1inch price edges closer to 15% crash as 1INCH bears shatter key support level

- 1inch price shows signs of exhaustion in line with the bearish market outlook.

- Investors can expect a 15% crash as the $0.0.451 support level is breached.

- A flip of the $0.501 support level will invalidate the bearish thesis for 1INCH.

1inch (1INCH) price has pulled a 180 and ended its bullish outlook as it slips below a key support level. If this outlook continues, 1INCH could trigger a double-digit crash.

Also read: Bitcoin’s 2% crash wipes $4.21 billion in OI and handicaps altcoins, what’s next?

1inch price edges closer to a crash

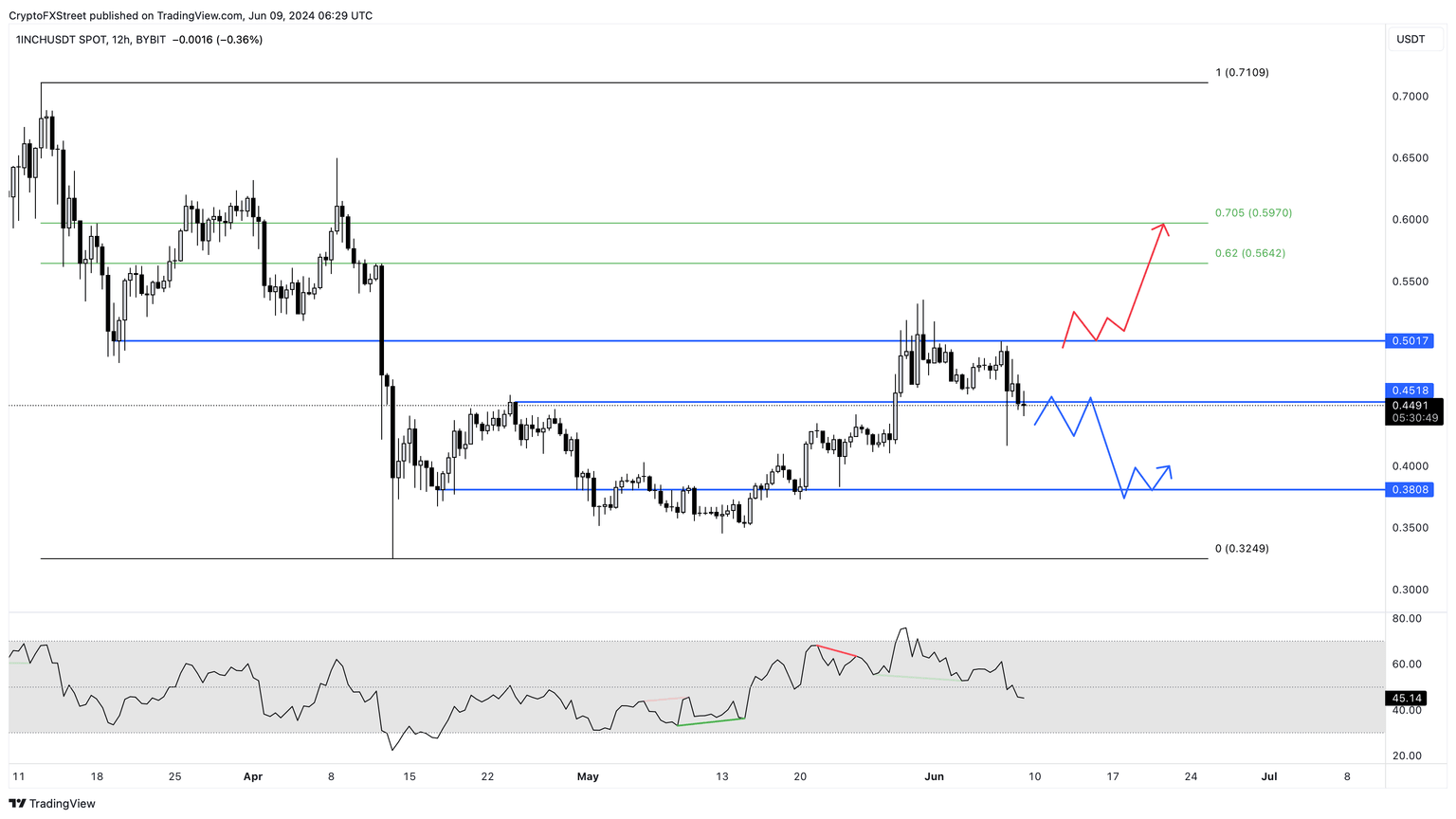

1inch price formed a bottom around mid-May and kickstarted a reversal. After growing by 52% in just 16 days, 1INCH formed a local top at $0.534 on May 31. Due to the stiff resistance around $0.501 the altcoin slipped into consolidation below the aforementioned hurdle. As buyers failed to step up and market conditions worsened, 1INCH slid 16% and currently trades below the $0.451 support level.

The Relative Strength Index (RSI) has slipped below the 50 mean level, suggesting that the bearish momentum is now in control. If 1inch price fails to recover above $0.451, the chances of a sustained bearish move are high. In such a case, 1INCH could drop 15% and tag the $0.380 support level.

1INCH/USDT 12-hour chart

While the current outlook is predominantly bearish, it could turn bullish if Bitcoin (BTC) price sets a new weekly high above $72,000. This development could trigger a bullish move for altcoins, including 1inch's price. In this case, if the $0.501 support level is flipped into a support floor, it would indicate a continuation of the 52% rally that began in mid-May.

Under these bullish circumstances, 1inch price could attempt a retest of the 62% retracement level at $0.564, roughly 13% away from $0.501. If the momentum is strong, then 1INCH could revisit the 70.5% retracement level at $0.597.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.