AAVE price stabilizes at $66 as whales pick up retail investor's 300,000 AAVE dump

- AAVE price, after crashing by 15% at the beginning of the month, has recovered very little of the losses witnessed.

- Whale addresses have been noted accumulating AAVE adding $20 million worth of tokens in the last three days.

- AAVE holders’ losses had reduced to 65% around mid-July, but the broader market condition-induced crash increased the losses by another 13% in a month.

AAVE price has been marking a slow recovery owing to the broader market cues after losing a chunk of its market value a few days ago. While the crash ticked off the retail investors, the whales stepped in to ensure that losses did not extend any further.

AAVE price needs to recover soon

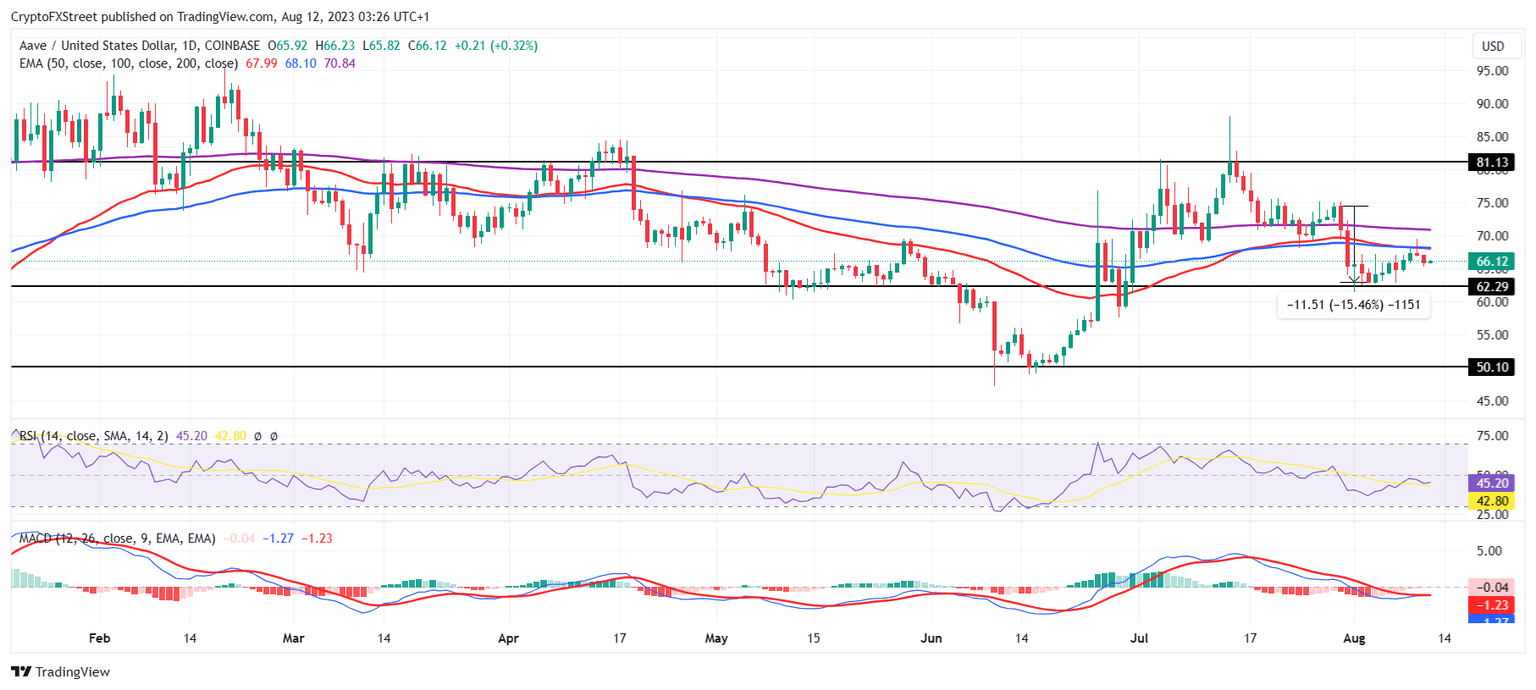

AAVE price trading at $66 is up slightly after crashing by 15% towards the end of July and the beginning of August to fall from $74 to $62. In doing so, the altcoin lost the support of the 50, 100 and 200-day Exponential Moving Averages (EMAs). This certainly impacted the investors as they did not take too long to make arrangements to offset their losses.

AAVE/USD 1-day chart

According to the supply held by the cohort holding, 10,000 to 100,000 AAVE retail investors could be seen dumping their tokens. In the span of 48 hours, this group’s supply decreased by 300,000, falling to 2.96 million AAVE. Their reaction was natural, considering the slow recovery of the asset.

Fortunately, before the selling could impact the price action drastically, the whales absorbed the blow and picked up the entire 300,000 AAVE supply. The addresses holding 100,000 to 1 million AAVE thus added these tokens bringing their total to 5.33 million.

AAVE supply distribution

In all fairness, considering the condition of the AAVE investors, offsetting losses was the right move by the retail holders. Up until mid-July, the profitability of investors had improved, with only 65% of holders observing losses. This was quickly destroyed as the 15% crash increased the concentration of investors facing a loss by another 13%, bringing the total to 78%.

AAVE investors at a loss

Thus, going forward, if the whales continue to support the asset, AAVE price would have a chance at recovery or else the fear in investors would steamroll any chance of the altcoin going back up.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B06.32.02%2C%252012%2520Aug%2C%25202023%5D-638274040565668100.png&w=1536&q=95)