Algo price could go sideways for weeks if the technicals evolve

- Algorand prices could continue coiling for weeks.

- ALGO price volume is unconvincing.

- Invalidation is a break above $0.7715.

Algorand could take more time than hoped for as the bulls have failed to breakout. Traders should consider looking for better opportunities in the market.\

ALGO price says, "look for better opportunities"

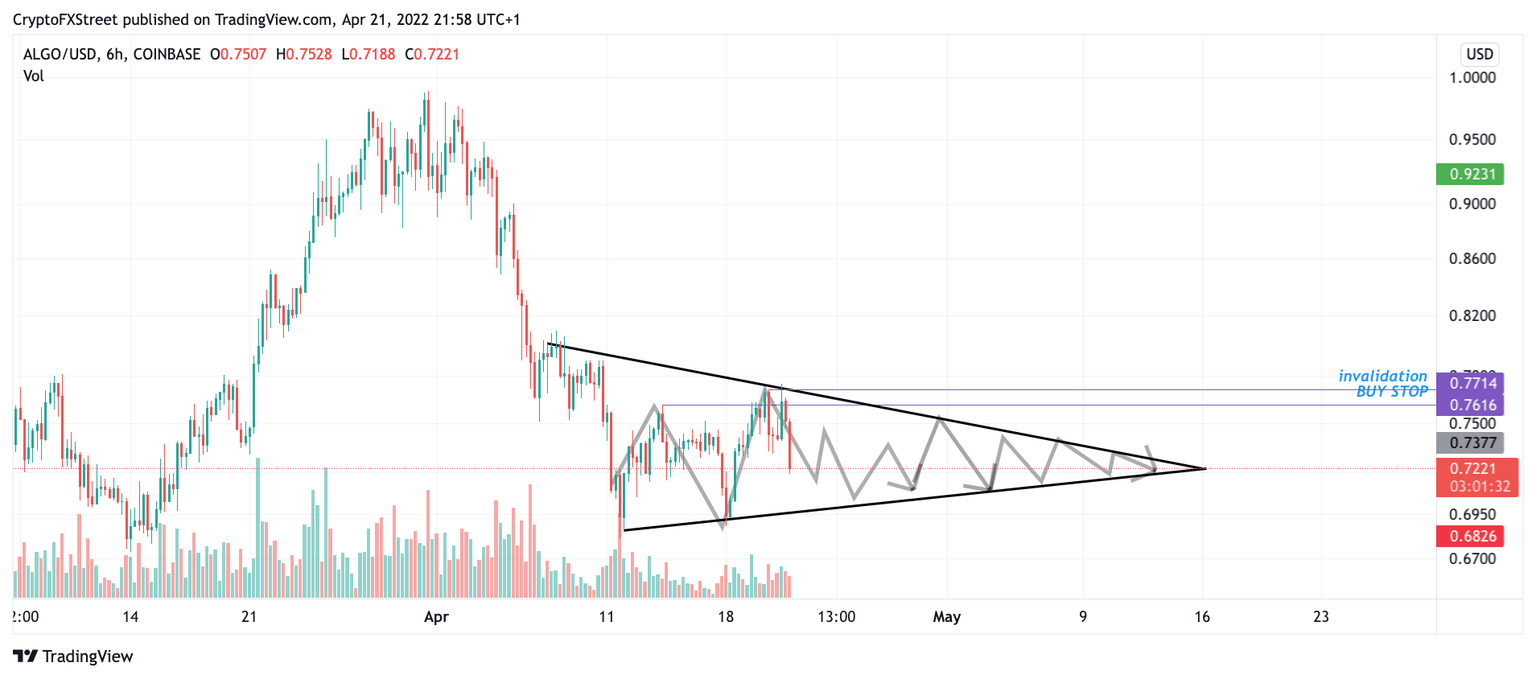

Algorand price looks like it could take a lot more time before a directional trend is confirmed as the price has failed to breakout after triggering buy orders at $0.75. Breakout traders are likely to cut their losses short and look for better opportunities as the price could be coiling into a larger triangle pattern in the coming weeks.

Algorand price has a lot more work to do now that the breakout has failed. The obvious initiative for traders is to capitalize on the big moves. However, a more subtle mantra amongst professional traders is to know when you're wrong to maximize buying opportunities. ALGO price could very well coil into a range for the next few weeks as the price is seeing considerable chop since Monday's fake-out. The volume profile also indicates a lack of involvement of smart money which further backs the idea of a long-term range in play.

ALGO/USDT 4-Hour chart

Invalidation of the neutral thesis is a close above $0.7715. If the ALGO price can tap its level, then the bullish count for a $0.92 ALGO price will be back on the table, resulting in a 30% increase from the current ALGO price. If the bulls cannot push past $77.15, traders should expect a sideways triangle followed by potential drops into $0.58, resulting in a 15% dip from the current Algorand price.

Author

FXStreet Team

FXStreet