A few hours away from Ethereum 2.0 launch, here is everything you need to know

- Ethereum's update is necessary to keep up with the growing users' demands.

- ETH 2.0 will make the network more secure and scalable.

- The rollout will occur in three steps and it will take two years to complete the process.

- A new improvement proposal will allow merging ETH 1.0 into Beacon Chain.

The Ethereum network came to life five years ago. Since that time, the project conceived as the world's computer has grown into the second-largest blockchain with tens of thousands of applications built on top of it. It has become a home for a burgeoning altcoin universe, a primary place of all major stablecoins activity, and a starting point for a decentralized financial system.

The network is now on the threshold of revolutionary changes that will make it even better and more suitable to satisfy the growing needs of the cryptocurrency community.

On December 1, Ethereum developers will mine the genesis block of Ethereum 2.0's Beacon Chain, turning a new page in the blockchain's history.

The upcoming event inspired ETH bulls worldwide and set the stage for a massive ETH price increase. ETH/USD jumped by over 20% in less than four days and hit a new multi-year high of $623. However, what's this hype is all about and why this milestone is so crucial for Ethereum users and the project itself?

The project is ripe for the changes

Ethereum is based on distributed ledger technology. However, unlike Bitcoin, it was not perceived as a peer-to-peer payment system. The main idea behind the project is to create an infrastructure of a virtual machine, the distributed computer that will allow users to execute code or store data.

The concept translated into a smart contracts technology that allows processing trustless transactions without third-party interference. Basically, smart contracts are pieces of code executed automatically when certain conditions are met. The transactions performed by smart contracts are validated by numerous computers scattered around the world, meaning that it is impossible to cheat or falsify the outcome.

The idea quickly gained popularity and morphed into a new trend of decentralized finance applications. However, popularity comes with a cost. Users have to pay gas – the amount of ETH tokens charged as a payment for the transaction being processed and validated on the blockchain.

As more and more users joined the blockchain and deployed their apps on it, the network became overloaded, resulting in painfully slow transaction rates and galloping transaction fees. In some cases, users had to pay thousands of dollars in gas for a transaction.

Currently, ETH is only capable of processing 35 transactions per second, while the lack of scalability makes its usage unpractical and, in some cases, too expensive. Ethereum 2.0 is set to solve these issues bringing the world's decentralized financial infrastructure to a new level.

What is Ethereum 2.0?

Ethereum 2.0 is a major network upgrade aimed at improving ETH scalability, making it more secure and efficient in terms of energy consumption without sacrificing decentralization of accessibility features. Apart from that, the new version will alter Ethereum's monetary policy, reducing its annual inflation to 1% and mining algorithm from Proof of Work (PoW) to Proof of Stake (PoS).

Ethereum 2.0 will become a unique self-sustaining financial ecosystem with an option to earn passive income for ETH holders who are willing to lock in their Ethereum tokens to validate blocks for rewards. ETH developers hope this solution will allow to increase the network speed and make it more efficient.

When will the transition take place?

As FXStreet previously discussed, a migration to a new protocol is a complicated process. Many things need to be taken into account to ensure a smooth transition for all network participants. To avoid major issues and ensure that the ecosystem does not collapse if something goes wrong, the developers chose a step-by-step approach.

In a recent "Ask Me Anything" (AMA) session, Vitalik Buterin mentioned that the transformation might take at least two years. Also, he outlined the three phases of the process:

A quick recap of the short and medium term of Ethereum scaling.

— vitalik.eth (@VitalikButerin) October 5, 2020

TLDR:

1. Ultra-high scaling with sharding + rollups will be possible *in phase 1*

2. Sharding is NOT "cancelled"

3. Get on a rollup asap; you get 100x scaling even without eth2 pic.twitter.com/fXW0Q3iAxu

Phase 0 already started on November 1, when the developers launched the deposit smart contracts to attract the first 16,384 validators and 524,288 ETH staked initially required to kickstart the rollout.

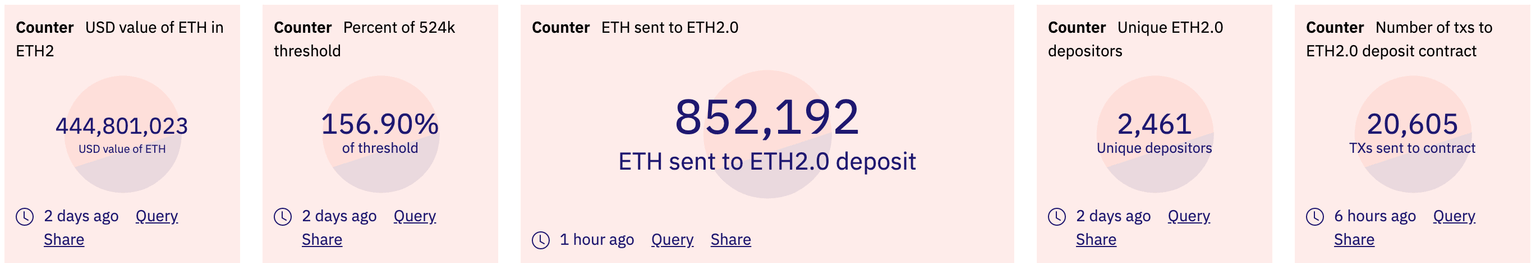

At the time of writing, a deposit contact tied to Ethereum's new Proof of Stake chain contains over 852,000 ETH obtained from over 2,000 unique depositors, meaning that the team gathered 157% of the required amount and is now ready to launch Phase 0.

ETH 2.0 deposits data

Phase 0, known as the Beacon Chain, will work as a coordination stage and it won't change anything about the current usage on the Ethereum blockchain. The Beacon Chain will coordinate the expanded network of shards and stakers, laying the ground for a secure, sustainable and scalable Ethereum blockchain.

Phase 1, known as Shard Chains, is scheduled for launch somewhere in 2021. The technology realized in this phase will improve Ethereum's scalability and capacity. Apart from that, Shard chains will spread the network's load across 64 new chains, making it easier to run a node with low hardware requirements.

Phase 2, or the Docking Mainnet, will occur in 2022 and eventually dock the existing Ethereum mainnet with ETH 2.0 upgrades rolled out during the previous stages. Basically, ETH 1.0 mainnet will be merged with ETH 2.0 beacon chain and sharding system and mark the full transition to proof of stake.

How to speed up the process

As a two-year period sounds like a whole lot in our fast-changing world, ETH developer Mikhail Kalinin submitted a proposal that will allow the Beacon Chain to interact with the Ethereum 1.0 blockchain.

According to the proposal titled "Executable Beacon Chain," the developer suggests rethinking the idea of keeping the original Proof-of-Work blockchain operating in a dedicated shard. He wants to simplify and speed up the whole transition process by embedding ETH 1.0 data directly into Beacon Chain's blocks.

He wrote:

We propose to get rid of this complexity by embedding eth1 data (transactions, state root, etc.) into beacon blocks and obligating beacon proposers to produce executable eth1 data. This enshrines eth1 execution and validity as a first-class citizen at the core of the consensus.

Vitalik Buterin has already praised the idea, calling it an excellent ongoing work on the merge.

Excellent ongoing work from @mkalinin2 on "the merge" (folding the existing ethereum system into eth2 to retire the PoW chain and fully enable withdrawals). This line of R&D is increasingly being prioritized and done in parallel to sharding and other eth2 improvements. https://t.co/OaGE9jPNkP

— vitalik.eth (@VitalikButerin) November 27, 2020

If the proposal is approved, Ethereum 2.0 may become a reality sooner than expected, opening the way to a whole new world of decentralized applications.

Author

Tanya Abrosimova

Independent Analyst