- Algorand will be the first non-Ethereum blockchain to deploy USDC.

- Previously, Algorand had signed up a collaboration deal with Tether (USDT).

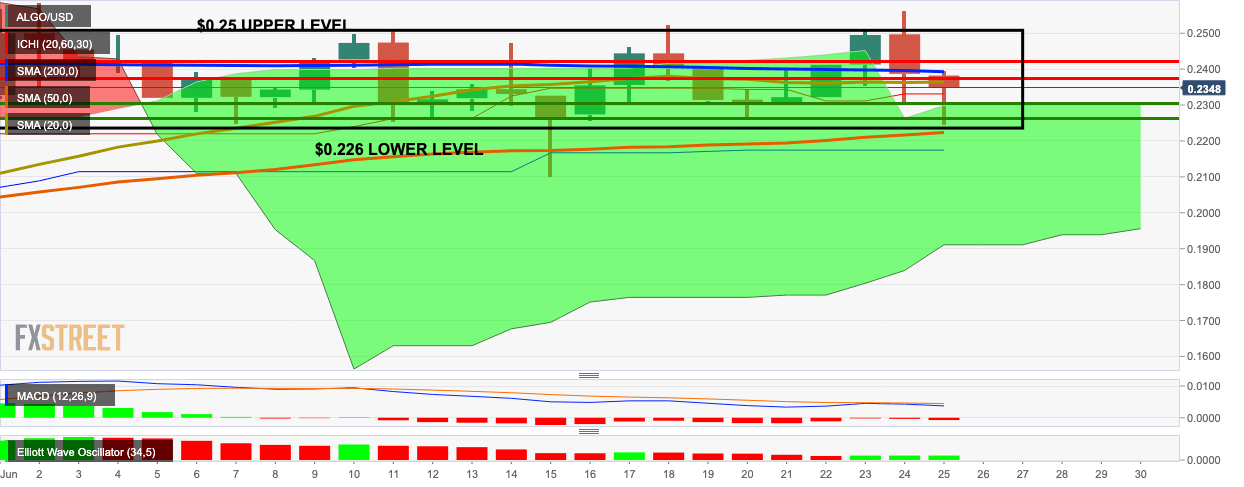

- ALGO/USD has been trending in a narrow range between $0.226 and $0.25 so far this month.

Centre, the collaboration between Coinbase and Circle that administers the USDC stablecoin, has recently announced a framework for multi-chain support for USDC. Algorand appears to be the first non-Ethereum blockchain to deploy support for USDC.

Exciting milestone for Circle and USDC announced today! https://t.co/CEHpxQdTSv

— Circle (@circlepay) June 24, 2020

Centre noted that it chose Algorand because the blockchain is optimized for high-volume financial applications. Circle will operate a token bridge allowing USDC on Algorand to be swapped with ERC-20 USDC tokens on the Ethereum blockchain. Fiat reserves will back all USDC stablecoins on Algorand.

USDC has become a very popular and significant asset on the Ethereum network. It was used to stabilize the Maker protocol after the March 2020 crypto crash. It has also helped facilitate margin trading on Binance and other exchanges.

Algorand Foundation COO, Fangfang Chen, said:

As more financial institutions and enterprises look to build decentralized financial applications, they need a well-suited infrastructure and a compliant, regulated, and widely accepted stablecoin.

Chen also noted that Algorand is excited to collaborate with Circle. They are looking to provide financial organizations with the tools required to leverage the benefits of USDC and explore real-world use cases. Algorand had previously also finalized a partnership agreement with Tether (USDT).

ALGO/USD daily chart

ALGO/USD has dropped from $0.2384 to $0.235 this Thursday as the bears stayed in control for the second straight day. The price has been trending in a narrow range between $0.226 and $0.25 over the entire month of June. ALGO/USD peeked above the green Ichimoku cloud this Tuesday before the bears entered the market. The MACD shows sustained bearish momentum, while the Elliott Oscillator has had three straight green sessions.

Support and Resistance

ALGO/USD has strong resistance levels at $0.236 (SMA 20), $0.2375, $0.2395 (SMA 50) and $0.242. On the downside, healthy support levels exist at $0.231, $0.2264 and $0.2228 (SMA 50).

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bulls target $100,000 BTC, $2,000 ETH, and $3 XRP

Bitcoin (BTC) is stabilizing around $95,000 at the time of writing on Wednesday, and a breakout suggests gains toward $100,000. Ethereum (ETH) and Ripple (XRP) followed BTC’s footsteps and hovered around their key levels.

Tether mints 3 billion USDT on Ethereum and TRON as markets stabilize

Tether ramps up its minting activity amid surging demand for stablecoins, often signaling heightened trading and liquidity needs. The issuer of the leading stablecoin by market capitalization has minted 2 billion USDT on Ethereum and an additional 1 billion USDT on the TRON network.

SEC delays decision on Franklin Templeton’s spot XRP ETF to June 2025

The Securities and Exchange Commission (SEC) has postponed its decision on Franklin Templeton’s spot XRP ETF, extending the review period to June 17, 2025. XRP traded at approximately $2.24 at press time, rising 7% over the past week, according to CoinGecko.

Trump Media announces new token launch and native crypto wallet in latest Shareholder letter

Trump Media unveils plans to launch a utility token and crypto wallet to monetize Truth Social and expand its streaming services. Markets react with a 10% drawdown on the Solana-hosted official TRUMP memecoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.