99% of AVAX holders are in loss ahead of nearly $100 million token unlock

- Avalanche token holders whose investment is profitable have reached an all-time low.

- Nearly 99.5% of all AVAX holders are sitting on unrealized losses.

- The AVAX team is set to release 9.54 million tokens, worth upwards of $97 million, on August 26.

- AVAX price nosedived nearly 22% within two weeks of an earlier token unlock event, so traders expect a repeat performance.

Avalanche (AVAX) price has dropped from its mid-July peak of $15.94 to $10.19 at the time of writing. The decline in the token of the smart contract platform can be attributed to the upcoming token unlock event and a massive drop in the percentage of AVAX holders sitting on unrealized profits.

The previous token unlock event increased the selling pressure on AVAX and sent the token to its June 10 low of $10.04. Nearly 21.82% was shaved off from the token’s price within the two weeks following the May 28 unlock. A similar impact is likely expected from Saturday’s AVAX token unlock.

Also read: Optimism Whales scoop OP tokens ahead of Ethereum Cancun upgrade

AVAX holders in profit declines to all-time low

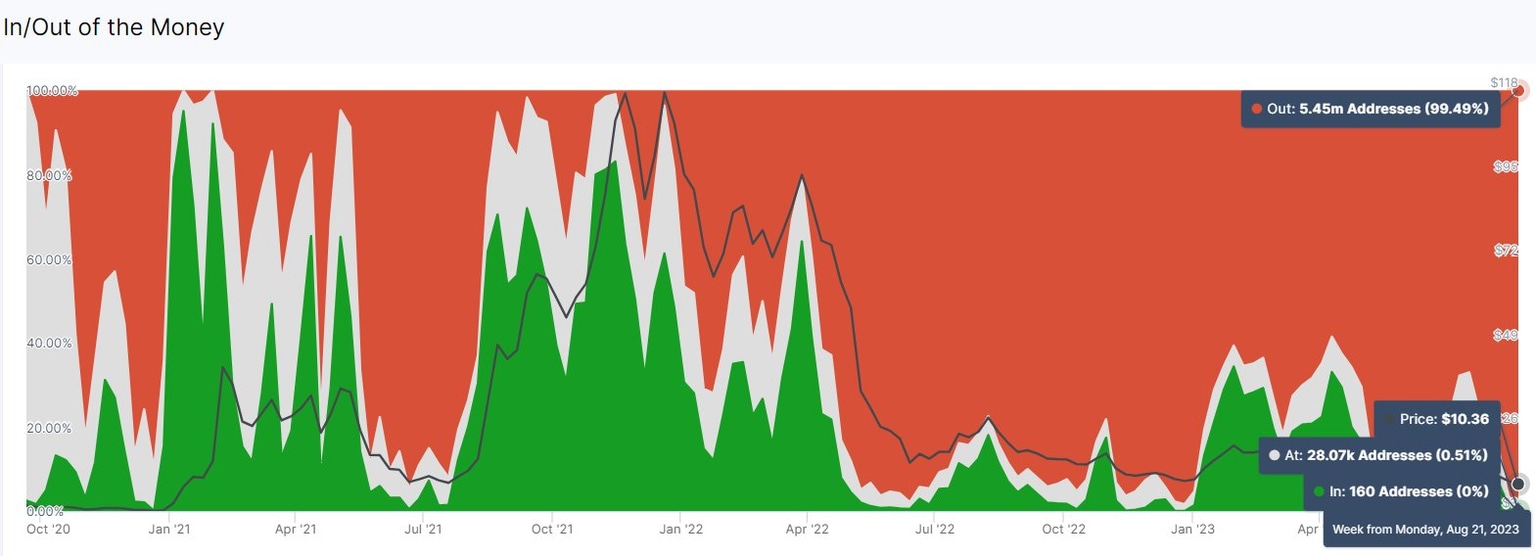

Based on data from crypto intelligence tracker IntoTheBlock, the percentage of AVAX holders in profit has taken a massive hit. For the week starting Monday, August 21, 99.49% AVAX holders are “out of the money” or sitting on unrealized losses, 0.51% are at break-even and a mere 160 addresses are sitting on unrealized profits.

On-chain analysts at IntoTheBlock note that AVAX price has witnessed similar price levels before – in June and December 2022. However, this marks the first time that nearly all AVAX holders are holding the DeFi token at a loss.

In/Out of the Money chart from IntoTheBlock

A key event for Avalanche this week is the token unlock scheduled for this Saturday, August 26. Nearly 2.77% of the token’s circulating supply, 9.54 million AVAX tokens will be unlocked in less than three days, according to data from token.unlocks.app.

The previous event on May 28 unlocked a similar percentage of the token’s circulating supply. In response to the unlock, AVAX price dropped 22% in under two weeks. AVAX price dropped from $14.89 on May 28 to $11.66 on June 12 and hit its June low of $10.04 on June 12.

AVAX token unlock on May 28 and the upcoming event for Aug 26

If the trend repeats, which is likely due to a similar volume of tokens and distribution, AVAX price could plummet lower. At the time of writing, AVAX price trades at $10.20. Avalanche’s token is likely to breach its June 12 low of $10.04 and drop to levels previously seen in 2021 of roughly $9.84.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.