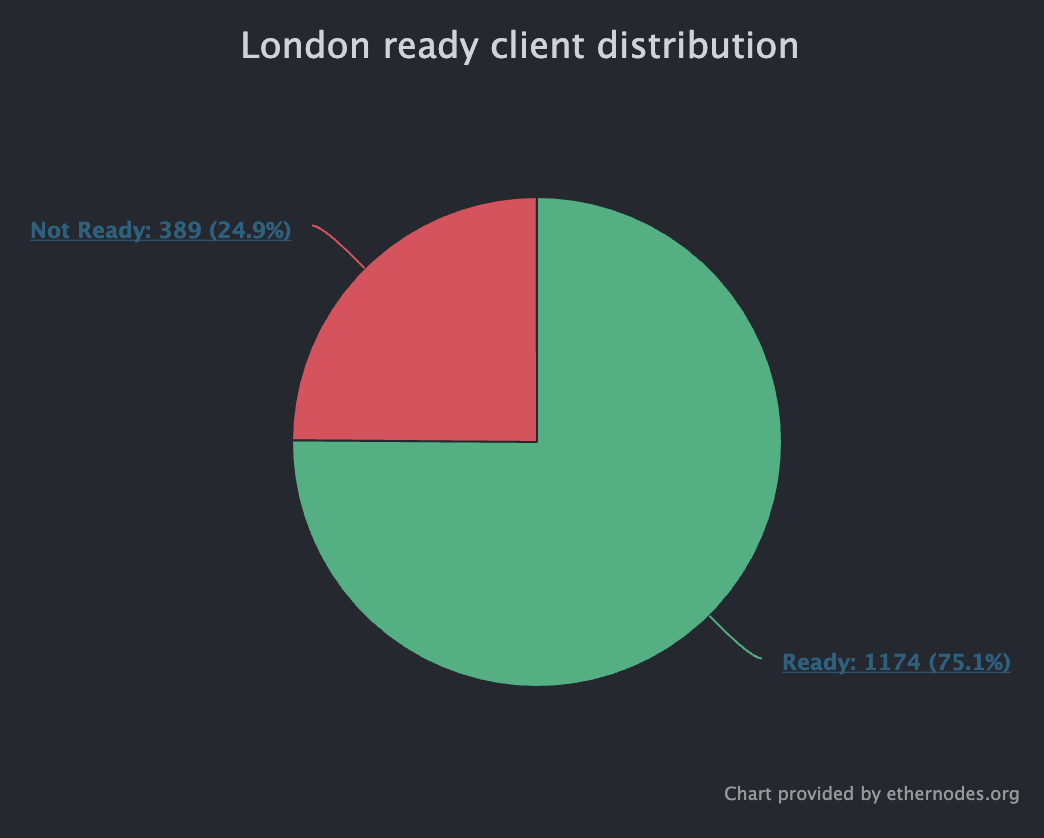

- Around 75% of Etheruem nodes are prepared for the London hard fork.

- The highly anticipated upgrade is expected to occur on block 12,965,000 scheduled for August 5, following a slight delay.

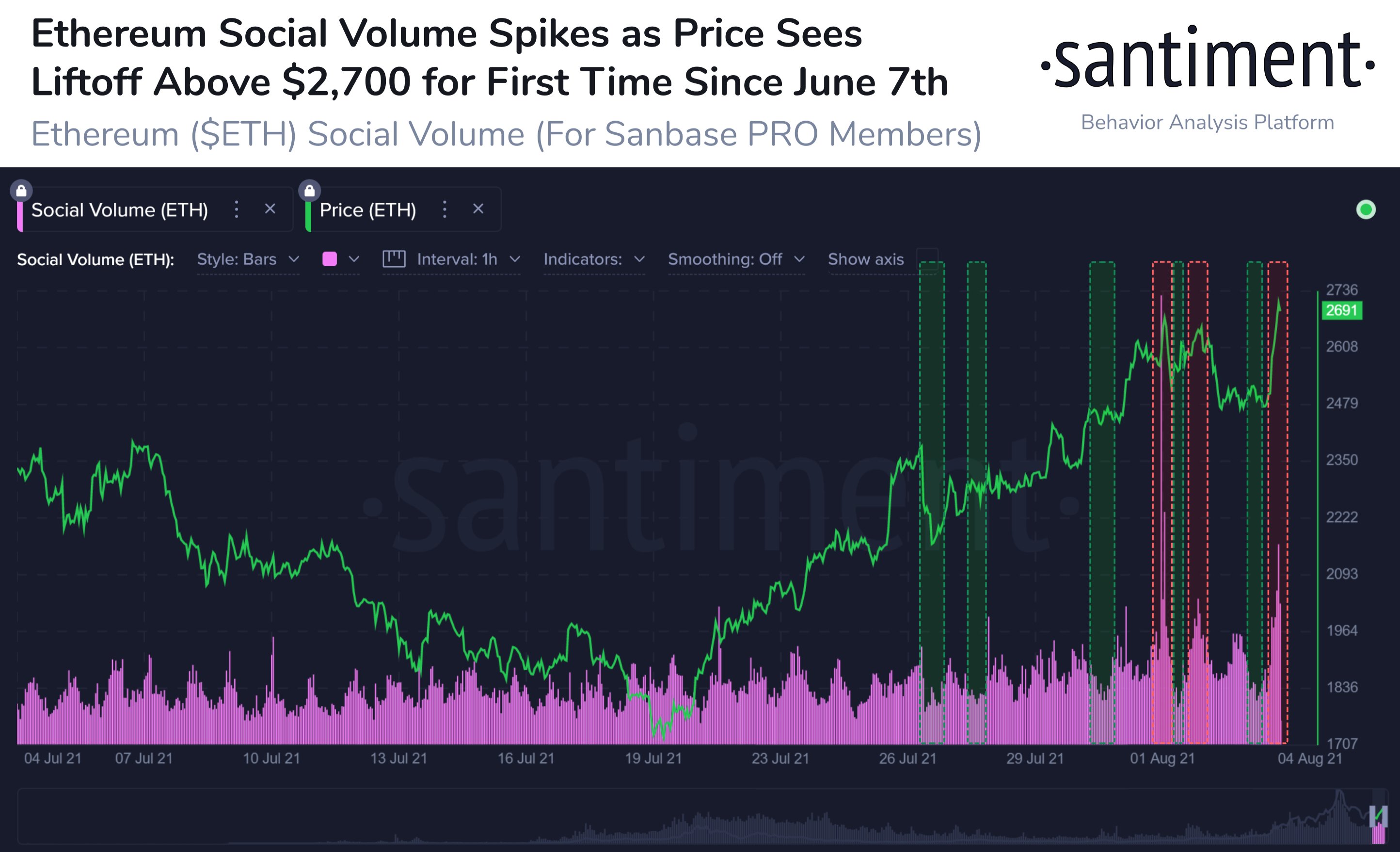

- Ethereum price managed to slice above $2,700 for the first time since early June.

Roughly 75% of Ethereum nodes are ready for the upcoming upgrade, the London hard fork. The ETH London upgrade is expected to take place on block 12,965,000, scheduled to occur on August 5.

Ether would not become a deflationary asset by default

One of the most highly anticipated events in Ethereum history, the London hard fork is expected to go live soon, as 75% of ETH nodes are fully prepared for the occasion. Node operators must update the client version that they run in order to be compatible with the upgrade.

Ethereum London ready client distribution

The London hard fork will introduce five Ethereum Improvement Proposals (EIPs), including EIP-1559, an eagerly awaited proposal that will present a base-fee burning mechanism.

EIP-1559 changes the way transactions get processed on the Ethereum blockchain, by indicating transparent pricing on the base transaction fee that is paid to miners in Ether. Part of the tokens will be burned and taken permanently out of the ETH circulating supply.

The annual supply change of Ether could be reduced by 1.4%, and around 6,000 ETH would be burned per day. As transactions occur on the Ethereum network, ETH could become increasingly deflationary.

However, investment banking giant Goldman Sachs believes that the London hard fork would not make ETH a deflationary asset by default.

The New York-headquartered firm believes that the upgrade will decrease the Ether inflation rate, and the base fee burnt will need to offset the issuance rate of Ethereum for the second-largest cryptocurrency by market capitalization to become deflationary.

Goldman Sachs further pointed out that an increase in Ethereum network activity could mean more ETH is burned, and there would be less Ether to be resold in the market, potentially reducing miner selling pressure.

There remains doubt on how the community will respond following the Ethereum London upgrade. Miners could see a huge impact from EIP-1559, and according to Compass Mining, ETH miners could see their revenue dip by 20% to 30% due to the fact that a part of their fees will be burned.

Ethereum price climbs above $2,700 and anticipates bigger moves

Ethereum price has seen a 12% surge on August 4, ahead of the London hard fork, closing above a critical resistance level.

The recent spike could also be attributed to the surge in Ethereum social volume, according to Santiment.

Ethereum social volume

Ethereum price managed to slice above the 100-day Simple Moving Average (SMA), recording a reaction high at $2,772. Currently, the 78.6% Fibonacci extension level at $2,710 continues to act as stiff resistance for ETH.

Should Ethereum price be able to close above $2,710, this could open up the possibility of a rally toward $2,994, the May 20 high. Bigger aspirations and bullish sentiment following the upgrade could incentivize ETH to tag the 127.2% Fibonacci extension level at $3,339 in the longer term.

ETH/USDT daily chart

However, investors should pay attention to the Relative Strength Index (RSI), which suggests that Ethereum price was slightly oversold on August 2 and August 4.

If Ethereum fails to galvanize investors’ enthusiasm following the London hard fork, ETH should discover meaningful support at the 61.8% Fibonacci extension level at $2,493, and the second line of defense at the 38.2% Fibonacci extension level at $2,187, coinciding with the 50-day and the 200-day SMAs.

Further selling pressure could see Ethereum price fall into the demand barrier, which extends from the 23.6% Fibonacci extension level at $1,999 to the 38.2% Fibonacci extension level at $2,187.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

XRP gains as traders gear up for futures ETFs debut this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.