Algorand Price Prediction: ALGO poised for a 30% rally on a strong close

- Algorand rebounds from the 100-day simple moving average, but volume is uninspired.

- ALGO triggers the April 23 bullish hammer candlestick pattern.

- Late March low and 50% retracement level team up to halt correction.

Algorand price strength proves to be sustainable today, and it lays the groundwork for a rally to the ascending channel’s upper trend line at $1.64.

Algorand price bounces out of bed for a 20% gain

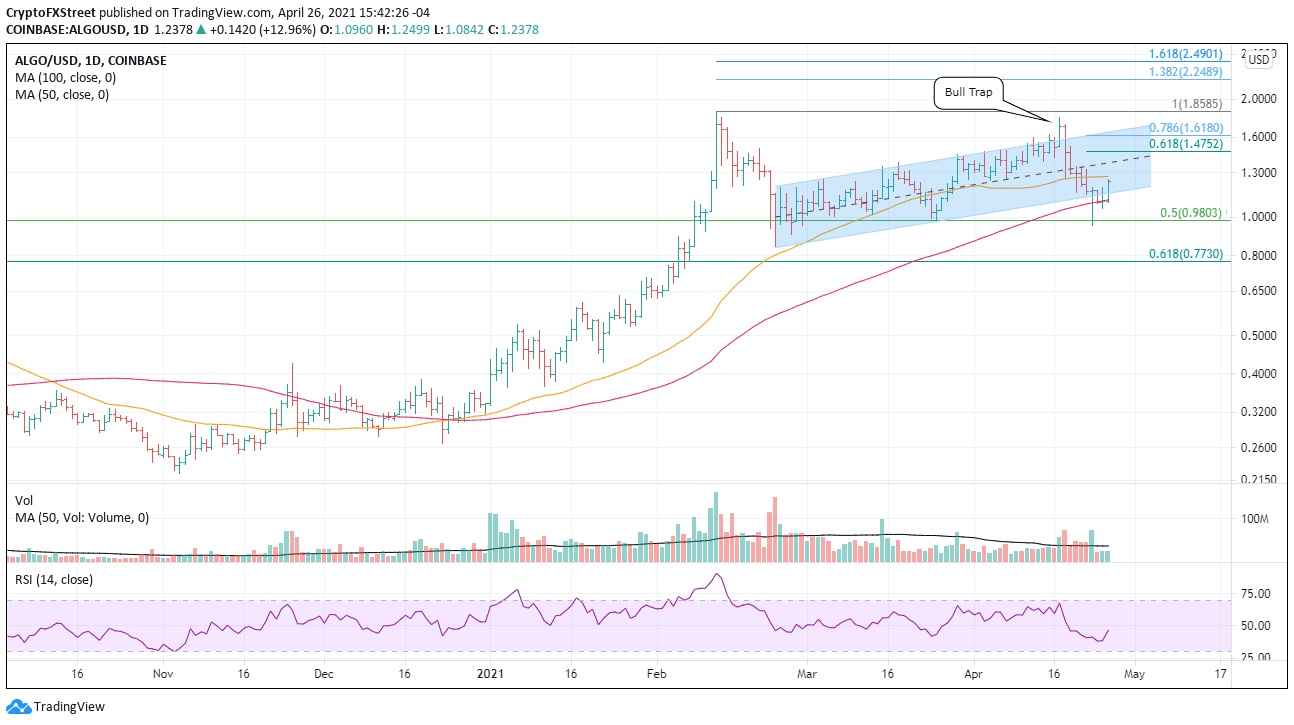

After catching speculators in a bull trap on April 17, ALGO immediately turned down and declined almost 50% before marking a bullish hammer candlestick pattern on April 23. The bottom slightly undercut the convergence of the late March low with the 50% retracement level at $0.98.

Today ALGO traded above the hammer’s high at $1.195, triggering a buy signal that has carried the digital token above the channel’s lower trend line and close to the 50-day SMA at $1.27. If the rally sticks, it clarifies the short-term outlook and opens a path to the channel’s upper trend line at $1.64.

The 50-day SMA at $1.27 is the first obstacle for Algorand price, followed by the mid-line of the channel at $1.38 and then the 61.8% Fibonacci retracement of the April decline at $1.47. A pause or mild reversal may unfold at the 78.6% retracement at $1.62, but it is anticipated that the magnet effect associated with the upper trend line will pull ALGO to $1.64.

Higher targets will need to be determined after ALGO reaches the channel’s upper trend line.

ALGO/USD daily chart

The cryptocurrency market can turn on a dime, and a new bearish turn would knock ALGO below the lower trend line and to the 100-day SMA at $1.11 again. A test of this month’s low at $0.95 would have to be considered, dependent on the impulsiveness of the decline. Further weakness will not find support until the February low at $0.84.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.