- Aave token is listed on Coinbase Pro amid growing DeFi popularity.

- The token price is poised for a strong recovery, once the $89 barrier is out of the way.

Aave (AAVE) is the 27th digital asset with a current market capitalization of $1 billion. The native token of the pioneer DeFi protocol focused on decentralized lending bottomed at $70 on December 11 amid the sell-off on the cryptocurrency market and recovered to $85.6 by the time of writing. The coin has gained over 4% in the past 24 hours; however, it is still down 5% on a week-to-week basis.

AAVE comes to Coinbase Pro

The leading US-based cryptocurrency exchanges listed AAVE tokens on Coinbase Pro, the platform focused on professional traders. The head of listings on Coinbase, Zach Segal, announced the news on Twitter, saying that 2020 was the year of DeFi:

It’s been a huge year of growth in #DeFi. Excited to be listing three more DeFi tokens on Coinbase Pro today! https://t.co/UDOliy1Xep

— Zach Segal (@zosegal) December 14, 2020

Currently, users can transfer the coins to their accounts. However, the trading functionality will be unlocked at 9 AM PT on Tuesday, December 15, provided that the token gathers enough liquidity.

Once a sufficient AAVE supply is established on the platform, users will be able to trade the token against BTC and several fiat money, like USD, EUR, and GBP.

The trading functionality will be rolled over in three phases: post-only, limit-only, and full trading.

The upside is the path of least resistance for AAVE

AAVE price hit bottom at $25 on November 5 and has been gaining ground ever since. The price completely recovered from the September-October sell-off and hit a new all-time high at $96.5 on December 3 before the correction started.

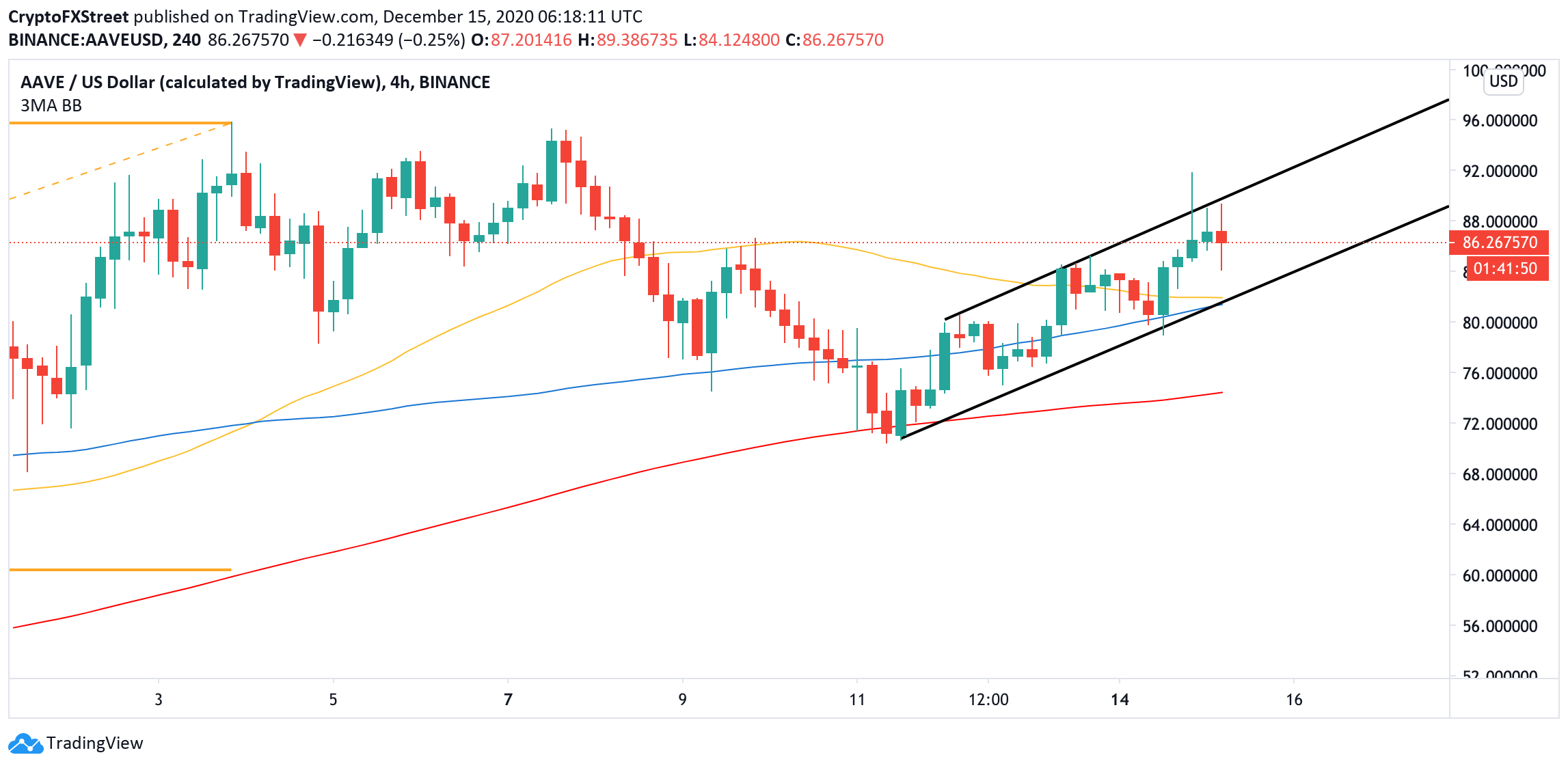

On the intraday charts, AAVE is moving within an upside-looking channel with the channel support at $81. This barrier is reinforced by a combination of 4-hour EMA100 and EMA50. Once it is broken, the sell-off may be extended towards EMA200 on the same timeframe and local bottom of $70 hit o December 11.

AAVE/USD, 4-hour chart

On the upside, the recovery is capped by the upper line of the channel at $89. A sustainable move above this area is needed for the upside to gain traction, with the next focus on $93 followed by the all-time high of $96.5.

%20Analytics%20and%20Charts-637436104859759178.png)

AAVE's In/Out of the Money Around Price data

Meanwhile, the In/Out of the Money Around Price data confirms strong support on the approach to the $81 area. Over 336 addresses purchased over 800,000 coins between $81 and $83.6. If it gives way, the sell-off may continue towards $74.

The way to the north is a bit less cluttered with the resistance areas. The IOMAP cohorts show that there is an insignificant barrier above the current price, with 700 addresses holding only 100,000 coins.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

The crypto market is stuck in the mud

The crypto market has been hovering in a narrow range for the past four days, adding just over 2.5% over the past seven days to $2.72 trillion. These are levels below the 200-day moving average, indicating that the balance of power is now on the sellers' side.

Fintech and crypto firms push for bank licenses under Trump administration

Fintech and crypto firms seek bank charters under Trump, aiming for growth, lower costs, and legitimacy amid expectations of a more business-friendly regulation.

ETH consolidates below $2,000 as Standard Chartered alters its prediction for 2025

Standard Chartered analysts led by Geoffrey Kendrick lowered the bank's expectations for Ethereum's price in 2025. The bank adjusted its latest prediction, reducing Ethereum's 2025 price target from $10,000 to $4,000.

Solana price faces 50-day resistance as SOL futures debut on CME Group with $5M volume on fifth anniversary

Solana (SOL) stagnated around the $128 mark on Monday despite multiple bullish catalysts. The recent SOL unlocks by Alameda Research, ahead of FTX creditor repayments, have created a persistent bearish overhang since early March.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.