AAVE price is safe from a potential 40% crash as investors are likely to change their behavior

- AAVE price fell by more than 12% over the past 24 hours to trade at $65.75.

- Over the past couple of weeks, investors have been conducting more transactions in losses than profits, which led to several bouts of selling.

- This selling might come to an end as the MVRV ratio suggests; AAVE is about to enter the “opportunity zone.”

AAVE price seems to have taken a hit from skepticism in the market, which was long in the making. AAVE holders appear to be losing patience, but if this changes, the altcoin would be safe from losing a key support level.

AAVE price downfall can be prevented

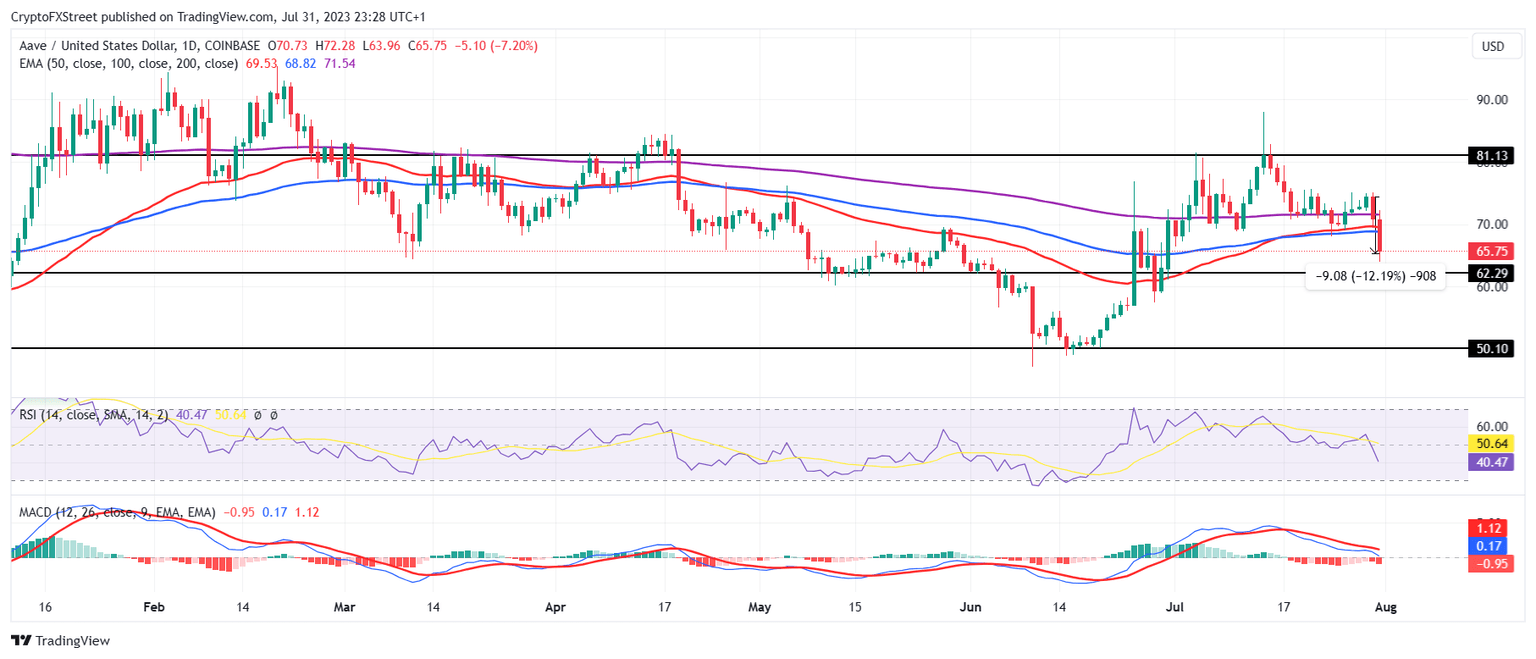

AAVE price is down by 12.19% in the last 24 hours, trading at $65.75, nearing the support level marked at $62.29. This line has been tested multiple times in the past as both support and resistance levels, but falling through it could prove to be catastrophic for the altcoin.

The next key support level below $62.29 lies at the June low of $50.10, and if the cryptocurrency was to slip to this level, it would register a 40% decline from yesterday’s opening price of $74. The indicators surely point towards a decline.

The Relative Strength Index (RSI) fell below the neutral line at 50.0, and a slip below the same suggests waning bullishness, i.e., diminishing chances of recovery. Similarly, the Moving Average Convergence Divergence (MACD) indicator is also observing increasing bearishness as the MACD line (blue) pulled away from crossing over the signal line (red).

AAVE/USD 1-day chart

Investors, too, are exhibiting bearishness; however, in their defense, the last few weeks have borne them nothing but losses. The overall ratio of transactions conducted on the network bearing losses exceeds those in profits, which suggests that AAVE holders weren’t very keen on holding on to their supply.

AAVE transactions in losses

Selling has already been observed in the past few weeks, and further selling would extend AAVE price drawdown. But this could be prevented if investors took a step back and halted their selling. If the selling pressure goes down, the altcoin would be able to find some room to recover as low prices would attract accumulation from investors.

The Market Value to Realized Value (MVRV) ratio indicates the same. The indicator is a measure of the profits and losses of the investors, and at the moment, it is far below the zero line at -10%. Further decline would push the MVRV ratio below 11%, which is known as the opportunity zone.

AAVE MVRV ratio

Historically, every time an asset reaches this area, the price tends to recover as accumulation takes precedence over selling. Should history repeat itself, AAVE price would bounce back after hitting $62.29, preventing a crash of 40% to $50.10.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B03.45.50%2C%252001%2520Aug%2C%25202023%5D-638264434221156557.png&w=1536&q=95)

%2520%5B03.46.46%2C%252001%2520Aug%2C%25202023%5D-638264434427751955.png&w=1536&q=95)