Altcoin season looks unlikely until 2024 despite mass accumulation, expert says

- Altcoins are in an accumulation period that is likely to last through Bitcoin halving.

- Crypto analyst Zero Ika says Bitcoin is more likely to outperform altcoins in the ongoing market cycle.

- Zero Ika recommends scaling from Bitcoin to altcoins towards the end of 2023, presenting an opportunity for profits in 2024.

Investors are accumulating altcoins in the current market cycle and they are likely to keep doing so until the end of the Bitcoin halving in 2024, says Zero Ika, the expert behind the crypto handle @IAmZeroIka. This pattern suggests that an altcoin season looks unlikely this year and more probable in 2024, the analyst said on Twitter, adding that it looks like a good time to scale from Bitcoin to altcoins in order to capitalize on the upcoming opportunity.

Also read: XRP social dominance explodes with likely price rally in the altcoin

Altcoin season is likely only in 2024

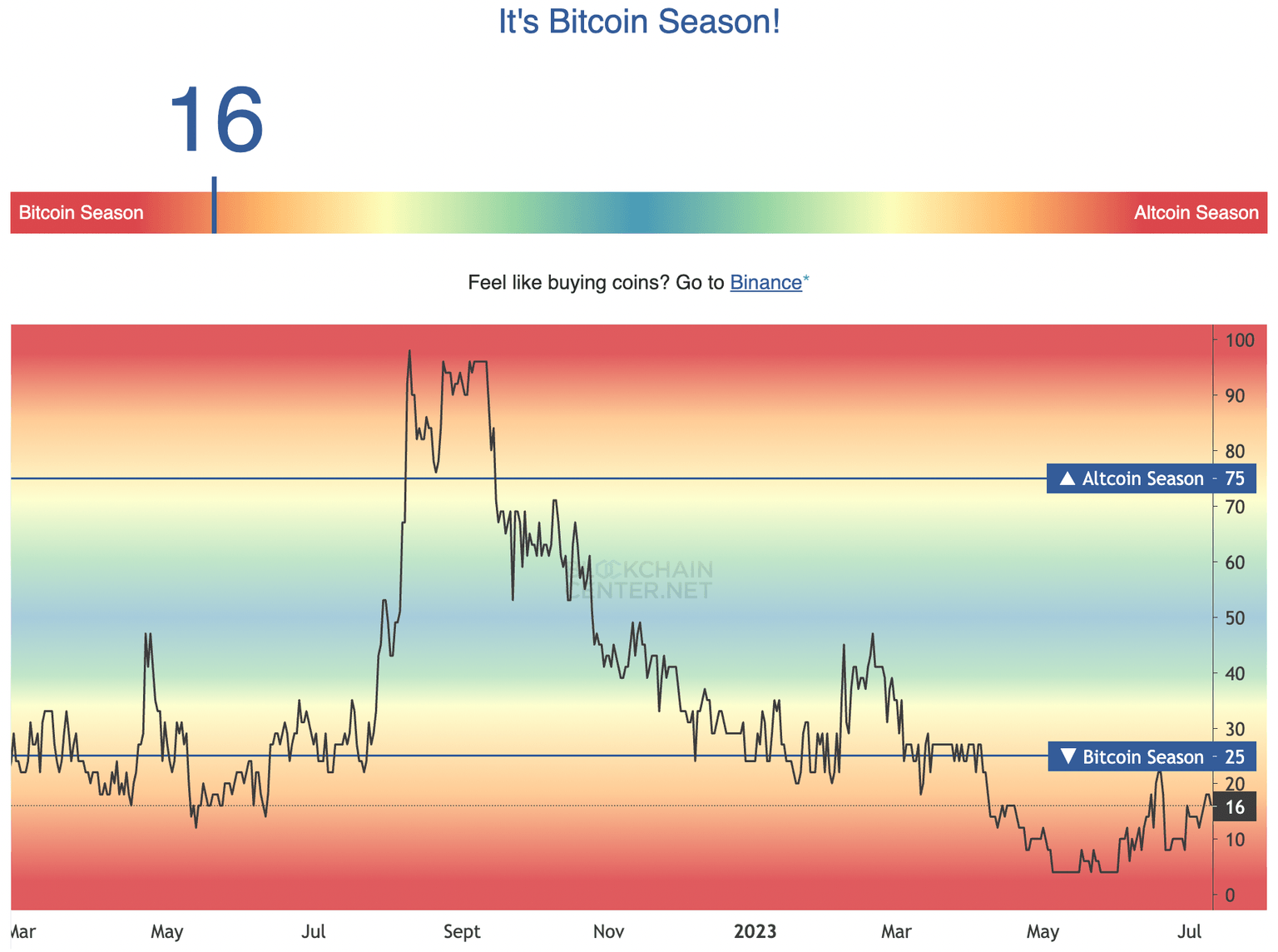

Based on the altcoin season index by BlockchainCenter.net, it is currently Bitcoin season. The index calculates whether it is a Bitcoin or altcoin season by evaluating the performance of the top 50 cryptocurrencies by market capitalization.

An altcoin season occurs when 75% of the top 50 coins perform better than Bitcoin over a 90-day period in terms of price and market capitalization.

Alt season indicator

After evaluating the altcoin season index, Zero Ika said that the current picture isn’t likely to change in the altcoin market until 2024.

represents the purest state of the altcoin market since it hasn't BTC and ETH.

— ZERO IKA ️ (@IamZeroIka) July 9, 2023

As said in the previous charts, altcoins are currently facing a big accumulation period which has 460B as range high and 290B as range low.

In my opinion, this is intended to last till… pic.twitter.com/m0cRHqi9ON

The analyst argues that an altcoin season is not likely before the next Bitcoin halving. Based on his analysis, Bitcoin is likely to outperform altcoins until the end of 2023. Zero Ika explains this offers traders an opportunity to accumulate more altcoins with no major movements until the end of 2023.

The expert explained that the plan is to slowly scale in from Bitcoin to altcoins at the end of 2023 or the beginning of 2024. Zero Ika explains that the plan does not take into consideration the possibility of a new Bitcoin all-time high in 2023.

Through a chart that tracks the market capitalization of assets excluding Bitcoin and Ethereum, the analyst proves “mass accumulation” among market participants.

Crypto total market capitalization excluding Bitcoin and Ethereum

As seen in the chart above, there has been accumulation of altcoins, excluding Bitcoin and Ethereum, by traders since mid-2022. According to Zero Ika, the next phase is expansion, starting April 2024, post Bitcoin halving.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.