Aave Price Analysis: AAVE technicals turn bearish, as declines to $70 linger

- AAVE large volume holders remain optimistic despite the recent correction from $95.

- A break under the descending channel’s boundary will add credibility to the downtrend eyeing $70.

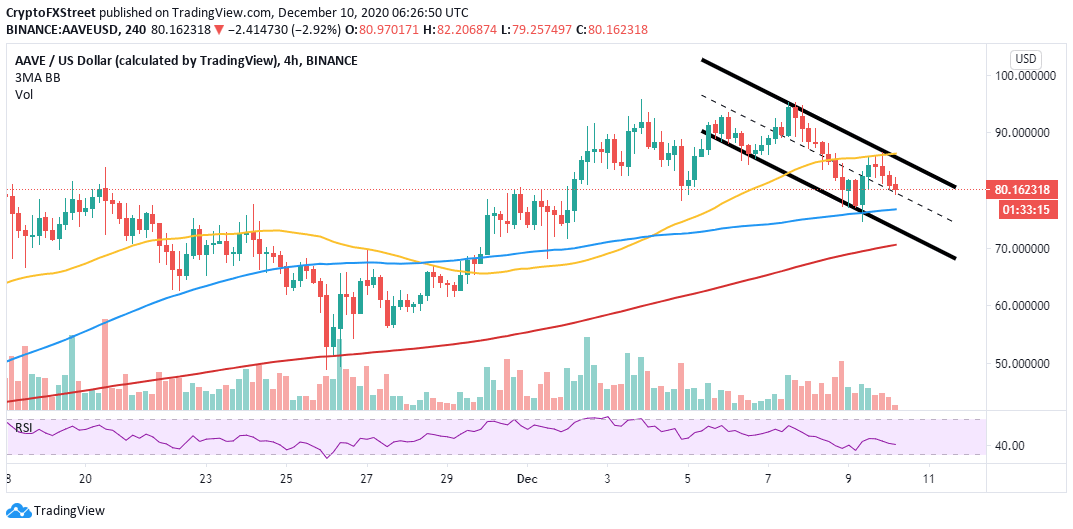

Aave recently resumed the downtrend, sabotaging an anticipated recovery, targeting $80. A descending parallel channel has also come into the picture, suggesting that declines may continue in the near term.

AAVE downward momentum intensifies

The decentralized finance (DeFi) token made a considerable rebound following the losses incurred earlier this week. A December high at $95 created a barrier, which cut short the rally to price levels above $100.

AAVE is trading at $79 when writing in the wake of a rejection suffered at the 50 Simple Moving Average. The bulls’ main aim is to keep the price above the channel’s middle boundary. However, more losses will be confirmed if AAVE closed the day under $80.

On the downside, the 100 SMA is in line to prevent the token from falling sharply. The 200 SMA at $70 seems like the most robust support level. It would come in handy if AAVE/USD dived under the descending channel. The Relative Strength Index adds credibility to the bearish narrative as it slopes toward the oversold area.

AAVE/USD 4-hour chart

AAVE investor sentiment remains unchanged

Despite the overhead pressure on AAVE, investors are choosing to stick with the project. Santiment’s holder distribution highlights an increase in the number of addresses holding between 100,000 to 1 million AAVE. The large volume holders have grown from 452 at the beginning of December to 456 on December 10.

AAVE holder distribution

In other words, the whales in this cryptocurrency project seem not to worry about the retracement in price. Moreover, it shows that they are willing to wait because they believe a rebound could occur anytime from now.

Altcoin Sherpa, a renowned altcoins bull, reckons that AAVE “is a blue-chip DeFi project” that is worth holding even when the price is going down. He added via a message on Twitter that he would be increasing exposure with every dip Aave makes.

The trader’s remarks are bold but help to point out that the sentiment surrounding AAVE is positive. Various people have agreed with him on the statement, saying that they will consider increasing their stakes in the DeFi token.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B09.45.29%2C%252010%2520Dec%2C%25202020%5D-637431809484681430.png&w=1536&q=95)