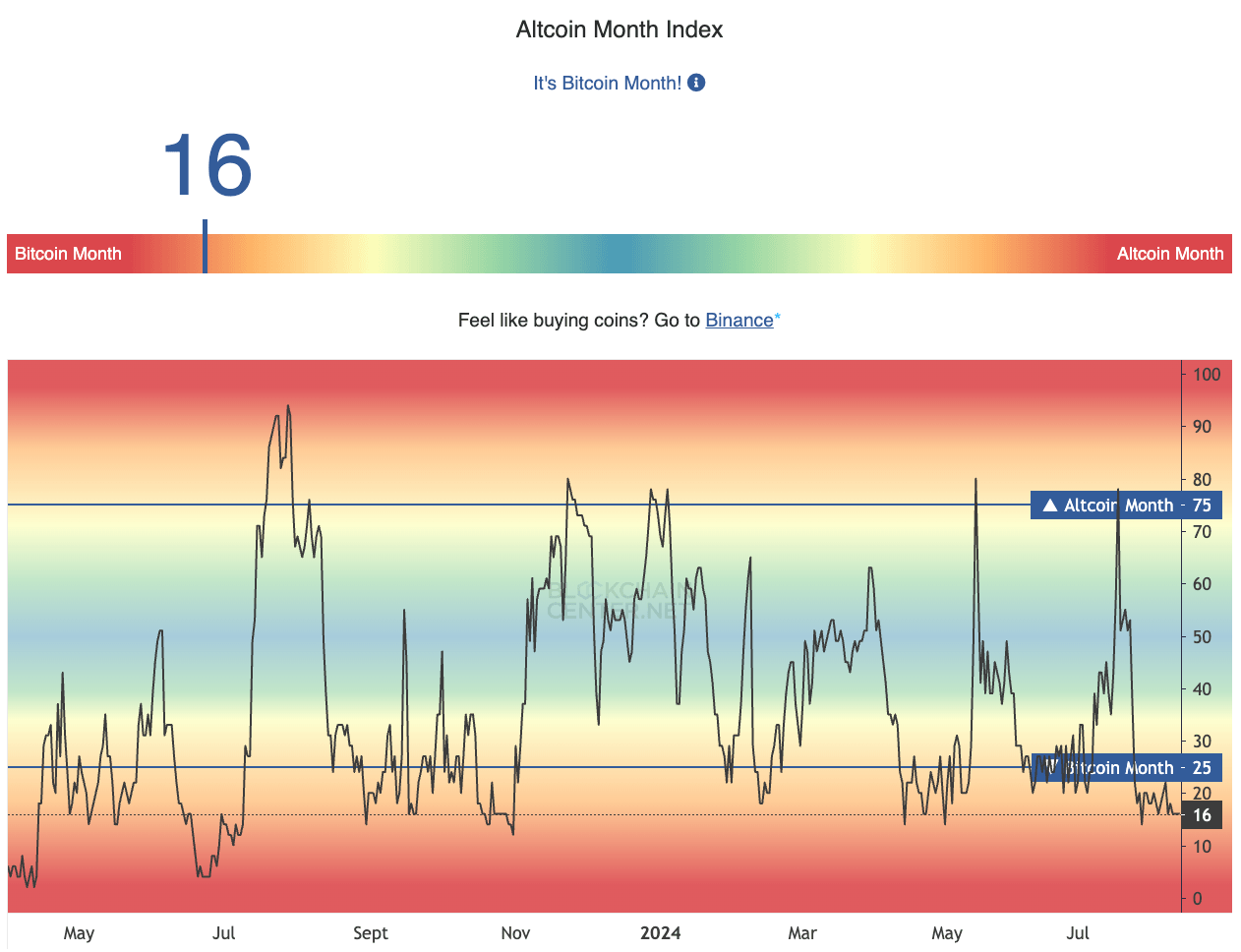

When 75% of the top 50 altcoins outperform Bitcoin over a 30-day period, it is considered an “altcoin month” per the altseason index compiled by Blockchaincenter.net. The indicator shows that currently it is a Bitcoin month as the performance of altcoins continues to lag when compared to that of the largest cryptocurrency.

Altcoin month index on Blockchaincenter.net

In these conditions, the altcoin season may not be feasible in the short term unless certain conditions are met. Arthur Hayes predicts that the altcoin season will not return until Bitcoin and Ethereum break above key resistance levels at $70,000 and $4,000, respectively.

Hayes says that, in the ongoing cycle, net inflows to US-listed Exchange Traded Funds (ETFs) is a market mover for Bitcoin and Ethereum. Hayes says that a combination of higher inflows to ETFs and gains in Bitcoin and Ether are likely to give way to a year-end rally and a “strong foundation” for the return of the altcoin season.

Hayes is optimistic on a new Bitcoin all-time high and predicts a bull market in response to developments in the US economy.

Once the US debt ceiling charade is over, liquidity will gush from the Treasury and possibly the Fed to get markets back on track. Then, the bull market will begin…

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.