- Algorand price develops a rare bullish reversal pattern.

- Short sellers start to get trapped, feeling the pressure as ALGO ticks higher.

- Downside risks are present but limited.

Algorand price has given bulls and bears an extended headache over the past three months. A series of false breakouts higher and lower have yielded a prolonged range trade that warned of some deeper moves south, but that may no longer be the case.

Algorand price forms big bear trap, 75% gain up ahead

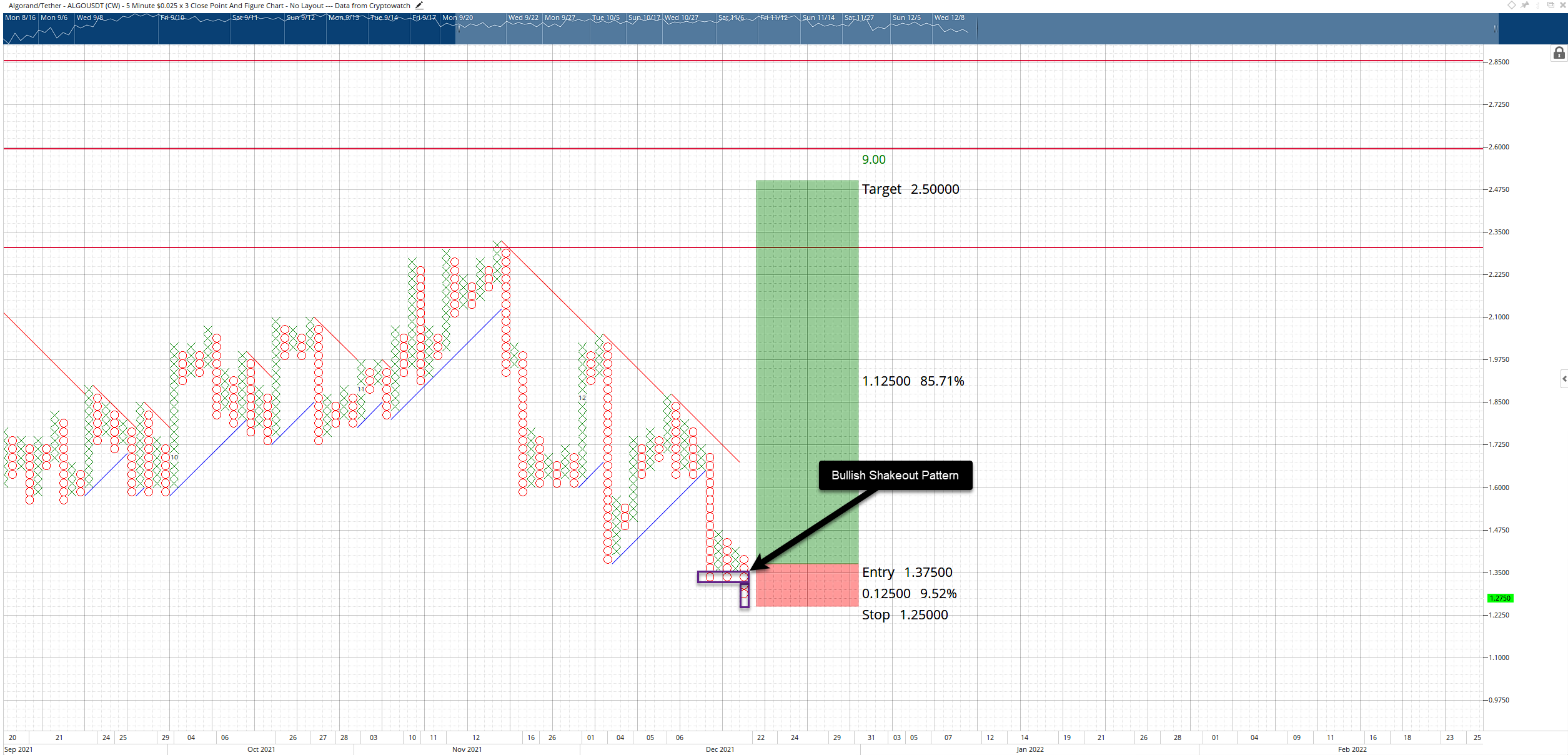

Algorand price is developing one of the rarest and most sought-after bullish reversal patterns in Point and Figure Analysis: the Bullish Shakeout. The Bullish Shakeout pattern is only valid during an uptrend and shows up near or at the bottom of a corrective move. The pattern requirements are two to three Os below a triple-bottom (minimum of two Os, maximum of three Os) at the bottom of a swing.

Adding to the strength of this pattern is how it affects short-sellers. A breakout below a triple-bottom is a potent short signal and one that many Point and Figure traders regard as the minimum of criteria for an entry. However, when the triple-bottom fails to produce a sustained move lower, short-sellers get trapped. And as prices move higher, the trapped shorts end up turning into buyers and exacerbating the buying pressure.

Algorand has fulfilled all of the conditions for a Bullish Shakeout, and because of that, a long opportunity now exists. The theoretical long entry is on the 3-box reversal with a buy stop at $1.375, a stop loss at $1.25, and a profit target at $2.50. This trade represents a 9:1 reward for the risk opportunity. A three-box trailing stop would protect any implied profit post entry.

ALGO/USDT $0.025/3-box Reversal Point and Figure Chart

As bullish as this trade setup is, its entry rules are particular. No more than three Os can develop below the triple-bottom. This means that if Algorand price moves to $1.2250 or below, the long setup is invalidated.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Cardano stabilizes near $0.62 after Trump’s 90-day tariff pause-led surge

Cardano stabilizes around $0.62 on Thursday after a sharp recovery the previous day, triggered by US Donald Trump’s decision to pause tariffs for 90 days except for China and other countries that had retaliated against the reciprocal tariffs announced on April 2.

Solana signals bullish breakout as Huma Finance 2.0 launches on the network

Solana retests falling wedge pattern resistance as a 30% breakout looms. Huma Finance 2.0 joins the Solana DeFi ecosystem, allowing access to stable, real yield. A neutral RSI and macroeconomic uncertainty due to US President Donald Trump’s tariff policy could limit SOL’s rebound.

Bitcoin stabilizes around $82,000, Dead-Cat bounce or trendline breakout

Bitcoin (BTC) price stabilizes at around $82,000 on Thursday after recovering 8.25% the previous day. US President Donald Trump's announcement of a 90-day tariff pause on Wednesday triggered a sharp recovery in the crypto market.

Top 3 gainers Flare, Ondo and Bittensor: Will altcoins outperform Bitcoin after Trump's tariff pause?

Altcoins led by Flare, Ondo and Bittensor surge on Thursday as markets welcome President Trump's tariff pause. Bitcoin rally falters as traders quickly book profits amid Trump's constantly changing tariff policy.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.