About 4 billion MATIC stands inches away from turning profitable again as MATIC price nears $1

- MATIC price noted a 9% rally over the last week to bring itself to trade at $0.91.

- Although the project is gaining traction among new investors, it is still not finding much support from its existing holders.

- The $1 mark level is critical for MATIC price as nearly half of the circulating MATIC supply will become profitable once breached.

MATIC price has been stuck under a key barrier for the entirety of May, and as the month comes to a close, the chances of the altcoin breaching this barrier seem bleak. However, if the cryptocurrency finds support from its investors, June might look green for MATIC.

MATIC price needs to be at this level

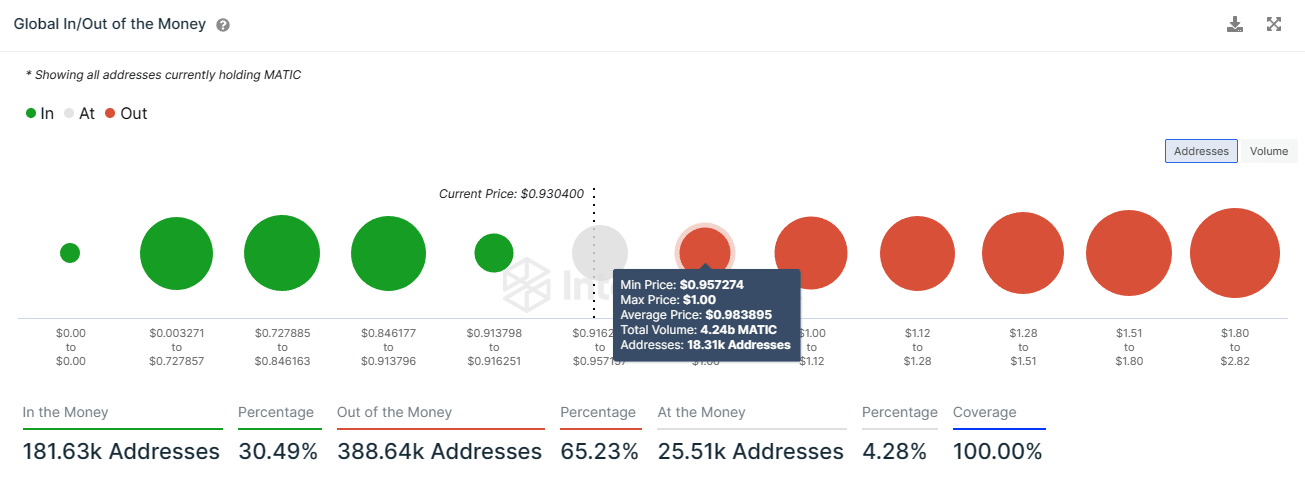

MATIC price has a lot of bullishness awaiting beyond the $1 mark. Acting as a critical psychological support level and a technical barrier, flipping $1 into support would be profitable for more than 18,000 investors.

At the moment, more than 4.2 billion MATIC worth over $3.8 billion is awaiting a rally to $0.98, the average price at which these tokens were purchased. These 4.2 billion MATIC represent a little under half of the entire circulating supply of the altcoin. Thus if it becomes profitable, the uptrend potential of the cryptocurrency will increase immensely.

MATIC GIOM

However, MATIC price would need to mark a 9.6% rally from the current trading price of $0.91 for this to occur. This may be difficult since investors do not have much support right now despite the 9.7% rally from the previous week. Daily on-chain transactions are averaging at half of April’s average, suggesting that MATIC holders are refraining from participating.

MATIC number of transactions

Although network growth looks strong, it could imbue some bullishness in the current holders. The indicator shows the rate at which new addresses join the network, which exhibits whether the project is gaining or losing traction. By the looks of it, the bullishness noted here might work in favor of a price rise.

MATIC network growth

For MATIC price to reach $1, it must first flip the barrier at $0.95 into a support floor. This price level coincides with the 50-day Exponential Moving Average (EMA). Once the altcoin bounces off it, a rise to $1 is likely.

MATIC/USD 1-day chart

This is evinced by the Relative Strength Index (RSI) and the Awesome Oscillator (AO). Both the indicators are turning positive, with the RSI sitting in the bullish zone above the neutral line and AO switching to green bars above the neutral line. If the investors become active again, these indications could become true, and MATIC price would soon be on its way to hitting $1.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B23.21.46%2C%252029%2520May%2C%25202023%5D-638209892382093744.png&w=1536&q=95)