Algorand price bears come out in full force aiming for $0.60

- Algorand price fell 7% in the NY trading session.

- ALGO price volume is returning in bearish favor.

- Invalidation for the bearish downtrend is a price spike to $0.79.

Algo prices fell at free-fall speed during NY trading hours. The ALGO price action is hinting at larger drops in the coming days.

Algorand price lacks a reason to consider a bullish scenario

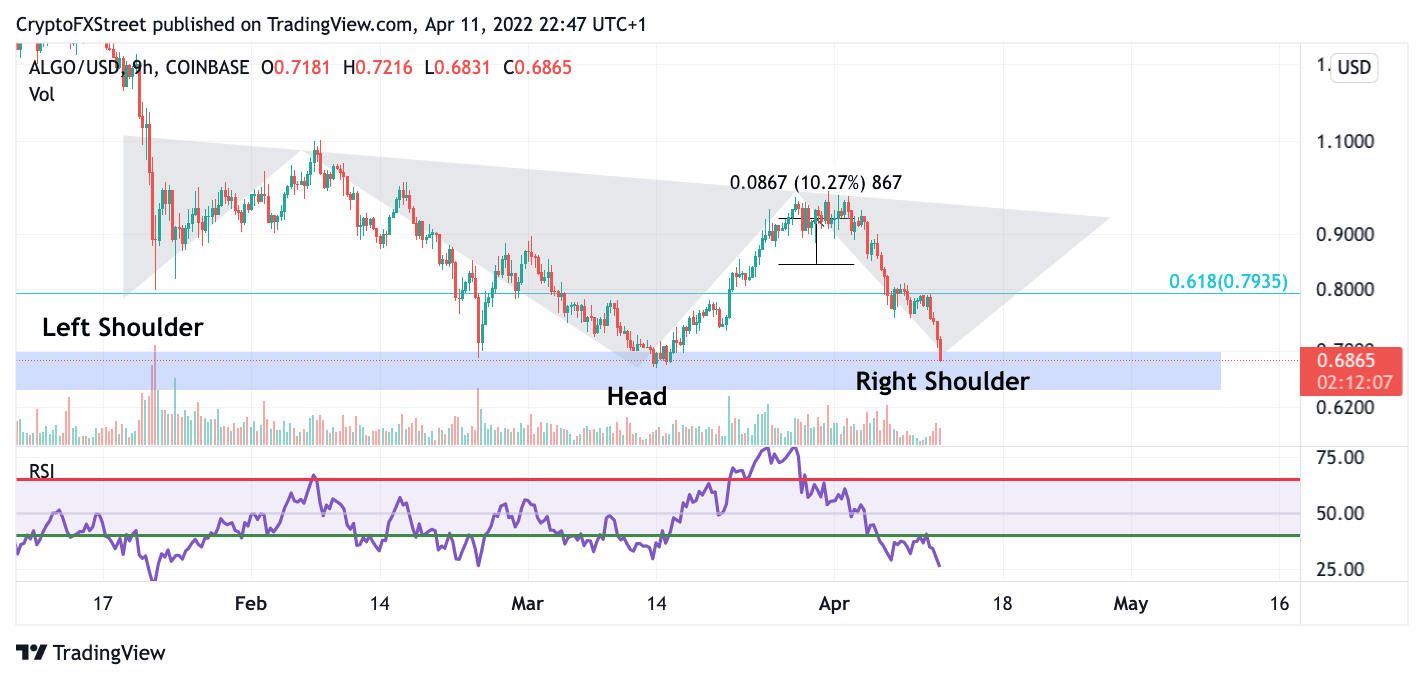

Algorand price is inches away from invalidating the bullish trade setup written late last week. The bullish thesis showed ALGO price developing an inverse head and shoulders pattern that forecasted a 17% uptrend rally. Now the current price at $0.69 looks dangerous to continue holding as an investment, as the bulls have yet to show any desire to defend the price.

Algorand price adds further confluence of complete bearish control of the downtrend on the volume profile indicator. The ramping bowl-like pattern is a textbook signal indicating strength and confidence from the bears. ALGO price could continue bleeding, tagging prices at $0.64 and possibly $0.60 along the way.

ALGO/USDT 9-Hour Chart

Invalidation of the downtrend will be a sizeable bullish spike into the swing highs at $0.70. If the bulls can accomplish such price action, they should have no issue hurdling back into $0.75 and $0.80, resulting in an 18% increase from the current Algorand price.

Author

FXStreet Team

FXStreet