Algorand price in bearish continuation to $0.30

- Algorand price action shows clear signs of another round of selling.

- ALGO is at risk of another 35% wipe in value.

- A move exceeding last week’s flash crash lows is very likely.

Algorand price action has recovered a significant amount of last week’s losses, but the technical structure screams of a bearish continuation move. First, however, sellers need to show a clear rejection of higher prices – so far, this has not happened.

Algorand price action generates anxiety for bulls and bears

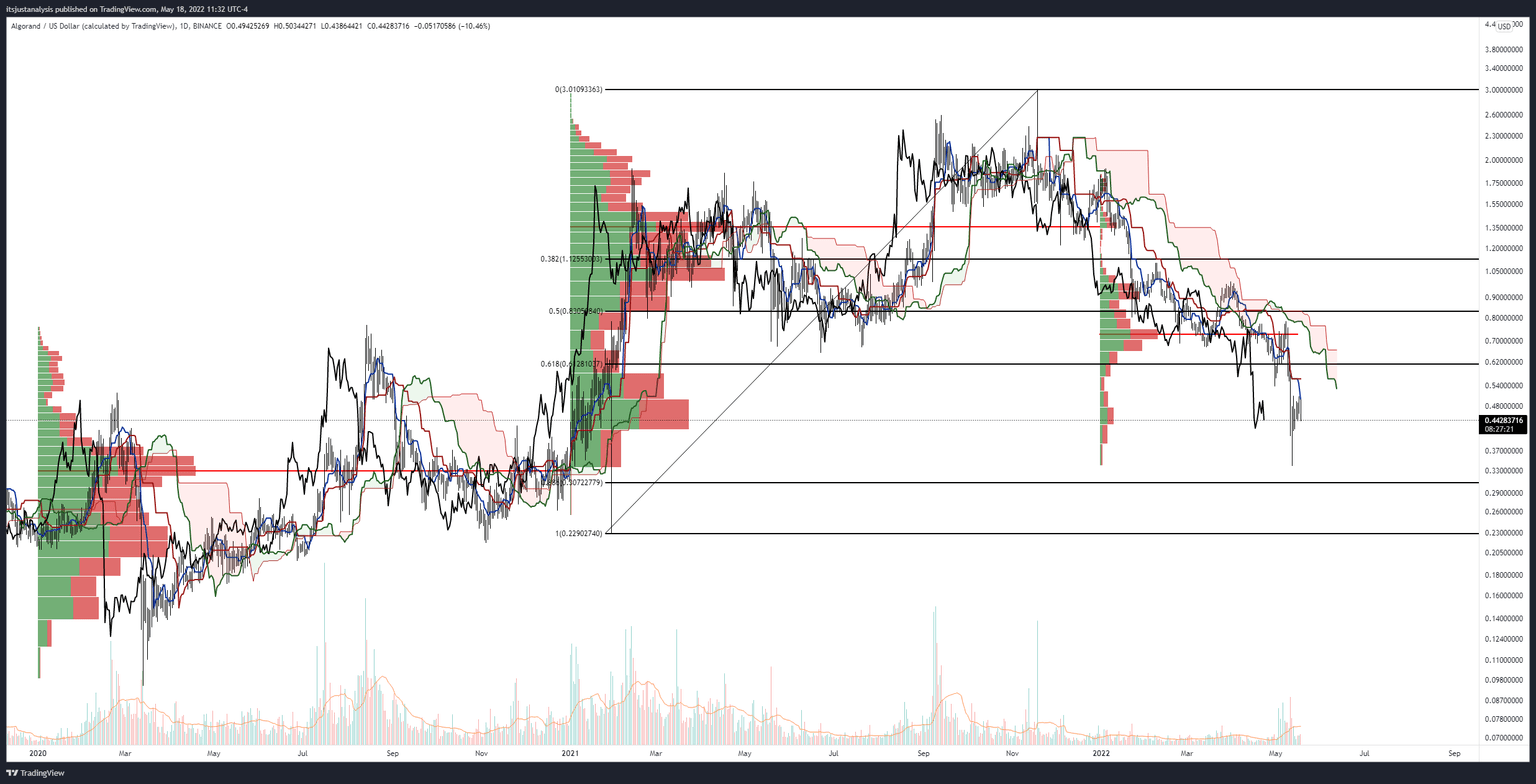

Algorand price is at a make-or-break point on its daily Ichimoku chart. Today is exactly one week from the flash crash made on May 12. Since that crash, Algorand has made an impressive 40% gain off those lows – but those gains are now at risk of being wiped out.

A standard bearish continuation pattern known as a bear flag is currently present. Bear flags are upwards moving channels that occur after a downtrend, then typically weaken or lose momentum before sellers return and resume downside pressure to new lows.

The critical price level that bears will want to target is a daily Algorand price close at or below $0.44. A close at $0.44 would be the lowest close in five days and position ALGO just a hair above last Tuesday’s flash crash close and below the open. ALGO has an open path to the 2022 low at $0.34. However, Algorand price may move lower than $0.34, possibly to the 2020 Volume Point of Control at $33.

ALGO/USDT Daily Ichimoku Kinko Hyo Chart

If bulls want to invalidate any further downside pressure, then, at a minimum, they’ll need to close Algorand price above the Tenkan-Sen at or above $0.50. But the road above $0.50 has many strong resistance levels, some sharing the same value area, which exacerbates that resistance. As a result, any near-term upside potential is likely limited to the 2022 Volume Point of Control at $0.75.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.