A bull case for why MATIC price will explode to $2

- MATIC price shows signs of continuing the uptrend if the $1.63 and $1.53 support levels hold.

- Transaction data shows moderate resistance levels present between bulls’ paths to $2 or higher.

- A daily candlestick close below $1.53 will invalidate the bullish thesis for Polygon.

MATIC price looks ready for another leg up as it moves above a crucial resistance barrier. This development with Polygon shows that more gains await for patient holders.

MATIC price awaits higher highs

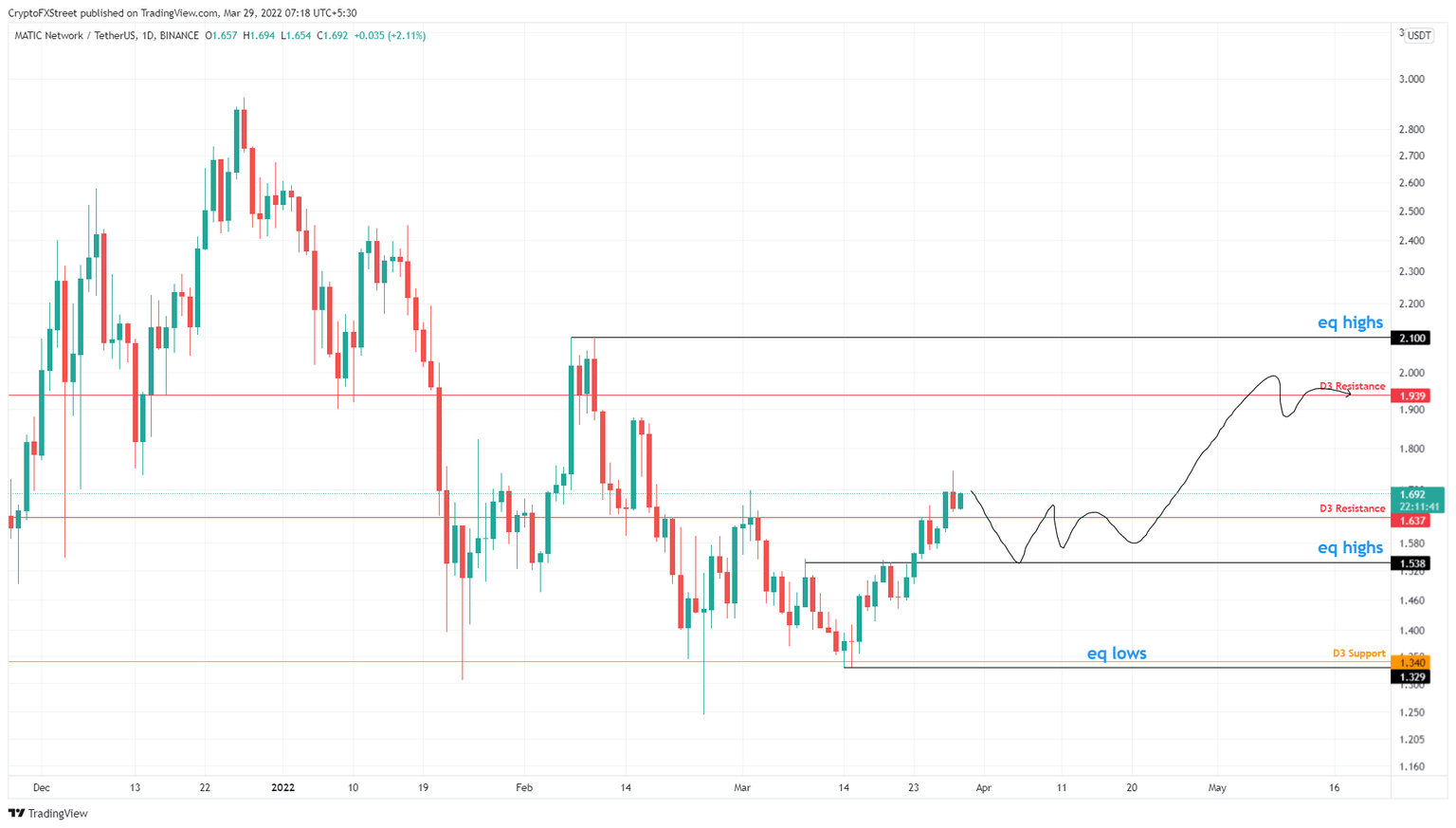

MATIC price rallied 31% after bouncing off the three-day support level at $1.34 on March 15. The resulting upswing shattered through the equal highs at $1.53 and pushed past the three-day resistance barrier at $1.63.

Although Polygon is facing a minor slowdown, it is necessary for bulls to recuperate for the next leg-up. As long as the MATIC price holds above the $1.53 support level, there is a good chance for the next leg-up to be explosive.

The first hurdle that MATIC price will face is the $1.93 resistance barrier; clearing this blockade will allow bulls to retest the $2 psychological level and the equal highs formed at $2.10. In total, this move would constitute a 30% gain from $1.63.

MATIC/USDT 1-day chart

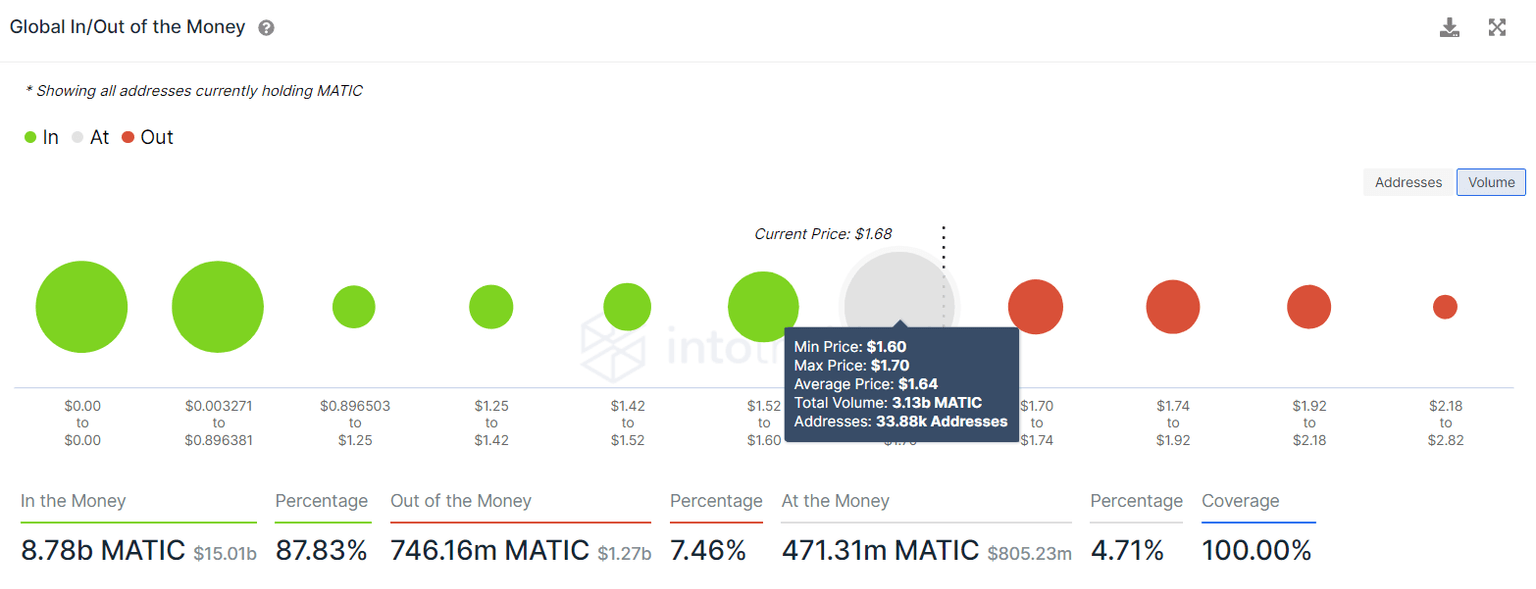

As detailed above, MATIC price needs to hold above the $1.53 support level for an explosive move and the IntoTheBlock’s Global In/Out of the Money (GIOM) model also reveals something similar.

The transaction data shows that roughly 3.13 billion MATIC tokens were purchased between 1.60 and $1.70. Therefore, a decisive move below $1.53 will put these investors “Out of the Money” and potentially trigger a panic sell.

Moreover, the clusters of underwater investors present at $1.72 and $1.83 are relatively weak and will likely be overcome with a quick surge in buying pressure.

MATIC GIOM

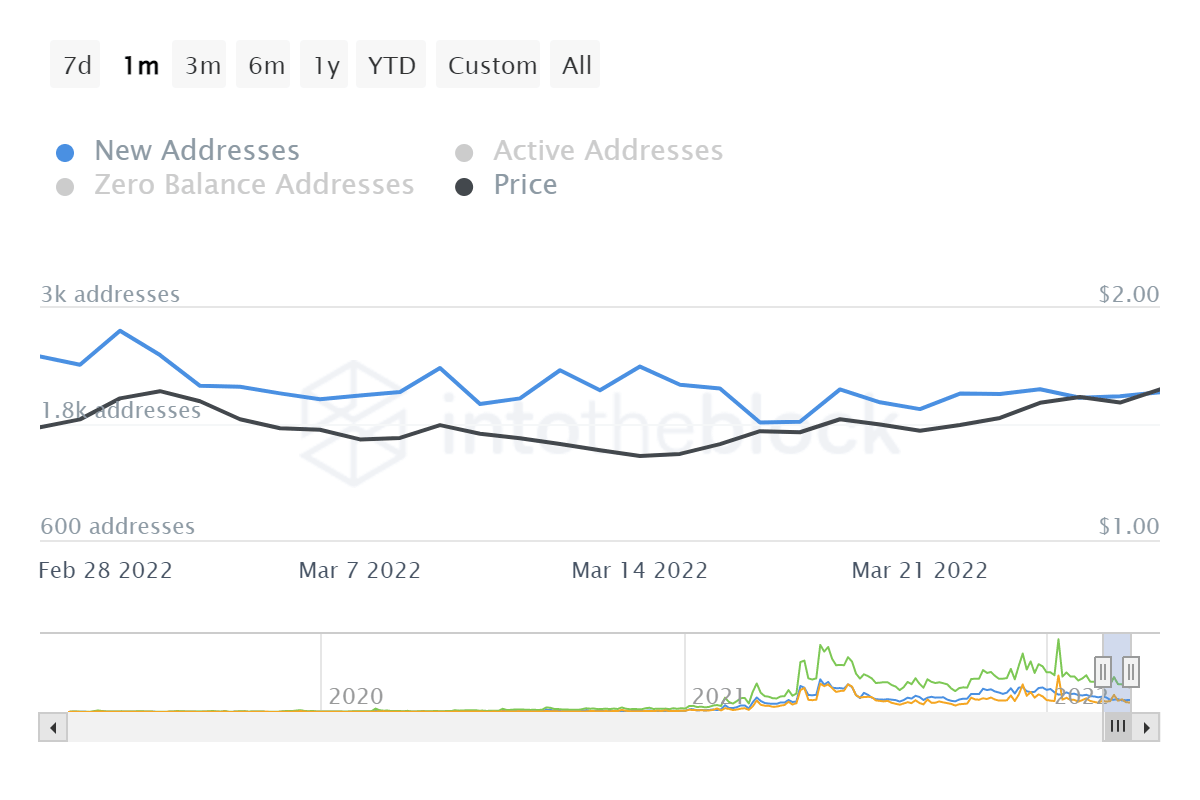

Although the number of new active addresses has progressed from 2,500 to 2,130, which is a relatively small decline over the past month. Hence, the on-chain metrics for MATIC price do not point to a factor that could ruin the run-up to $2 or higher.

The new addresses joining the network show that investors are interested in Polygon at the current price levels. So, the upswing outlook makes sense from both an on-chain and technical perspective.

MATIC new addresses

While things are looking up for MATIC price, the optimism is contingent on bulls holding above the $1.53 support level. A decisive daily candlestick close below this level will produce a lower low and invalidate the bullish thesis. In such a case, Polygon could revisit $1.46 before establishing a directional bias.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.