U.S. Federal Reserve Chairman Jerome Powell suggested a series of interest-rate increases that might be higher than the usual 0.25 percentage point.

Good morning. Here’s what’s happening:

Prices: Bitcoin retreats from $42K as Fed Chair Jerome Powell suggests that "front-end loading" might be the plan for U.S. monetary policy makers as they hike interest rates.

Insights: Listed crypto companies' share prices have underperformed bitcoin (BTC) price moves.

Technician's take: BTC is holding support, similar to what occurred in late March before a 16% price rise.

Prices

Bitcoin (BTC): $40,745

Ether (ETH): $3,004

op Gainers

There are no gainers in CoinDesk 20 today.

Top Losers

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| EOS | EOS | −11.0% | Smart Contract Platform |

| Solana | SOL | −5.1% | Smart Contract Platform |

| Litecoin | LTC | −4.4% | Currency |

Bitcoin retreats after touching $42K

"Front-end loading" sounds like the early phase of a construction project, and that's the phrase Federal Reserve Chair Jerome Powell used Thursday to describe a possible strategy by the U.S. central bank to tamp down inflation running at a four-decade high.

The idea is that the Fed might enact a series of steep interest-rate increases – say 0.5 percentage point per meeting, versus the more typical 0.25 percentage point – to make sure consumer prices don't spiral out of control.

“We’re really going to be raising rates and getting expeditiously to levels that are more neutral and then that are actually tight,” Powell said on a panel alongside European Central Bank President Christine Lagarde, arranged by the International Monetary Fund (IMF).

The risk is that higher borrowing costs crimp spending and investment and the economy slides into a recession.

Bitcoin is seen by many investors as an inflation hedge, and it's also seen as a risky asset that might come under pressure during a period of shrinking economic growth. So Powell's hawkish tone was enough to send bitcoin's price lower – just as the largest cryptocurrency appeared to be gaining steam.

The price reached a 10-day high, nearly touching $43,000, but then slid back toward $40,000, erasing recent days' gains.

"Bitcoin price action has continued to whipsaw between a wider range of $38-$47,000,” Tammy Da Costa, analyst at DailyFX, told CoinDesk's Angelique Chen.

U.S. stocks ended the day lower, and U.S. Treasury yields rose.

Markets

S&P 500: -1.5%

DJIA: -0.8%

Nasdaq: -2.1%

Gold: $1,953, -0.1%

Insights

One Year After Coinbase’s IPO, Most Listed Crypto Companies Are Underwater

The last quarter of 2020 was an exciting time. Bitcoin seemed meteoric, given the new institutional interest in the asset class. Coinbase Global (COIN) filed preliminary paperwork with the SEC for a listing, and soon after, pre-IPO contracts were trading on FTX that valued the company close to $75 billion.

But just over a year since its IPO, Coinbase’s stock is down nearly 55%, underperforming bitcoin, which is down around 26% for the same time period (to be sure, many tech stocks are also down for this same period), as investors’ appetite for listed crypto companies seems to have waned.

In a note published last year, Singapore’s QCP Capital wrote that investors were no longer assigning a strong premium to licenses and regulatory friendliness like they once did, which would in turn put pressure on Coinbase’s stock.

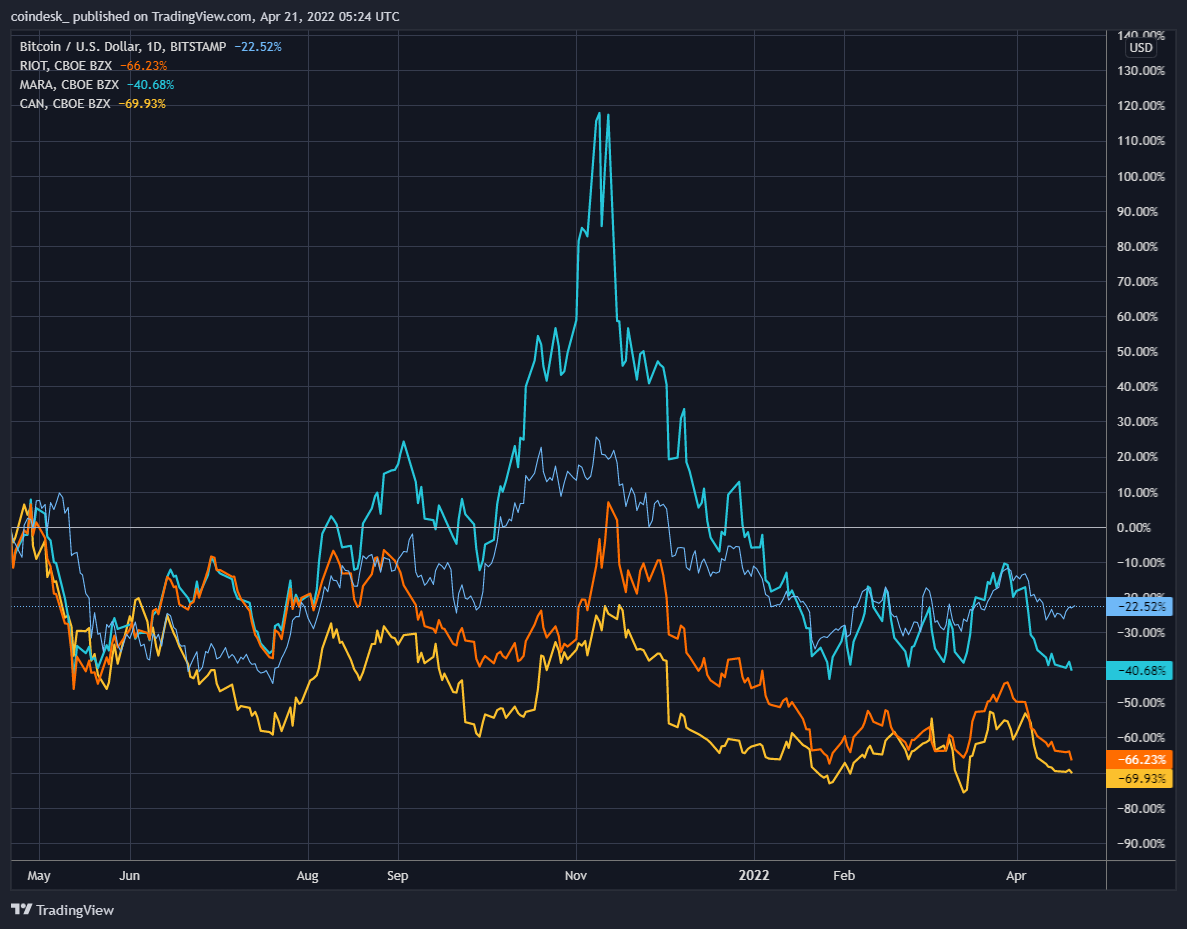

(TradingView)

“That premium has been on the pretext that it would give them a free pass while governmental agencies took their war on crypto to other platforms and exchanges instead, like Binance,” QCP wrote at the time. “If now, a regulated U.S. entity who is offering a product that is already being offered in the U.S., going through the proper legal route, can face such harsh action, then nobody is assured to be safe anymore.”

Coinbase’s regulatory compliance and U.S. base also keeps it out of some of the more interesting parts of crypto like lending. It also meant that Coinbase had a slow start in the derivatives market, which overtook the spot market for the first time in June 2021, behind many of its non-US-based rivals, likely turning investors away from its stock.

Hong Kong’s BC Technology Group, which runs the institutional-focused digital assets platform OSL, has seen a similar fate with its stock. Although it had a brief rally after positive earnings, the stock is down nearly 66% over the last year.

Mining stocks aren’t fairing much better. RIOT Blockchain, which operates bitcoin mining farms throughout the U.S., is down nearly 66% over the last year while Marathon Digital, another miner, is down 40%. Canaan, a manufacturer of mining equipment, is down nearly 70%.

Michael Del Grosso, an analyst at Compass Point Research who covers miners, explains this poor performance by saying in a previous CoinDesk interview “Mining stocks currently are leveraged plays on the price of bitcoin.”

These mining stocks had their moment when China ordered operations shut in-country and the global hash rate was in flux. But as that sorted itself out and bitcoin flirted with all-time highs yet couldn’t sustain itself, the stocks sank like rocks.

Currently, Compass Point maintains a neutral rating on Riot Blockchain.

This begs the question, are there any listed crypto companies that are actually above the water line?

Indeed there are: crypto banks like Silvergate Capital and Signature Bank.

(TradingView)

Both of these banks, which provide banking services to crypto exchanges, have managed to outperform bitcoin over the last year. Given that they are tied to exchanges, their value is based upon the volume of transactions on an exchange.

And volume is maintained at a brisk pace, as is demand for other tools Silvergate provides, like Leverage.

So perhaps the problem with these listed companies isn’t a market hostility to listed crypto companies, but rather that the market needs more than them just being a proxy for the price of bitcoin.

Technician's take

Bitcoin (BTC) generated a positive momentum signal on the daily price chart, similar to what occurred in late March. That suggests buyers could remain active toward the $46,700 resistance level.

The cryptocurrency is up 4% over the past week.

The relative strength index (RSI) on the four-hour chart is declining from overbought levels, which typically occurs during a brief pullback in price. Still, support at $40,000 could maintain BTC's recovery phase.

Initial resistance is seen at $42,400, where sellers were active earlier in the New York trading day. On the daily chart, however, the RSI is rising from oversold levels with stronger momentum, indicating a rise in bullish sentiment.

Important events

8:30 a.m. HKT/SGT(12:30 a.m. UTC): Japan: Jibun Bank Manufacturing PMI(Apr) PREL; Jibun Bank Services PMI(Apr) PREL

3:15 p.m. HKT/SGT(7:15 a.m. UTC): S&P Global Composite PMI(Apr) PREL

9 p.m. HKT/SGT(1 p.m. UTC): International Monetary Fund Press Briefing: Regional Economic Outlook for Europe, April 2022

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.