Algorand price pulls back before resuming the uptrend towards $2.50

- Algorand price corrects after a two-day blistering performance.

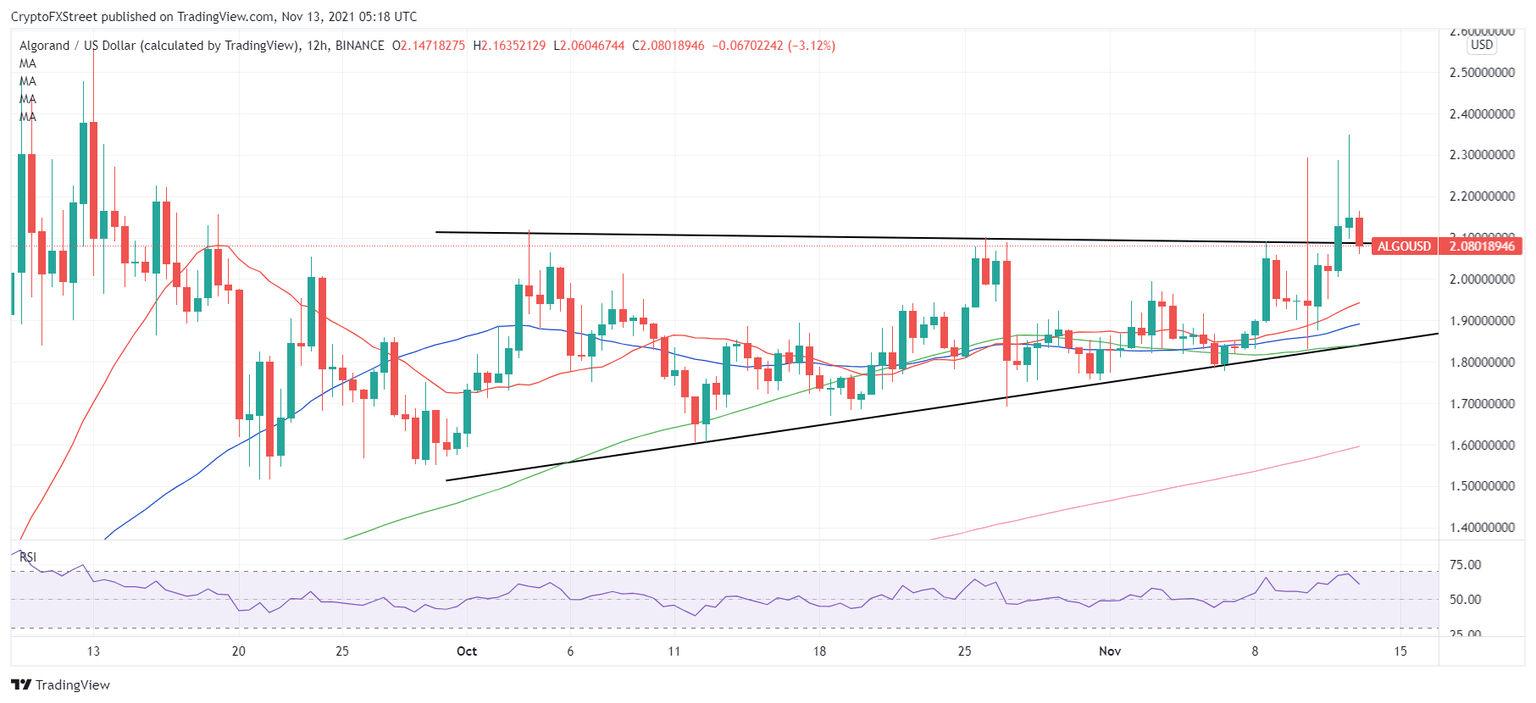

- Ascending triangle breakout on the 12H chart points to more upside.

- ALGO price remains on track to recapture $2.50 and beyond.

As the granddaddy of the cryptocurrencies, Bitcoin, enters a consolidative mode, altcoins, such as Algorand, seem to have taken the current bullish wave in their stride.

ALGO price rose over 10% over the past two trading days, breaking out of the one-and-a-half-month-long range play to reach the highest levels since September 13 at $2.43.

The latest rally in ALGO price was on the back of its partnership with Watr Foundation, a new Swiss-registered foundation. Watr is known for its protocol to digitize supply chains and boost transparency around sustainability.

Algorand is expected to outperform in the coming weeks, given its focus on eco-friendly, secure, and interoperable protocol, which offers an edge to investors when compared to Bitcoin.

Algorand price bides time before the next push higher

Algorand price is extending its correction from two-month highs reached on Friday, losing 3.5% in the last 12 hours. ALGO bears look to retest the $2 mark once again.

Despite the retreat, ALGO’s renewed uptrend remains intact after the price confirmed an upside breakout from an ascending triangle on the 12-hour chart a day before.

The technical breakout has opened doors for a rally towards $2.63, which is the measured pattern target.

On their journey northwards, ALGO bulls will face initial resistance at two-month highs of $2.43, above which the September 13 top of $2.55 will be put to test.

Recapturing the latter will lead to a smooth sail towards the abovementioned pattern target.

ALGO/USD 12-hour chart

With the downtick in the Relative Strength Index (RSI), at the moment, ALGO price could fall further towards the upward-pointing 21-Simple Moving Average (SMA) at $1.94.

If the corrective pullback picks up pace, then ALGO bears could extend their control towards the fierce support at $1.88, where the bullish 50-SMA and November 11 low coincides.

Further south, a sustained break below the confluence of the triangle support and 100-DMA at $1.83 will confirm the pattern failure and call for a bearish reversal.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.