Addressing the crypto investor dilemma: To invest or not?

- Bitcoin price trades around $63,000 with no directional bias.

- The consolidation has pushed crypto investors into a state of uncertainty.

- Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Bitcoin’s consolidation crosses the two-month mark but shows no signs of a breakout or a directional move. Investors waiting with bated breath for a volatile move remain confused about whether to buy the dips or keep some cash reserves for a rainy day.

Why are crypto investors confused?

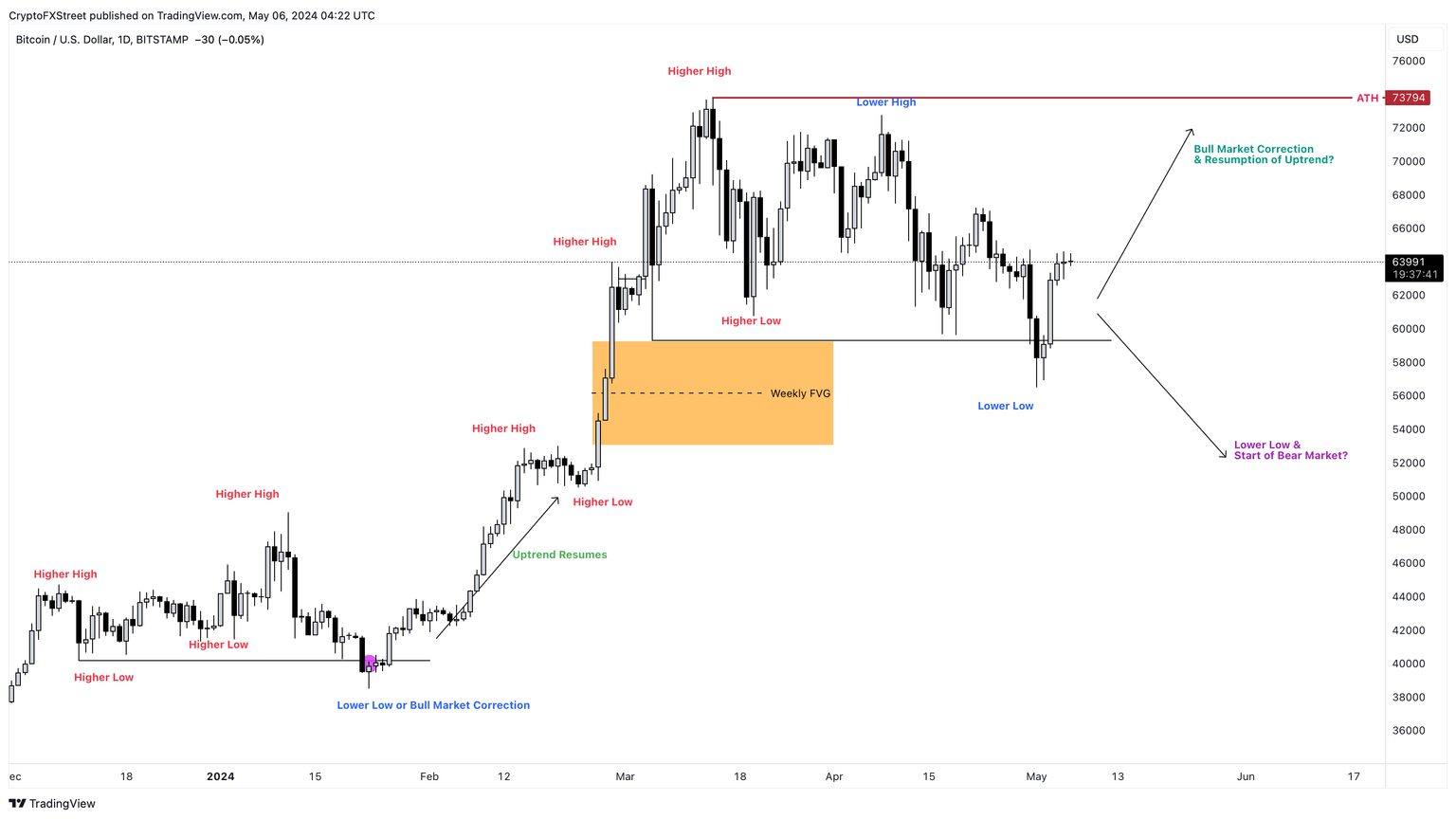

During the bull market or uptrend, the market structure is simple - higher highs and higher lows with an occasional lower low that recovers immediately, leading to the resumption of the uptrend. In a bear market or downtrend, the market structure contains lower lows and lower highs with an occasional higher high that is sold off immediately, leading to the continuation of the downtrend.

Bitcoin’s current position, as shown in the chart below, is in a state of uncertainty. It could recover and rally higher or kickstart a downtrend. This uncertainty has made altcoin markets risky. Some alts show strength even at the slightest uptick in Bitcoin, like the ZetaChain (ZETA) price, which shot up 42% in under four days. Others, however, show faux strength, which is immediately undone, leaving behind a massive wick to the upside.

As a result of this state of confusion, impatient or inexperienced traders are dancing to the market’s tune and are likely losing money.

Read more: Bitcoin Weekly Forecast: Should you buy BTC here?

BTC/USD 1-day chart

Solutions to the crypto investor dilemma

While the dilemma is real, its solutions are also simple and straightforward.

- The first and the best solution to this problem is to remain patient, which many traders are unlikely to practice.

- The second solution is to be a long-term investor, i.e., buy the dip on altcoins with strong fundamentals and wait.

- Trading the market based on events or news. For example, Tesla’s addition of Dogecoin to its payment system was bullish news for DOGE. Considering meme coins were a popular investment category before the markets consolidated, buying a long position on DOGE would have been ideal.

- Trade the trending categories. In addition to tracking the news, this technique involves constantly monitoring the markets to see which altcoins or categories show strength. After identifying these relatively strong altcoins, it’s just a matter of riding the wave.

Regardless of multiple solutions, investors first need to identify their risk appetite and expertise level before selecting a solution and trying to find success in that.

Concluding thoughts

Based on previous FXStreet publications, the pause in Bitcoin and the larger crypto market’s bull run could most likely lead to a continuation of the uptrend. From a technical standpoint, Bitcoin must first overcome the $70,000 psychological level. Beyond this, a stable weekly candlestick close above the current ATH of $73,949 needs to occur. These two developments will be enough to attract sidelined buyers and investors to join the party.

However, failing to do so could result in a reversal of the uptrend, similar to the events after April 2021. A 60-70% correction is followed by an uptrend that leads to a new ATH. To scout such a bearish outlook and profit from it, investors need to watch for a weekly candlestick close below $50,000. This move would break the bullish market structure on a high time frame, attracting profit-takers.

Read more: Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.