AAVE V3 deployment on Ethereum layer 2 METIS network unanimously approved

- AAVE DAO community has concluded voting on a proposal to roll out its Version 3 on Ethereum Layer 2 METIS network.

- The deployment will offer 100,000 METIS tokens as liquidity mining incentive to AAVE users over a six-month period.

- AAVE and METIS price declined despite this bullish catalyst.

AAVE DAO’s recent proposal to deploy version 3 on the Ethereum mainnet got 100% unanimous support from its community. The proposal will bring METIS liquidity incentives to AAVE users over the next six months, boosting the liquidity for both AAVE and METIS, an Ethereum layer 2 token.

Also read: BNB price bullish outlook shakes as Binance battles FUD following Bitcoin withdrawal pause

AAVE Version 3 deployment on METIS Network receives 100% approval

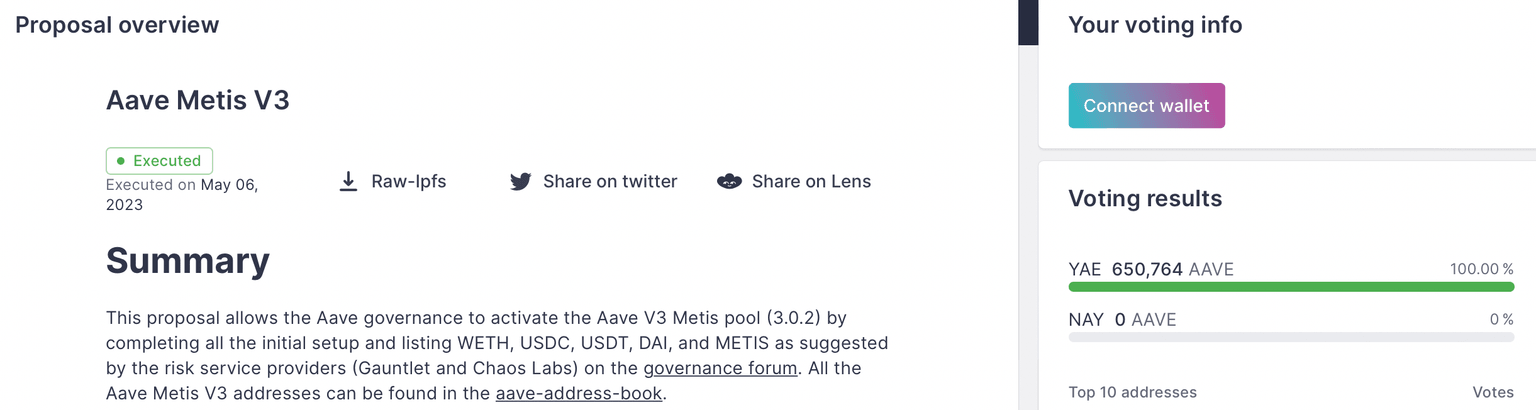

AAVE, a DeFi lending protocol, is set to deploy its Version 3 on the Ethereum layer 2 network METIS. The decentralized autonomous organization (DAO) proposal garnered a unanimous response from its community, and the voting concluded with 100% of votes supporting the deployment.

AAVE Metis V3 proposal

The deployment on the layer 2 protocol will effectively increase market liquidity for both the involved ecosystems. A reward of 100,000 METIS tokens will be distributed as incentives to AAVE users for liquidity-mining initiatives.

Even if the governance proposal’s execution should theoretically be a bullish catalyst for AAVE and METIS, the prices of the two tokens have nosedived by nearly 5% each, ahead of the Version 3 rollout. It remains to be seen whether the deployment turns out to be a non-event or a bullish catalyst that fuels recovery in AAVE and METIS prices.

In the bull run of 2022, METIS gained popularity among crypto traders for its cheap transaction fees and speed. Since then, the launch of Optimism and Arbitrum shadowed METIS popularity and the Total Value Locked (TVL) in the protocol is down from $469.64 million in March 2022 to $38.65 million at the time of writing.

AAVE’s Version 3 deployment could boost the utility of METIS network, aiding in the recovery of its declining TVL.

AAVE V3 deployment on METIS could be a bullish catalyst

There are two reasons why experts like CryptoNikyous believe AAVE V3 deployment could catalyze a METIS price recovery. The first is that METIS played a key role in the previous bull run, amassing upwards of $450 million in TVL, helping support fast and cheap Ethereum layer 2 transactions.

The second reason is METIS’ roadmap. On April 6, the layer 2 network shared a detailed roadmap featuring fraud proofs, sequencer decentralization, and a first-of-its-kind hybrid rollup. These features are key to the L2 growth in the Ethereum ecosystem.

Lending giant and 3rd biggest project in crypto by TVL - $AAVE is finally deploying on $METIS

— Nikyous (@CryptoNikyous) May 7, 2023

Deployment is expected to take place on Mon, 8th of May.

How to profit from this BIG catalyst?

Some easy strategies and undervalued gems.

Short thread on @MetisDAO @AaveAave pic.twitter.com/nogaBSSxAW

These features are key to the L2’s growth in the Ethereum ecosystem and could help catalyze a METIS price recovery.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.