Aave price rally of 30% faces threat from whales and mid-term holders

- Aave price has charted a near 60% rally since it began recovering on June 16, with 32% of that increase occurring in the past week.

- AAVE whale transactions, which hit a five-month high last week, have since dropped by 40%.

- The supply is also moving from mid-term holders to short-term holders, who have grown to 21.5% of the supply from 4% in the span of 11 days.

Aave price has been one of the best-performing crypto assets for days now. The altcoin has been marking consistent gains and has managed to recover a significant chunk of the losses witnessed over the past few weeks. But these gains seem to be in trouble as they could vanish if investors pull back, which is seemingly the case presently.

Aave price rally might take a break

Aave price has risen by more than 32% in the span of a week, which has added to the already ongoing rally that began on June 16. Since then, the cryptocurrency’s value has grown by over 56%, bringing its trading price to $78 from $50. In just two weeks, the altcoin has made its investors' significant profits as AAVE hit a five-month high today.

AAVE/USD 1-day chart

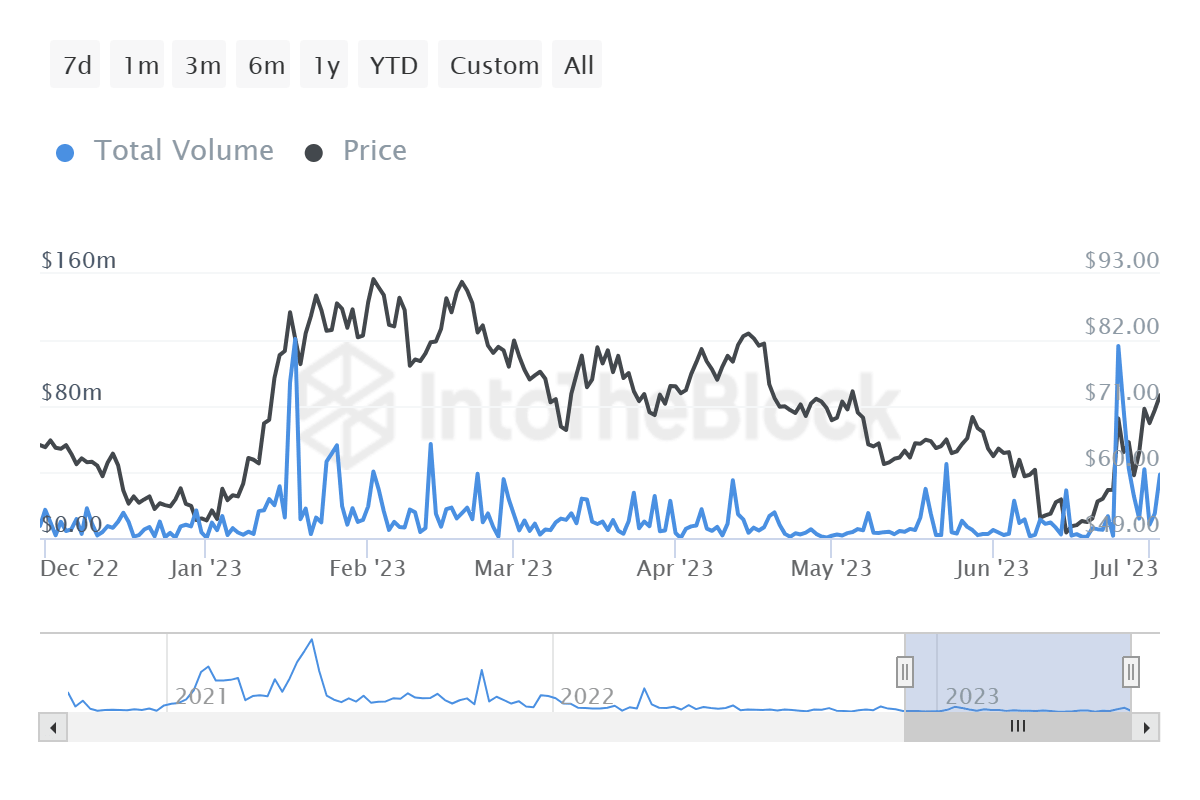

But Aave price now faces the possibility of a decline as investors seem to be taking a break and enjoying their profits. The first and the most important cohort to do this is the whales, whose transactions have seen a 40% drop in just seven days. These addresses were conducting transactions worth over $116 million until a few days ago, the highest since January this year.

AAVE whale transactions

However, at the time of writing, the total value generated by their transactions was a little over $72 million. This volume is also on the verge of declining as whales are likely going to sit tight until either corrections or further gains arrive.

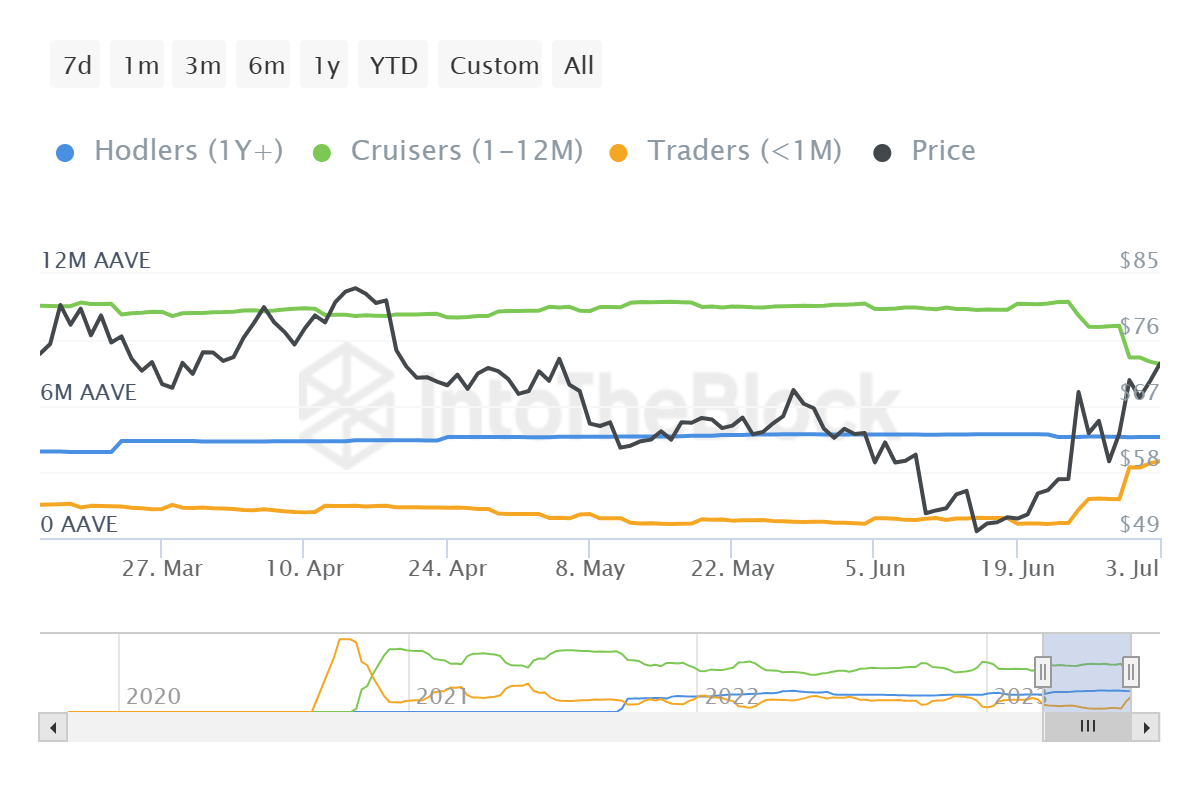

The chances of the latter are lower than the former since retail investors are also acting relatively bearish at the moment. Profit-taking has possibly come into focus, which is why one of the most loyal cohorts has sold its supply. The mid-term holders (investors with AAVE bought between a month and a year) have observed a stark dropoff in their supply.

About 16% of the entire circulating AAVE supply has moved from their addresses to short-term holders. These wallets are known to hold the supply for less than a month, making AAVE more susceptible to selling. As they now own about 21.85% of all AAVE, their actions could significantly impact the price.

AAVE supply distribution

Thus traders looking to accumulate at current price levels should watch their activity, as sudden selling could lead to price falls and unprecedented losses.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.