While technologists continue to explore artificial intelligence (AI) use cases in all business verticals, a Coinbase research report suggests that AI-related tokens may be over-hyped right now, at least in the short and medium term.

The rising popularity of generative AI spurred niche crypto sub-ecosystems over the last couple of years. However, Coinbase research analyst David Han believes that the rapid changes in AI “make us cautious” of the long-term sustainability of most AI tokens.

One of the primary challenges with crypto AI projects lies within the core of both technologies. While crypto projects often aim for decentralization, the current AI offering relies heavily on centralized components and data sources, argues Han.

In addition, most projects in the niche have failed to attract investors — resulting in under-indexed capital allocation.

The report highlights two opportunities for the crypto AI ecosystem — improving the blockchain data for creating human-readable transactions and analysis and helping decentralize the predominantly centralized AI infrastructure. However, Han said:

A decentralized AI future, as it is currently envisioned by many in the crypto industry, is not guaranteed — in fact, the future of the AI industry itself is still largely undetermined.

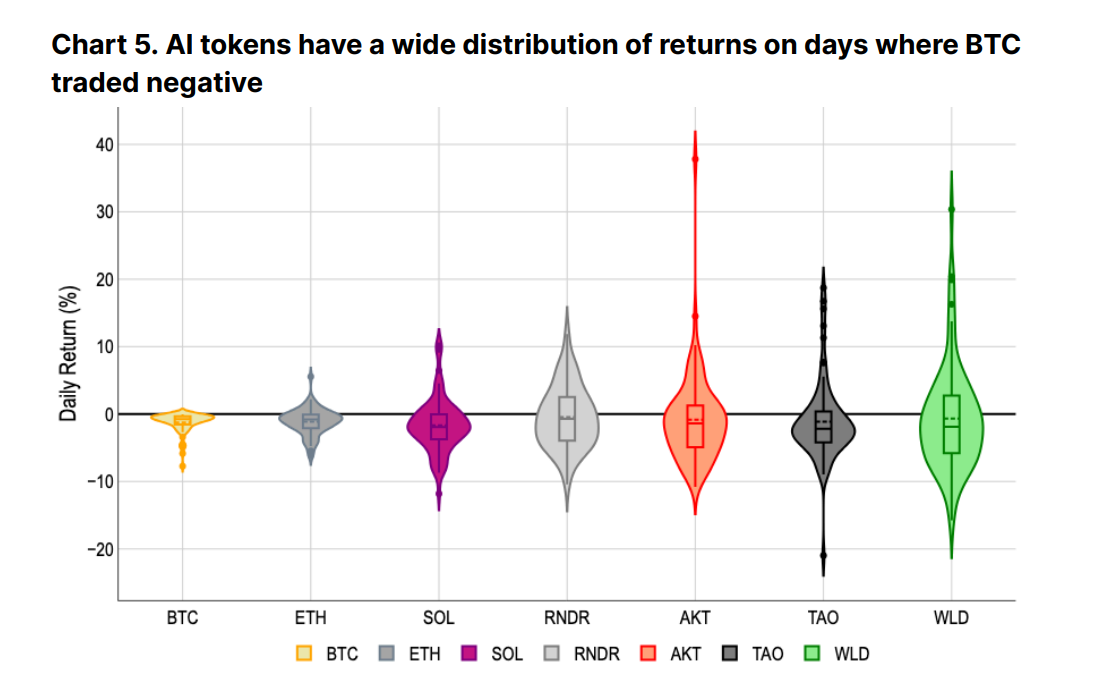

Despite the negative outlook, many AI tokens haverecently outperformed Bitcoin (BTC $67,411) and major stocks such as Nvidia and Microsoft. Coinbase attributed this to the market sentiment built by the broader crypto market and supported by related AI news headlines.

AI tokens have a wide distribution of returns on days where BTC traded negatively. Source: coinbase.bynder.com

The crypto AI narrative could grow even stronger amid the continued constructive crypto market and the outperforming AI sector. However, Coinbase suggests that driving “meaningful adoption” will require more than just decentralizing AI components.

It is important to note that the AI ecosystem is currently in its nascency and will have to “understand the underlying trading narrative” at the very least, eventually providing a comparable alternative to today’s crypto assets.

Complimenting Coinbase’s suggestion for meaningful developments in the crypto AI sphere, Ethereum co-founder Vitalik Buterin recently said AI could becrucial to eradicating bugs buried deep within its code.

Ethereum co-founder Vitalik Buterin shares optimism about using AI to fix blockchain bugs. Source: Vitalik Buterin on X

On Feb. 19, Buterin shared his excitement for AI-powered auditing to identify and fix buggy code in the Ethereum network, describing it as the “biggest technical risk” to the network.

AI tokens cumulatively hold a market capitalization of $51.18 billion as of March 8, according to Crypto.com data. These tokens serve AI-based projects, applications and services, such as decentralized AI marketplaces, AI-powered trading algorithms and AI-driven decentralized autonomous organizations, to name a few.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Could a Solana ETF debut in 2025? Expert weighs in

Solana (SOL) made the rounds across crypto communities on Friday as key executives from VanEck and BlackRock gave contrasting views on the possibility of a SOL exchange-traded fund (ETF) launching in the US.

Cardano Price Prediction: ADA soars 18%, eyes $0.8104 following increased buying pressure and recent rumors

Cardano (ADA) is up 18% on Friday following rumors of the federal government leveraging its blockchain to build a blockchain-based election voting system.

Ethereum Price Forecast: ETH could stage 60% rally despite recent decline

Ethereum (ETH) is trading near the $3,000 psychological level on Friday, as its rising exchange reserve and declining network fees hint at potential reasons for its recent price decline.

EU’s strict screening measures signal a regulatory shift in crypto

The European Banking Authority (EBA) has released guidelines to enhance compliance for financial institutions, payment service providers (PSPs) and crypto asset service providers (CASPs) in the European Union (EU).

Bitcoin: New high of $100K or correction to $78K?

Bitcoin (BTC) surged up to 16% in the first half of the week, reaching a new all-time high of $93,265, followed by a slight decline in the latter half. Reports suggest the continuation of the ongoing rally as they highlight that the current trading level is still not overvalued and that project targets are above $100K in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.