- Apple’s annual developer conference WWDC 2024 is set to kick off on Monday.

- Investment bank Morgan Stanley said Apple will likely launch a new and improved Siri at the conference.

- Prices of AI-related coins like Worldcoin, Render, Fetch.ai fell ahead of the start of the developer conference.

Apple’s Worldwide Developer Conference (WWDC) 2024, which starts on Monday, has the potential to influence prices of AI-related tokens as the company is expected to release several updates at the event, including a revamped version of Siri, according to reports from Reddit, Apple Insider and Bloomberg.

Project Greymatter is the focus of the discussions on what to expect from the Cupertino-headquartered tech giant. Bloomberg has previously reported on the project, which is based on a set of Artificial Intelligence (AI) tools that the company is expected to integrate into core apps like Safari, Photos and Notes.

Apple Insider reported earlier in 2024 that the investment bank Morgan Stanley believes that the tech giant will benefit the most as AI becomes mainstream. The bank’s analysts highlighted Apple’s Edge AI work, namely an improved AI-powered Siri 2.0 and a broader AI-enabled operating system.

What to expect from Apple WWDC 2024

Reports from Reddit’s OpenAI note that Apple Insider has received the exact details of virtual assistant Siri’s new functionality. The Apple news website states that the tech giant has tested a variety of different prompts for the new AI. Siri’s new prompts reportedly contain “natural” language, as spoken by humans.

In January, Apple Insider reported that analysts at Morgan Stanley expect the tech giant to benefit the most from developments in Artificial Intelligence.

WWDC 2024 is scheduled to kick off on Monday at 17:00 GMT. The announcements at the conference could catalyze gains in tokens in the AI category, like Worldcoin (WLD), Fetch.ai (FET) and Render (RNDR). The three assets lost between 3% and 6% of their value on Monday.

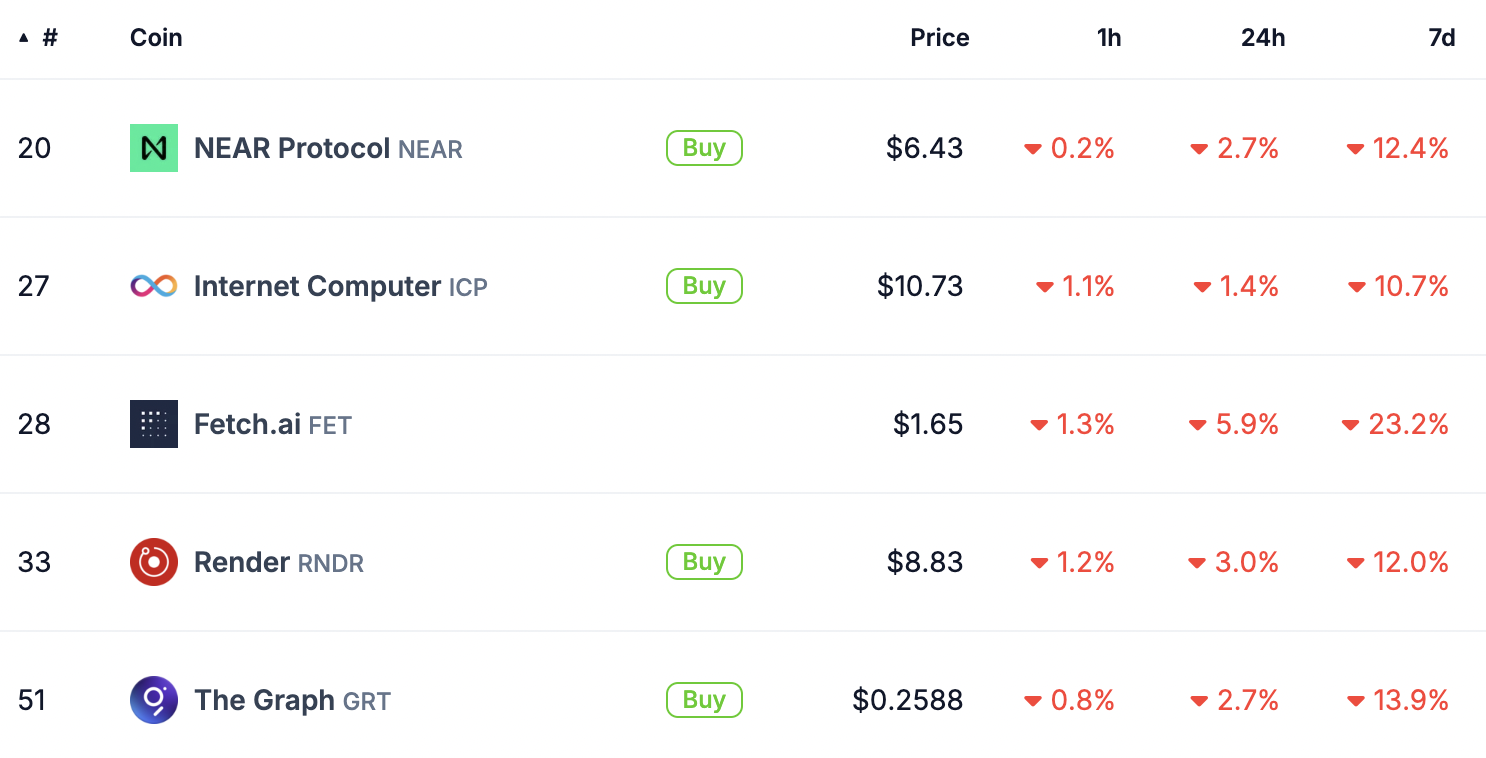

Data from crypto aggregator CoinGecko shows that the top five AI tokens ranked by market capitalization have seen their prices decline in the past 24 hours and seven days.

Top 5 AI category crypto tokens on CoinGecko

AI-related announcements at WWDC 2024 could catalyze gains in WLD, FET and RNDR. The phenomenon has occurred previously. NVIDIA’s earnings reports and AI-related updates or announcements from OpenAI and other tech giants have fueled rallies in AI tokens with large market capitalization.

At the time of writing, WLD and FET prices are down nearly 6%, while RNDR has lost nearly 3% of its value in the last 24 hours, respectively.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP funding rates flashes negative, eyes $2.17 following 4% decline

Ripple's XRP declined 4% on Friday following a decline in its funding rates. The remittance-based token could decline to test the $2.17 support level if the crypto market decline extends.

Pro-crypto Senator Lummis likely to chair potential crypto subcommittee

In a post on Thursday, Fox Business reporter Eleanor Terret unveiled the Senate Banking Committee's latest plan to kick off a new subcommittee committed to crypto, likely to be headed by Bitcoin strategic reserve advocate Senator Cynthia Lummis.

Lack of Bitcoin allocation could be risky for nations in 2025: Fidelity

Fidelity Digital Assets' Look Ahead report for the crypto market in 2025 highlights key trends expected for the year, including increased Bitcoin adoption by governments worldwide, broader use cases for stablecoins and more app blockchain launches.

Crypto Today: BTC traders hold $90K support as SUI, LTC, TIA see green

The cryptocurrency market’s losing streak entered its third day; aggregate market cap declined 10.9% to hit $3.1 trillion. Bitcoin price stabilized around the $91,800 area as bulls moved to avoid further downside.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.