- Cardano price slides further even with equities closing in the green on Thursday.

- ADA rips lower, falling another 1% in the ASIA PAC and European session.

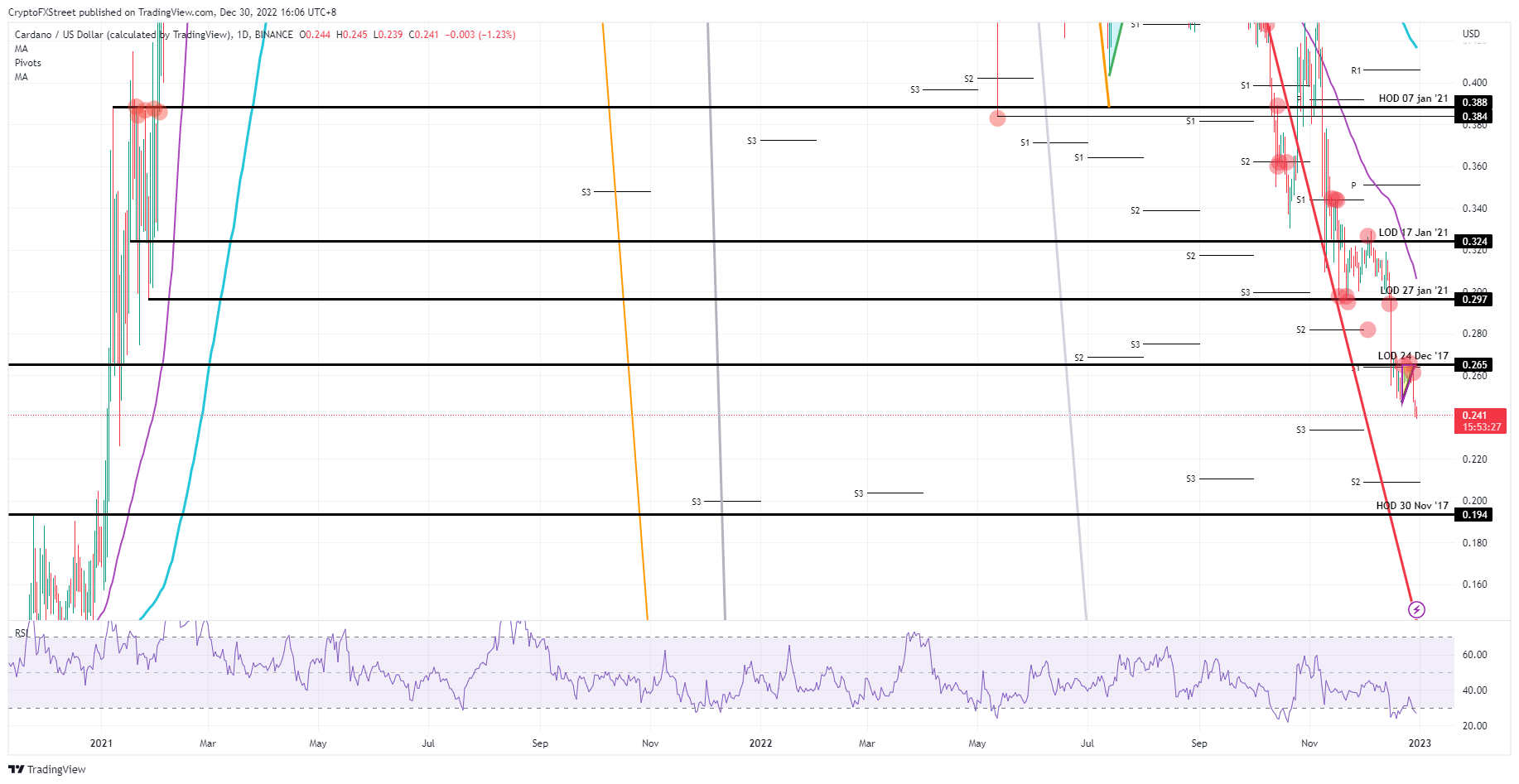

- New yearly lows look granted as the decline continues towards $0.194

Cardano (ADA) price is officially on a losing streak as price action is tanking for a third day in a row. The decline comes as liquidity wears thin, and traders are fleeing further into safe havens as markets gear up for a recession in 2023. Although equities rallied on Thursday, only a fraction of the losses got paired back, as a negative close was unavoidable;

Cardano price needs to turn the page soon

Cardano price should be scaring traders away by now, or at least have them stay out of it for a moment and do the much-needed homework for 2023 to time the right entry and take-profit levels. There is no point in engaging in this decline, as the risk of starting 2023 with a too-negative balance is too big. Rather wait, step aside, and let the mayhem occur, and only after then engage in the price action to start building up long positions.

ADA price thus needs to see this pain trade through, as Socrates had to empty the poison cup to the bottom. Let the avalanche run through, possibly towards $0.200, with the pivotal support level at $0.194 providing the most secure support level nearby. To add everything up, traders must remember that another 20% decline is still possible.

ADA/USD daily chart

Upside potential, although unlikely at the moment, must be traded with big precautions. The first level to the upside would be, of course, $0.265, a pivotal level that got broken and falls in line with the monthly S1 for December. Once price action can break and close above there, expect a massive influx from bulls and see price action rally up towards $0.297 or $0.300.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP corrects as traders weigh possibility of SEC appealing Ripple ruling

Ripple (XRP) trades with minor losses on Friday as holders weigh the impact of a likely appeal by the US Securities & Exchange Commission (SEC) in the Ripple lawsuit.

Bitcoin Weekly Forecast: $70,000 mark on sight as bulls remain strong

Bitcoin has risen around 3% so far this week, breaking above its range upper limit of $64,700. This gain was supported by increased institutional demand for ETFs, which recorded inflows of more than $612 million this week.

Crypto Today: Bitcoin, Ethereum and XRP steady above major support levels, Worldcoin leads AI token gains

Bitcoin, Ethereum trade above key supports at $65,000 and $2,600, as of Friday. XRP corrects slightly, holding steady above $0.5892. Worldcoin climbs 3% as Polymarket bet shows a 66% chance of OpenAI becoming a “for profit” entity before April.

Top 3 meme coins Dogecoin, Shiba Inu and Pepe: Rally continues

The prices of the top 3 meme coins by market capitalization, Dogecoin, Shiba Inu and Pepe, extend their gains on Friday after a rally on Thursday. The technical outlook for the three coins hints at further gains ahead as they all broke above bullish technical patterns.

Bitcoin Weekly Forecast: $70,000 mark on sight as bulls remain strong

Bitcoin (BTC) has risen around 3% so far this week, breaking above its range upper limit of $64,700.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.