Algorand price set for explosive rally to $1.10

- Algorand price attempts to extend its consecutive daily gain to four.

- Strong buying pressure after ALGO hit new 2022 lows on Monday.

- The Point and Figure chart shows desirable entry opportunities ahead.

Algorand price action, like the majority of the cryptocurrency market, continues to recover after prolonged selling pressure. However, whether the current bounce is a real beginning to a new uptrend or simply a relief rally remains to be seen.

Algorand price begins a massive mean reversion higher to cover major Ichimoku gaps

Algorand price, on its weekly Ichimoku chart, has substantial gaps between the bodies of the weekly candlesticks and the Tenkan-Sen. Large gaps between the candlestick bodies and the Tenkan-Sen are not tolerated for very long, and they often correct within four to six periods, max. Therefore, ALGO is most definitely within that timeframe to begin a major move to return to equilibrium. The Point and Figure chart provides a clearer path and outlook for this scenario.

ALGO/USDT Weekly Ichimoku Kinko Hyo Chart

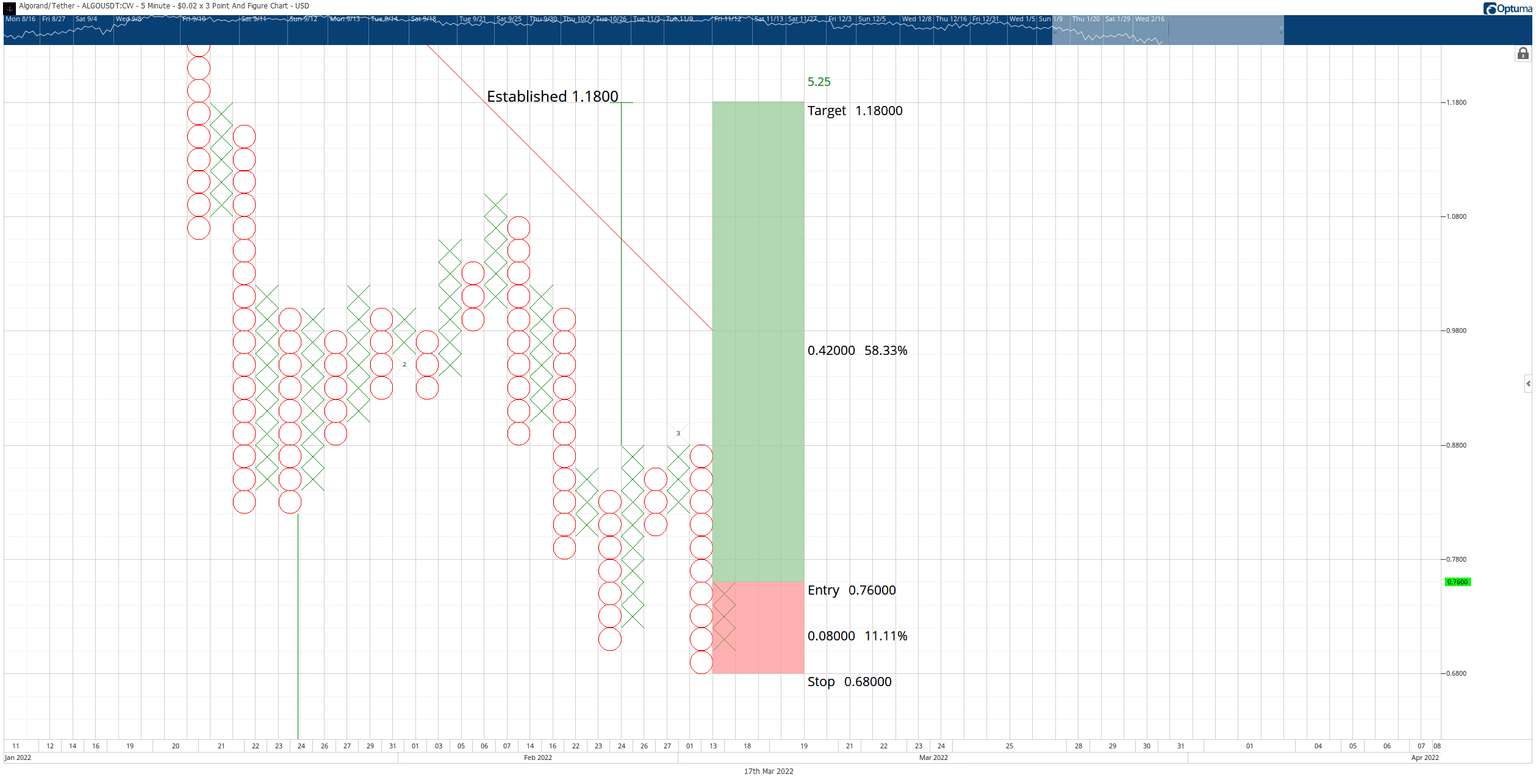

The hypothetical long entry for Algorand price is a buy stop order at $0.76, a stop loss at $0.68, and a profit target at $1.18. The trade represents a 5.25:1 reward for the risk. A two to three-box trailing stop would help protect any implied profit made post entry. While the profit target is identified at $1.18 on the Point and Figure chart, Algorand price is likely to find resistance and selling pressure before that profit target is hit. The $1.05 to $1.10 price range will probably act as primary resistance as it contains the 2022 Volume Point Of Control, the weekly Tenkan-Sen, and the 61.8% Fibonacci retracement.

ALGO/USDT $0.02/3-box Reversal Point and Figure Chart

The hypothetical long entry is invalidated if Algorand price return to $0.68 before the entry is triggered.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.