Following a £5.25m seed funding round, Ziglu has entered the cryptocurrency platform landscape with a simple promise to make purchasing and trading the likes of Bitcoin easier than ever before.

Founded by Mark Hipperson, who has made a name for himself in finance having successfully established Starling Bank, Ziglu is now available as a download from Apple’s App Store, with an Android version launching on Google Play shortly.

Ziglu will be looking to muscle in on a range of established competitors, but it may have found a key to success that’s going to be hard for rivals to replicate in the current crypto climate: accessibility.

Building Accessibility

The mystique surrounding cryptocurrencies has built an appeal among younger investors but has also led to a feeling of exclusivity among many older and less technologically-fluent audiences.

Hipperson hopes that Ziglu helps to bridge the gap between those able to invest and those who are fearful of some of the more complex crypto platforms.

“In 2020, we think the 25-45 demographic will want easy, safe access to crypto. Only about 1% of people go to the large platforms to buy crypto and we think we can do better, and perhaps get them better prices as well,” Hipperson explained.

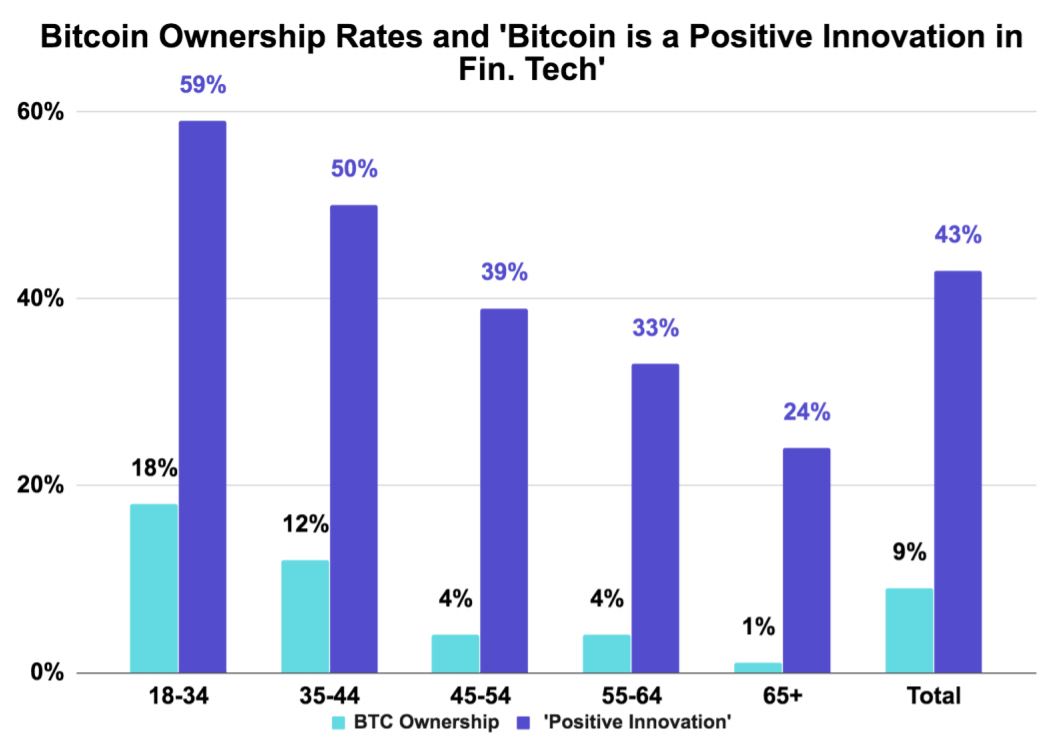

(Chart: AMB Crypto)

As the chart above shows, cryptocurrencies are still an alien concept for older generations, with the vast majority of people aged 45 or older greeting digital finance with suspicion.

Despite the wildly impressive triumphs of Bitcoin over the past decade, cryptocurrencies still appear to be the preserve of the ‘expert’. However, the arrival of Ziglu could be well-timed as individuals look for a greater level of financial inclusivity.

Effortless Exchanging

While the crypto app marketplace is becoming increasingly congested with more and more intuitive services, Ziglu’s focus is wholly on turning the process of buying cryptocurrencies effortless.

Purchasing the likes of Bitcoin, Ether, Litecoin and Bitcoin Cash is instant, and Ziglu’s USP stems from the app routing requests in order to find the best deal for customers. For instance, if Kraken has the best price for Bitcoin in British Pounds at the time a request is made, Ziglu will present that deal ahead of any others.

Healthy Transparency

Another key reason behind the widespread scepticism towards cryptocurrency platforms comes from a lack of transparency. Hidden costs can be severe in some crypto market places, but Ziglu promises a fresh approach that presents clarity and convenience in terms of pricing, with user funds held in a segregated account.

“This launch marks the beginning of an exciting journey for Ziglu to deliver transformational financial services for our customers. By offering immediate and safe access to best-price crypto, customers can spend, exchange and send their money, regardless of the currency, where, when and how they want,” said Hipperson.

Ziglu has successfully created an app that offers flexible, scalable and banking levels of security within its technological makeup. If the platform delivers on its pledge of fair and transparent pricing, it could act as a significant step towards more universal cryptocurrency adoption.

The Necessity of Inclusivity

Fundamentally, cryptocurrencies offer users access to banking in regions where such infrastructures don’t exist.

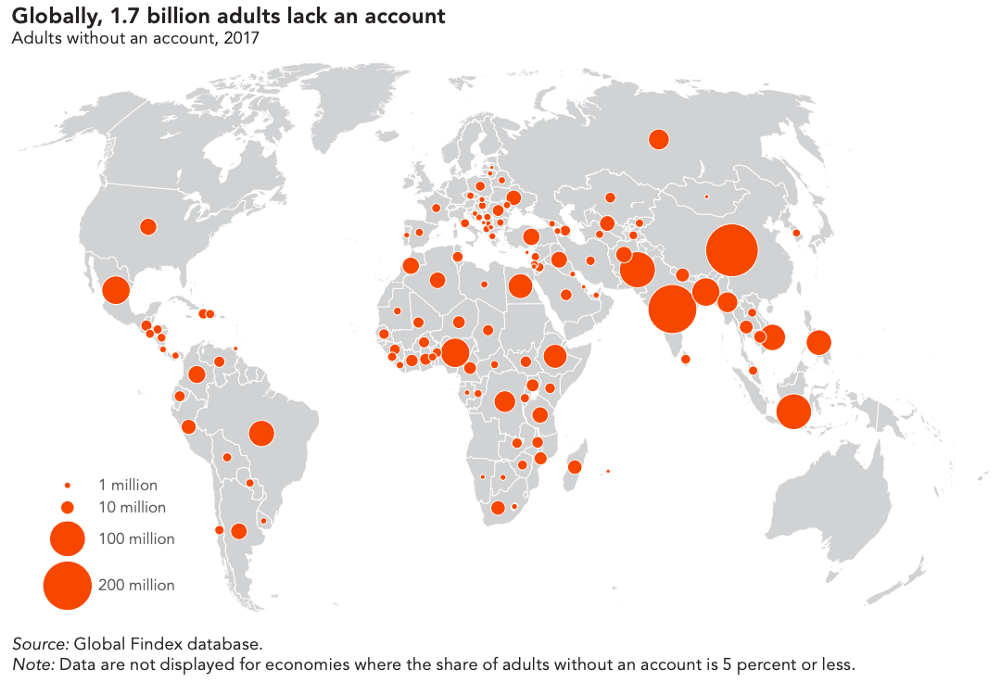

(Image: Medium)

With 100s of millions unable to set up bank accounts virtually every continent on earth, the necessity of digital platforms and decentralised cryptocurrencies is imperative.

The harsh reality of a recession will be set to hit deprived nations hard as businesses feel the strain of widespread losses from early 2020 and the emergence of COVID-19. With global economies forecast to struggle in the short term, leading to a loss of wealth and depreciation of assets, having easy access to a store of finance that is free of the influence of central governments could be a key development in ensuring the long term recovery of investors who would otherwise suffer from the economic downturns.

Ziglu is certainly saying all the right things, but there’s a long way to go for cryptocurrencies to develop into a fully accessible and inclusive alternative unit of finance across the world.

Impressively for such a famously unstable and speculative market, it’s clear that cryptocurrencies are here to stay. Now the onus is on developers to create platforms that can be transparent and trustworthy enough to see usage from investors with varying levels of technological literacy.

At a time when communities and businesses around the world alike are readying themselves for a period of significant financial hardship, the successful development and scaling of apps like Ziglu could ultimately provide users with a tangible route away from their ailing national economies should the worst occur.

All views and opinions expressed in this article are the opinions of the author and not FXStreet. Trading cryptocurrencies or related products involves risk. This is not an endorsement to invest in or trade any of the cryptocurrencies, stocks or companies mentioned in this article.

Recommended Content

Editors’ Picks

BNB Price Forecast: BNB recovery receives boost as trading volume hits $11.35 billion, highest yearly level

BNB (BNB) is extending its recovery, trading around $670 on Tuesday after rebounding from a key level over the weekend. On-chain data and technical outlook suggest a rally ahead as BNB breaks above the symmetrical triangle pattern, with ecosystem trading volume and stablecoin activity surging.

Crypto Gainers WIF, SPX, HYPE: Meme coins soar with Bitcoin’s recovery to $106K

Crypto market bounces back as Bitcoin (BTC) reclaims the $106,000 level at press time on Tuesday, resulting in a refreshed rally in top meme coins such as Dogwifhat (WIF) and SPX6900 (SPX), and Pepe (PEPE).

Meta shareholders turn down Bitcoin treasury reserve proposal as its stock soar on AI plans

Meta (META) shareholders opposed a proposal to adopt Bitcoin as a treasury asset, with more than 95% voting against the idea, according to a filing with the Securities & Exchange Commission (SEC).

Ripple price forecast: XRP price could hit $1.76 this week amid potential 20% correction

Ripple (XRP) faces legal uncertainty in its battle with the United States Securities and Exchange Commission, and the XRP price continues to slide. At the time of writing, XRP is trading at $2.1540, down 1.20% in the day.

Bitcoin: BTC dips as profit-taking surges, but institutional demand holds strong

Bitcoin (BTC) is stabilizing around $106,000 on Friday, following three consecutive days of correction that have resulted in a near 3% decline so far this week. The correction in BTC prices was further supported by the profit-taking activity of its holders, which has reached a three-month high.