88,000 Bitcoin options are set to expire this Friday: What does it mean for BTC

- The bitcoin options market is bullish ahead of the expiration this Friday.

- The expiration of the derivatives may have a limited impact on spot prices.

The volatile start of that week that saw Bitcoins sell-off from nearly $11,000 to $10,000 in a matter of hours may have an even more turbulent ending. According to the Skew, provider of data for Bitcoin and Ether derivative, 88,000 Bitcoin options contracts are set to expire on Friday, September 25.

#bitcoin options total open interest briefly reclaiming all-time-high before blockbuster expiry Friday of 88k options pic.twitter.com/tWPsSgjX0a

— skew (@skewdotcom) September 23, 2020

An option is a complex financial instrument that allows holders to sell or buy the underlying asset at a specific price (strike) at the expiration date. When it comes to the cryptocurrency market, options traders do not have to purchase or hold real coins; however, they often manipulate the spot prices towards their strike, creating large price swings ahead of the expiration.

Currently, over $100 million worth of BTC contracts trades every day across all exchanges - Deribit, Okex, Ledgerx, CME Group, Huobi, Bakkt, and Bit.com. It is more than half the total Bitcoin's market capitalization and three times as much as the daily average trading volume on the spot market.

The secret weapon

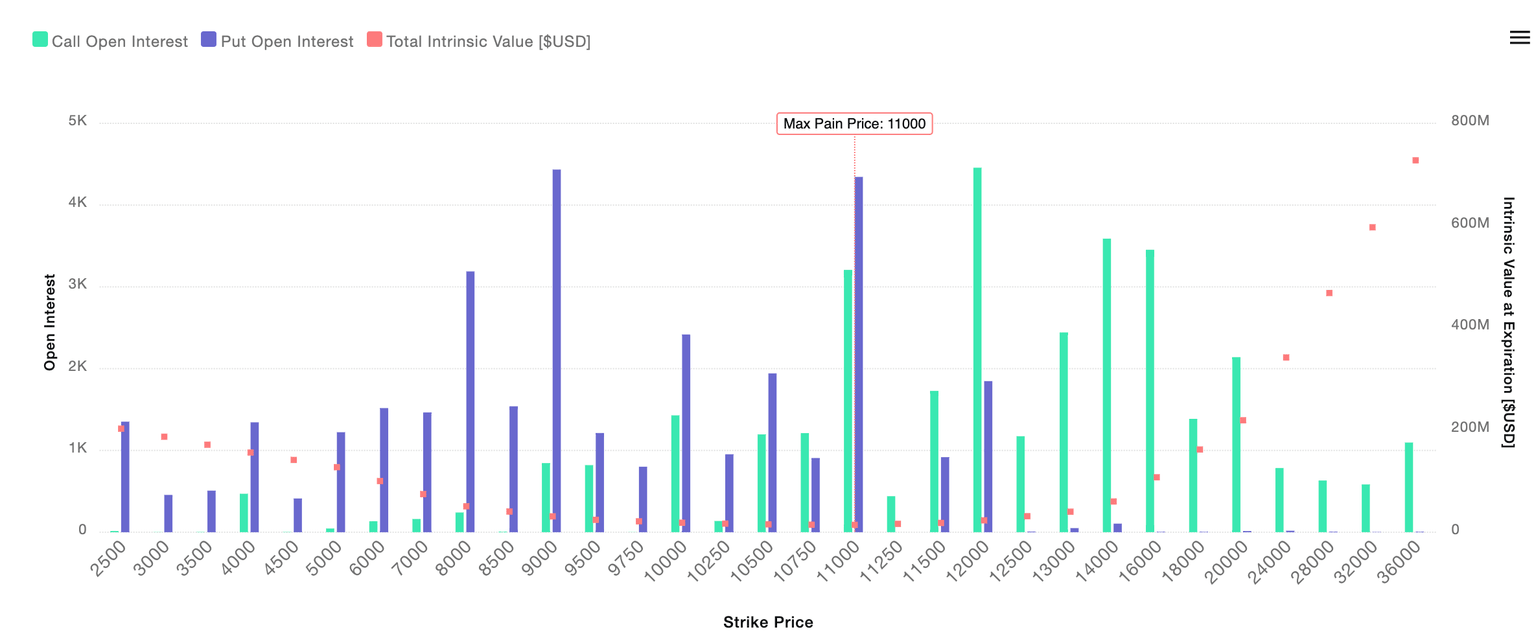

A closer look at the Bitcoin options stats reveals a somewhat bullish picture. According to the options market analytics provider Coinoptinstrack, call options are leading puts on the expiration date, which is a bullish setup. Meanwhile, the maximum put strike is $11,000, and a max call strike is $12,000, both above the current price.

Strike prices on September 25

Source: Coinoptinstrack

Basically, it means that some traders ignored the rule of a thumb that September is a bad month for Bitcoin and bet on the further price increase. The optimism might have been inspired by a Bitcoin's move above $11,000 on September 19.

Call options give the buyer a right to purchase BTC at a fixed price upon the expiry. Meanwhile, put options protect them from the price drops as they provide them with the right to sell the underlying asset at a specific price. The buyers of the options pay a premium to the sellers, influenced by the current sentiments.

If the market leans to the bullish side, the premium on call (buy) options increases and pushes the delta skew into the negative territory. On the other hand, bearish sentiments are accompanied by a larger premium on put (sell) options and a positive delta skew.

BTC 3-month options 25% delta skew

Source: Skew.com

The chart above shows that the skew indicator is below -10%, which is often considered a bullish signal.

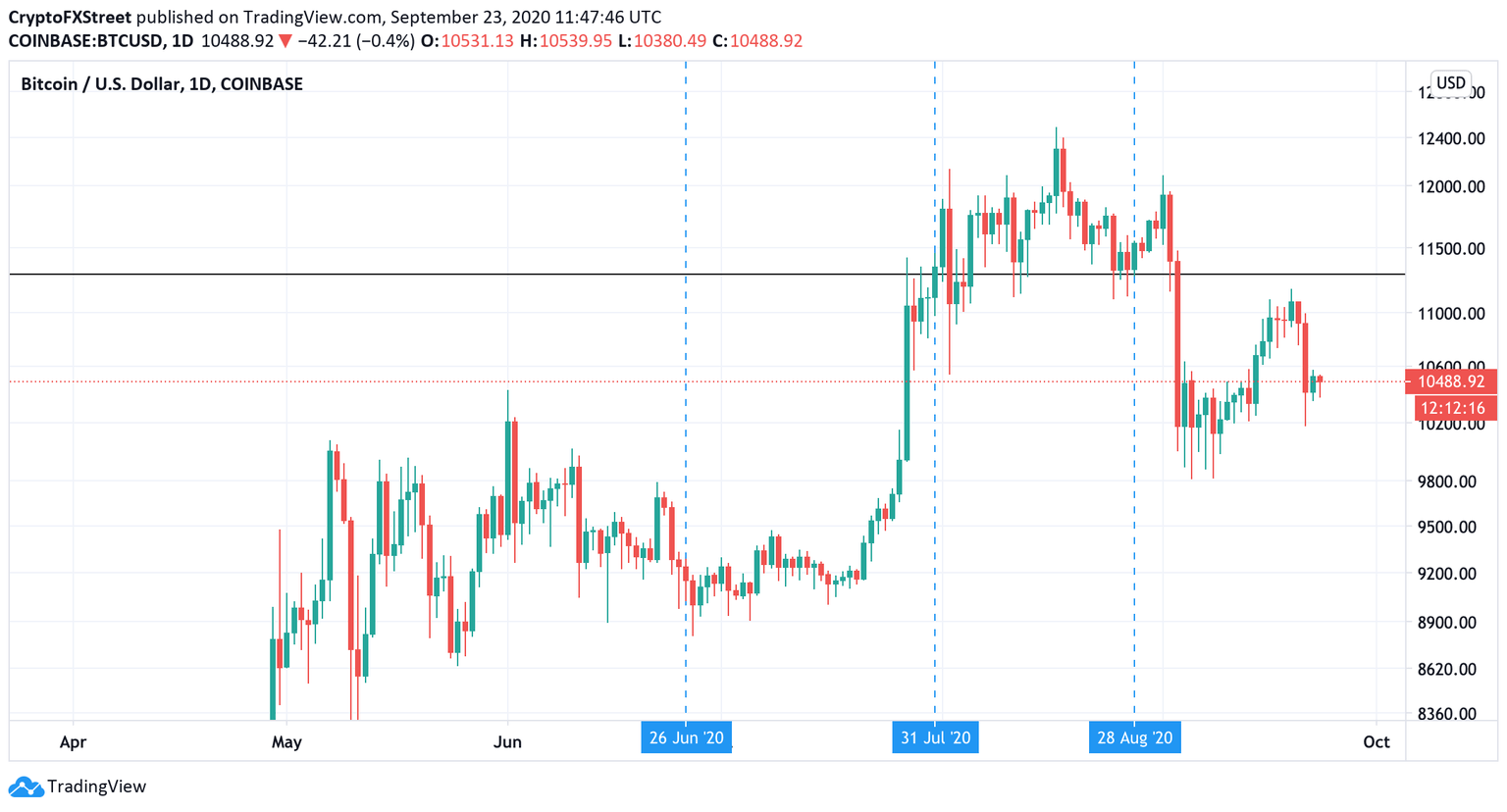

On the spot

The spot market may be vulnerable to high volatility caused by the upcoming expiration date on futures and options markets. However, the history of the previous three expirations shows that these instruments' impact on the spot prices may be exaggerated. The intraday range on all three occasions did not exceed $300.

BTC/USD daily chart

At the time of writing, BTC/USD is changing hands at $10,500. The coin has barely changed both on a day-to-day basis and since the beginning of Wednesday as the market is paralyzed by the growing uncertainty on the global markets. As we have explained recently, Bitcoin may be vulnerable to the short-term losses ahead of the US presidential elections, even though the options market tells a different story.

Author

Tanya Abrosimova

Independent Analyst