Algorand price targets $2 as platform adds support for several projects

- Algorand price had a significant breakout from a symmetrical triangle pattern on the 12-hour chart.

- The Algorand blockchain will support several other projects.

- ALGO will find weak resistance on the way up to $2, according to various indicators.

Algorand had a significant breakout from a key pattern and targets $2 in the long term. The platform has recently added support for Swingby, and the Algorand coin is now available on Chainalysis.

Algorand partners with important cryptocurrency projects to continue growing

Chainalysis, a blockchain analysis company, has partnered with Algorand to bring the cryptocurrency industry a solution for anti-money laundering compliance. Fangfang Chen, Chief Operating Officer of the Algorand Foundation, stated:

We needed a compliance partner that could not only help us adhere to regulations in Singapore where we are based but also global regulatory best practices. This will enable us to build the best transaction monitoring solution for the Algo token so that we can realize our mission of providing the world's first open, permissionless, pure proof-of-stake blockchain protocol securely and scalably.

#Swingby has received a grant to bring the Skybridge to #Algorand!

— Swingby (@SwingbyProtocol) March 31, 2021

We're excited to be working with the Algorand team on this exciting project.

Together we'll build:

️ Bitcoin to Algorand bridge

️ Ethereum to Algorand bridge

️ Skypools integrationhttps://t.co/jsDOcJHHwZ

The Swingby Protocol has received a strategic grant from the Algorand Foundation to bring its Skybridge technology to the Algorand blockchain. The Swingby Skybridge is a trustless bridge between BSC, ETH and BTC, as well as other blockchains.

Algorand price ready for new yearly highs

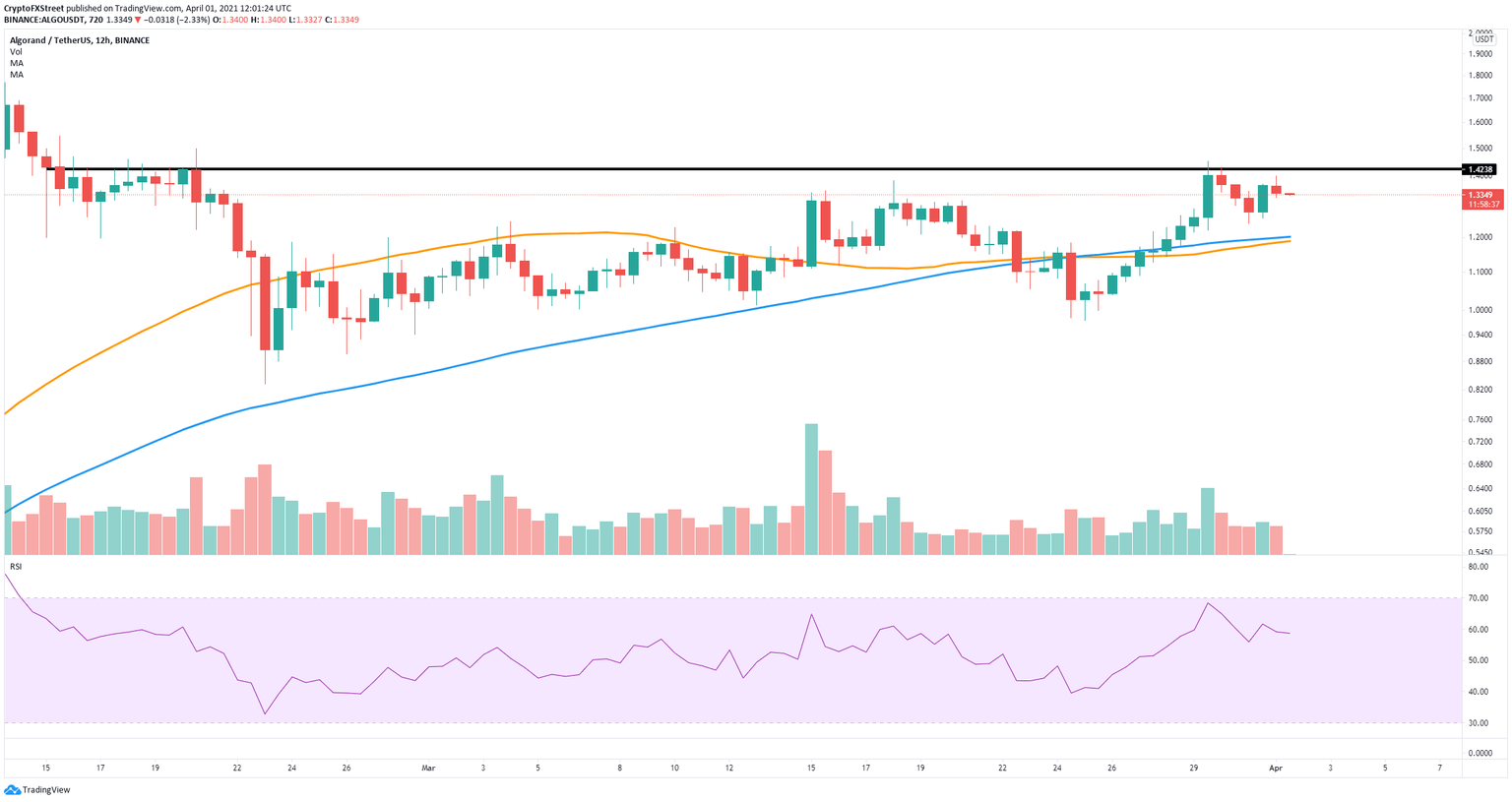

On the 12-hour chart, the Algorand price had a significant breakout from a symmetrical triangle pattern with a price target of $2 in the long term. This was calculated using the maximum height of the pattern as a reference point.

ALGO/USD 12-hour chart

There is practically no resistance on the way up beside the $1.42 level, which has rejected the price several times in a row and the 2021 high of $1.84.

ALGO/USD 12-hour chart

However, the strong resistance level at $1.42 has rejected ALGO two times – on March 29 and again on April 1. Additionally, the RSI is close to overextension, which adds some selling pressure to ALGO. The digital asset could fall toward $1.2, where the 50 SMA and 100 SMA coincide.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.