Algorand price likely to explode as on-chain metrics reveal clear skies

- Algorand price set a stable base around $0.675, triggering a 26% recovery rally.

- On-chain metrics suggest little to no hurdles for bulls up to $1.05, hinting at another run-up.

- A daily candlestick close below $0.675 will invalidate the bullish thesis for ALGO.

Algorand price shows resilience after witnessing a massive rally over the past week. This move could be key in triggering another run-up that can help ALGO recover its losses.

Algorand price awaits a catalyst

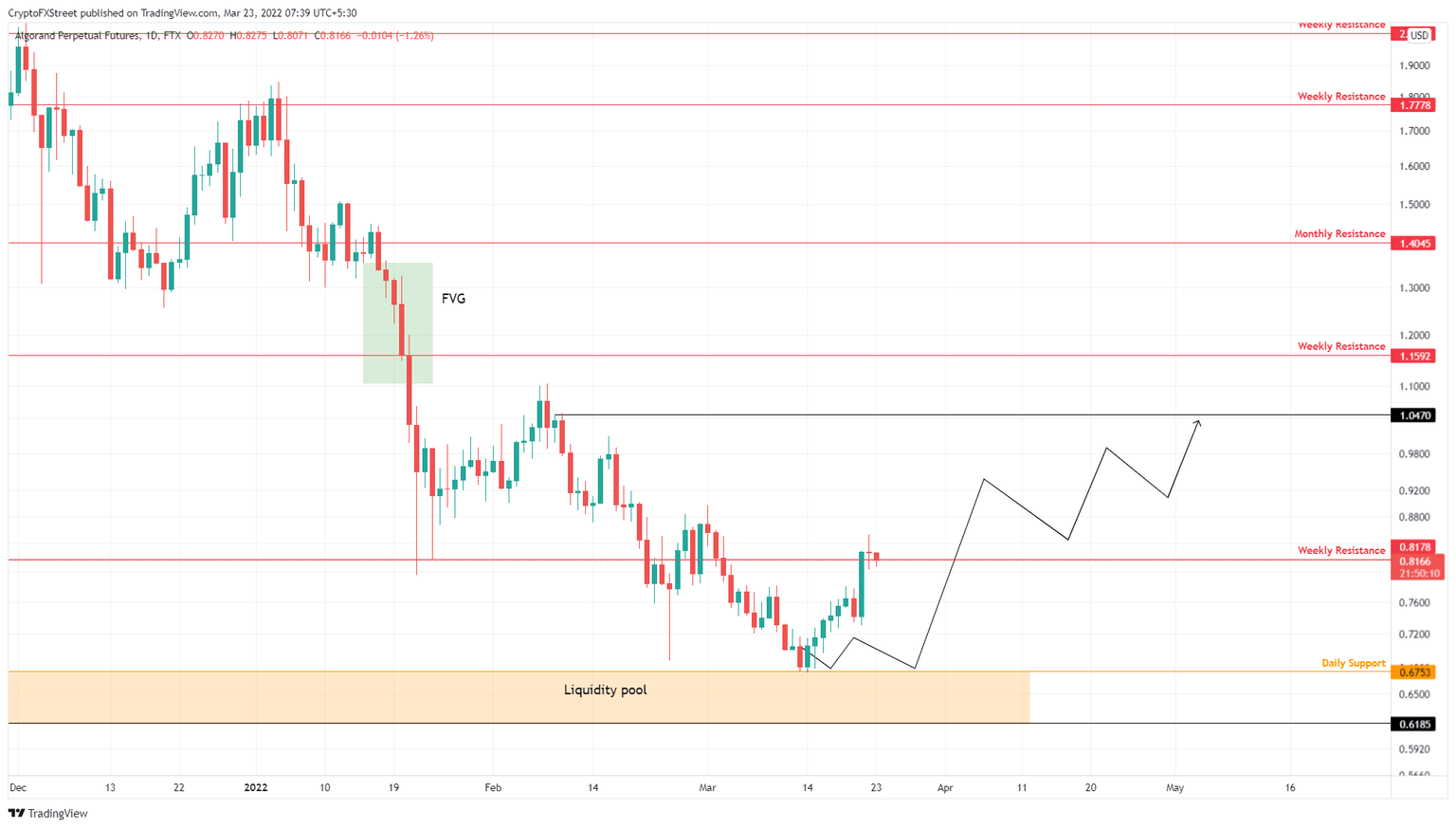

Algorand price has bounced off a stable support level at $0.675, triggering a 26% ascent to the weekly resistance barrier at $0.817. This move is significant since ALGO produced a daily candlestick close above $0.817, a crucial hurdle.

If bulls manage to hold above this barrier, there is a good chance this run-up will extend. A likely scenario could see ALGO briefly dip below the said support level before triggering another leg-up.

Regardless of the minor pullbacks, investors can expect Algorand price to resume a run-up to $1.04, which is where a perfect place for a local top to form. In total, this move would constitute a 34% gain from $0.776.

ALGO/USDT 1-day chart

Supporting this rally for Algorand price is IntoTheBlock’s Global In/Out of the Money (GIOM) model, which shows clear skies for ALGO bulls.

This index reveals that the next meaningful hurdle for Algorand price exists from $0.952 to $1.11 where roughly 712,000 addresses that purchased 895 million ALGO tokens are “Out of the Money.”

Therefore, a move into this cluster will be met with selling pressure from investors trying to break even.

ALGO GIOM

Albeit low, the number of transactions worth $100,000 or more has increased from 52 to 71 over the past month. This 36% uptick in transfers, that serves as a proxy of high networth investors, suggests that whales are interested in ALGO at the current levels.

ALGO large transactions

A daily candlestick close below $0.675 will create a lower low and invalidate the bullish thesis for ALGO. In such a case, Algorand price is likely to crash to $0.618, allowing buyers to regroup before another attempt at a rally.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.