Aave Price Forecast: AAVE ready for the ultimate rally to $80

- Aave could sustain the uptrend to $80 on account of a bull flag and a TD Sequential indicator buy signal.

- The technical perspective appears positive for AAVE, but on-chain metrics hint at a potential reversal.

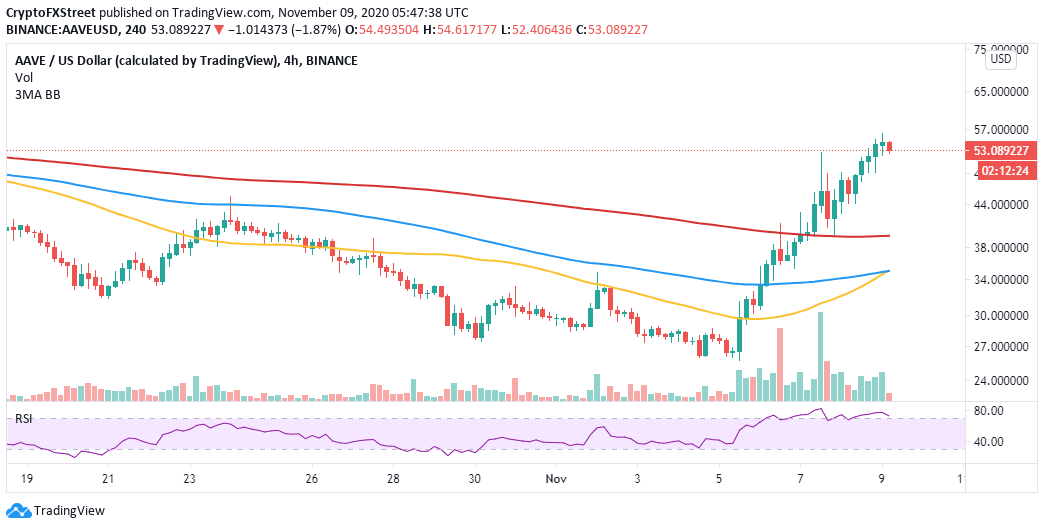

Aave broke down extensively following the migration from LEND. Support established at $26 shifted the bulls’ focus to recovery from seeking a market bottom. The first week of November was yielding for the cryptoasset as it culminated in gains above $50. At the moment, AAVE is doddering at $53 amid the battle to establish higher support before the uptrend resumes.

Aave technicals seem strong enough to sustain the uptrend

The trading in the last seven days was kind to the bulls who joined the market in masses, adding force to the tailwind. The liftoff from the anchor at $26 elevated the decentralized finance (DeFi) token above several vital levels, including the 50 Simple Moving Average, 100 SMA and 200 SMA. Despite the massive buying power, a delay encountered at $56 highlighted the need to established higher support.

AAVE/USD 4-day chart

Simultaneously, a buy signal was recently presented by the TD Sequential indicator on the 3-day chart. The call comes in the form of a red nine candlestick and can validate the bullish outlook. A bull flag pattern in the same timeframe reinforced the bulls’ position in the market, hence the possibility of the uptrend continuing to highs above $80.

AAVE/USD 3-day chart

It is worth noting that Aave has a clear path to $56 (most recent resistance zone). However, IntoTheBlock’s IOMAP model suggests the price action to $80 will not come without struggle based on the robust seller congestion between $55.6 and $56.2. Here, 275 addresses previously bought roughly 4.7 million AAVE.

Aave IOMAP chart

On the downside, support is significantly weak, suggesting that declines may come into the picture in the coming sessions. The initial point of contact in a reversal would be the zone between $50 and $51.6. Here, 879 addresses previously bought approximately 387,000 AAVE. Holding above this zone is very vital; otherwise, losses might extend to $45.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637404989674402285.png&w=1536&q=95)