- Aave is in the middle of a rebranding process as it plans to migrate its token from LEND to AAVE.

- This migration hype has helped Aave defy the crypto market bloodbath.

- IntoTheBlock’s IOMAP shows that LEND currently faces a moderate-to-strong resistance wall at $0.57.

One of the leading lights of the DeFi space, Aave, is an open-source, non-custodial lending protocol. As per DeFi Pulse, its the third largest protocol in the space, with around $1.45 billion locked in. Aave is currently in the middle of a rebranding process as it plans to migrate from its governance token LEND to its new and improved avatar AAVE. The protocol handed over the voting rights to the community to see if they really wanted this change.

Aave Governance is officially on mainnet, giving the decisional power to the community! Now it’s time to vote on the very first Aave Improvement Proposal (AIP) for the token migration from $LEND to $AAVE.

— Aave (@AaveAave) September 25, 2020

Thread on how to vote⬇️

Blog post for details: https://t.co/Z09ajBmb2Y

This changeover allows users to earn income by staking the new AAVE tokens in a reserve via a “Safety Module.” To do this, users need to give up their existing LEND holdings and receive AAVA at a ratio of 100 LEND to 1 AAVE.

The community seems to have overwhelmingly greenlit this migration.

The voting period for AIP1 to migrate from $LEND ➡️ $AAVE has ended, with an overwhelming 'YAE'

— Aave (@AaveAave) October 1, 2020

You can track the countdown to the migration start here: https://t.co/noc4D7wzmG

We will release instructions for migration and staking on Friday, and we are here to help you! https://t.co/xizn3JcPB6 pic.twitter.com/gwrsu3V6lX

The proposal has been approved by 100% of the votes and further announcements are expected this Friday.

The hype surround this migration helped LEND to make some bullish gains following three consecutive bearish days.

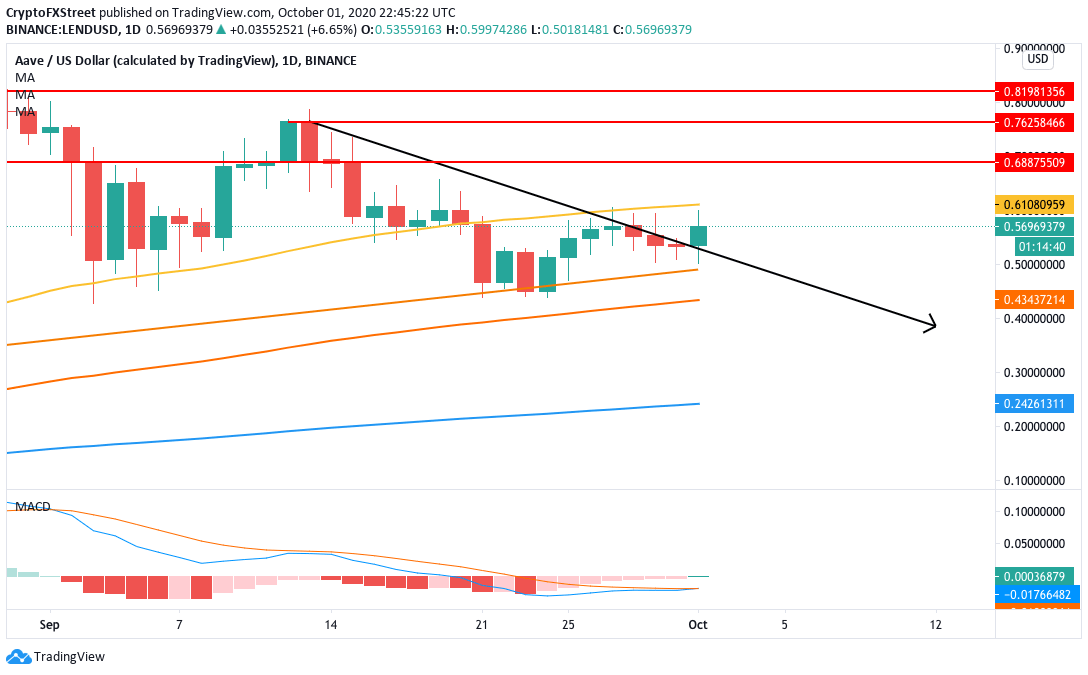

LEND/USD daily chart

LEND/USD went up from $0.53 to $0.56, breaking above the downward trending line in the process. The buyers are now going to aim for the SMA 50 curve ($0.61). The MACD shows that the market momentum is about to reverse from bearish to bullish, which will give the buyers enough firepower to make this move.

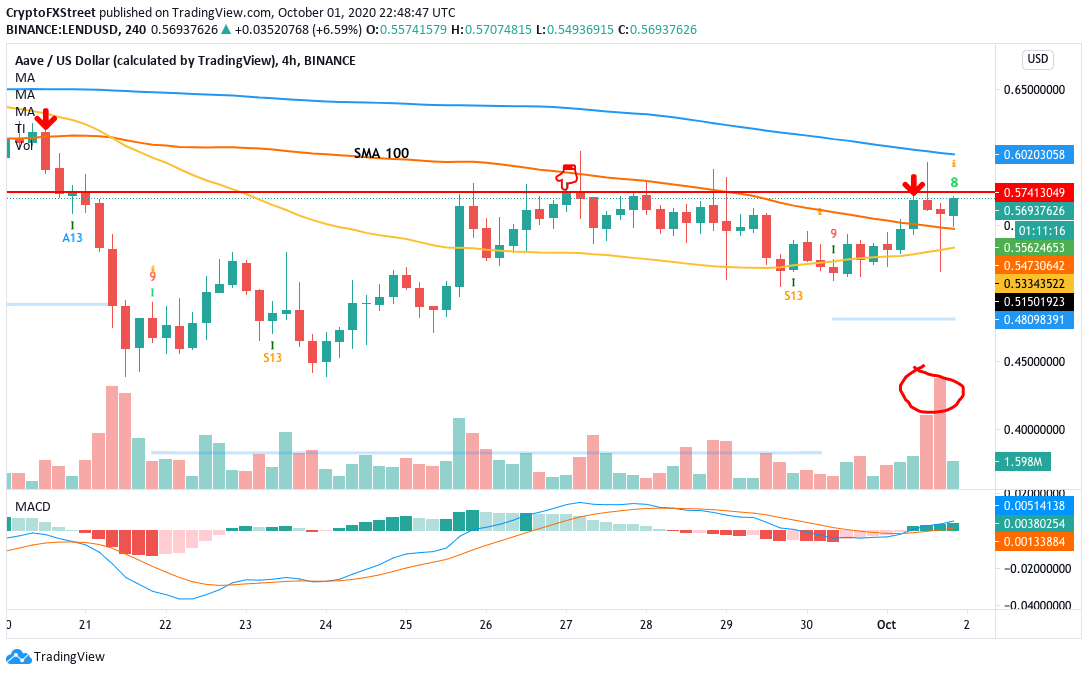

LEND/USD 4-hour chart

In the 4-hour chart, LEND has managed to cross above the SMA 100 curve for the first time since September 20. As of now, the $0.57-level acts as a significant psychological barrier for the DeFi lending protocol in this time-frame. The price is already floundering from selling pressure as it approaches this level, as signified by the two tall bearish volume spikes. On the flip side, if the buyers ride the positive momentum wave and break past the 0.57 resistance level, they should easily reach the SMA 50 curve at $0.60.

However, the TD-sequential indicator can throw a monkey wrench at our bullish thesis. As shown in the chart, the TD will be flashing a sell signal in a little over an hour. However, the SMA 100 should provide healthy support and absorb a tremendous amount of selling pressure in that case.

In fact, to get a better understanding of the potential price movement, let’s take a look at LEND’s IOMAP.

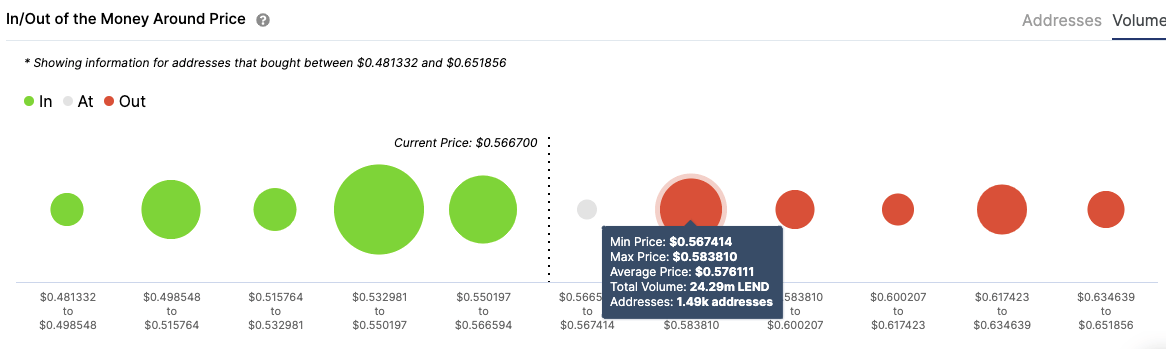

LEND IOMAP

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals there are strong support walls underneath LEND that could absorb a significant amount of selling pressure and keep the price up. The immediate support level lies at $0.55, where previously 1,800 addressed had purchased 31.44 million LEND tokens.

On the upside, we have a moderate-to-strong resistance wall at $0.57 (as previously validated in the 4-hour chart). In this level, nearly 1,490 addresses hand bought roughly 24.29 million LEND tokens. If the buyers break above this level, the next noticeable resistance they will face will be $0.625.

It’s not all sunshine and rainbows

While things look pretty good for Aave right now, there is one worrying indicator that we should definitely take into account.

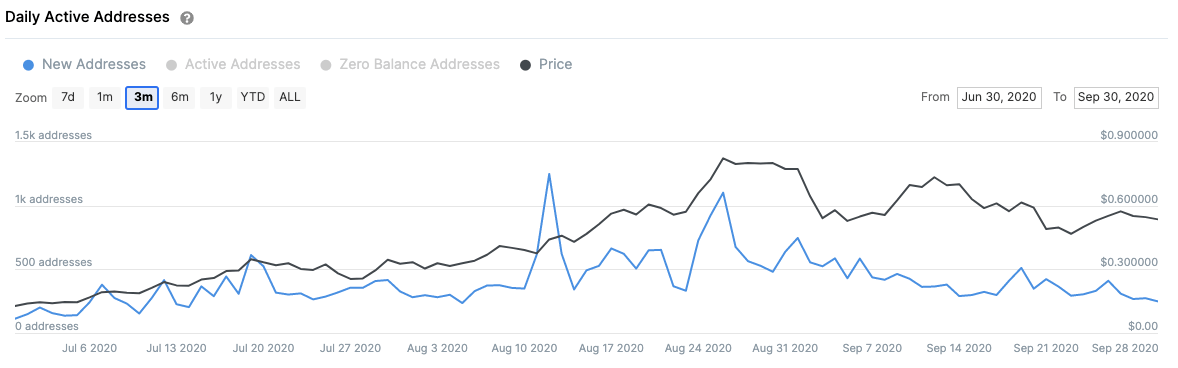

IntoTheBlock’s “Daily Active Addresses” model shows that the number of new addresses created on the Aave network topped-out on August 12 at a high of 1,250 addresses per day, calculated on a 3-month trailing average. Since then, Aave’s network growth has declined by new active addresses per day.

At press time, only 248 new addresses were created based on this trailing average, which can be considered a significant bearish sign for LEND.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.